Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 14, 2016

UK labour market resilience looks set to fade

Official data reveal only tentative signs of the UK labour market being hit by the EU referendum, remaining fairly resilient up to July. However, more timely survey data suggest there will be worse to come.

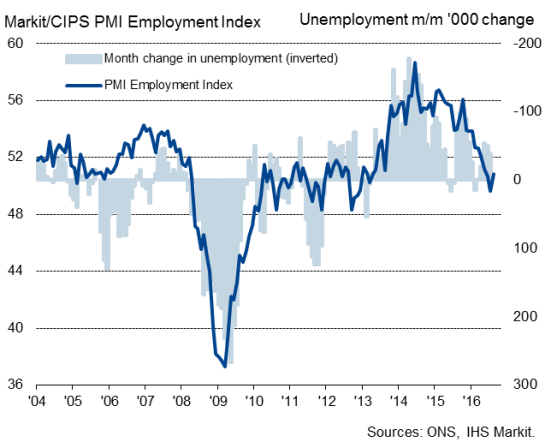

The headline unemployment rate held steady at an 11-year low of 4.9%, but the number is based on a three-month average. The rate for July alone - the latest available - was down to 4.7%, its lowest for eleven years (since September 2005), according to the Office for National Statistics.

Unemployment

There was also good news on employment, which rose by a healthy 174,000 in the three months to July, and the number of job vacancies also rose by 6,000.

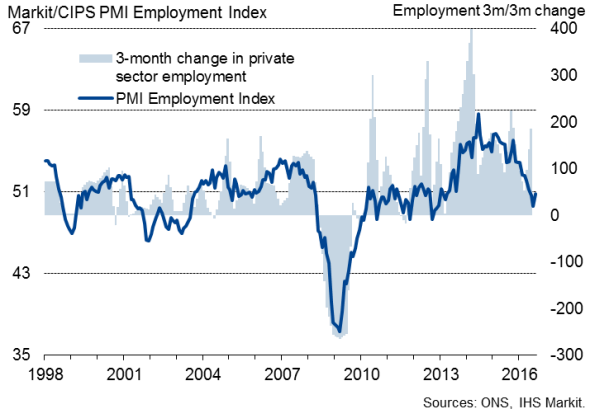

Employment

However, the number of people claiming jobless benefits rose in August and wage growth slowed. Excluding bonuses, underlying annual pay growth slipped to 2.1% in the three months to July.

IHS Markit surveys, which cut through the official data volatility and also provide a more up to date view of the labour market, also show a worrying trend.

Surveys point to weakening labour market

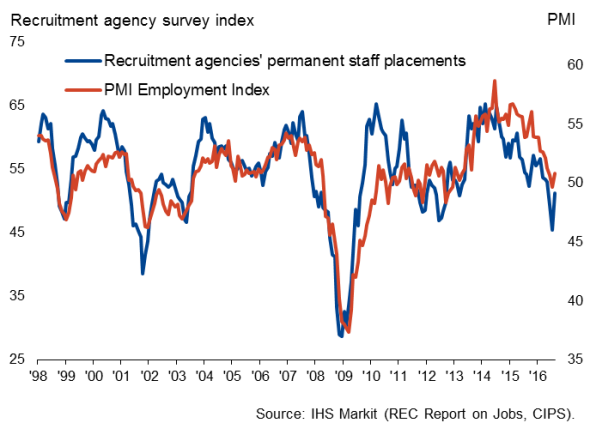

Surveys of both purchasing managers and recruitment agencies have indicated a marked cooling of the labour market, especially in the wake of the EU referendum. Even with a slight rebound in August, the PMI surveys have signalled the weakest hiring trend seen since the end of 2012 in recent months.

Survey measures of employment

Recruitment agencies have meanwhile reported declines in the number of people placed in permanent jobs in both June and July. This was the first time that back-to-back monthly falls had been seen for around four years, and though August saw a return to growth of permanent placements, the rate of expansion was only modest.

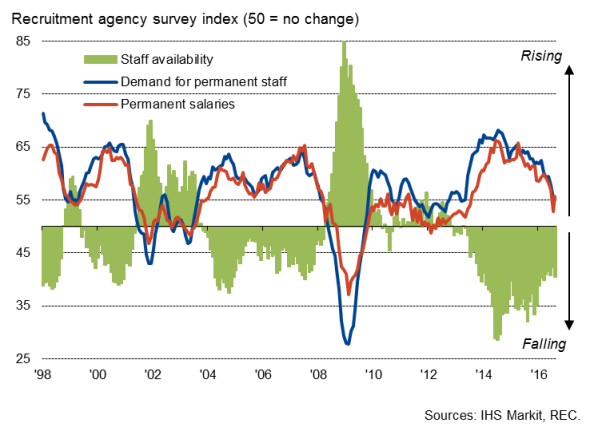

Anecdotal evidence from the surveys reveal that the demand for staff has been hit by worries about Brexit and the resulting uncertainty about the economic outlook, which have compounded a slowing trend in the pace of hiring that had already been evident since the start of the year.

The surveys also indicate how staff availability has continued to deteriorate in recent months, reflecting high overall levels of employment in the economy. But wage pressures have cooled considerably in line with weakening demand for staff.

Wages and labour market tightness

We expect that the combination of rising unemployment, weak wage growth and higher inflation will squeeze households' budgets, constraining consumer spending in coming months. With consumer spending having been a key driver of economic growth, this clearly adds to the risk of a steep slowing in the pace of growth as we head into 2017.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092016-Economics-UK-labour-market-resilience-looks-set-to-fade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092016-Economics-UK-labour-market-resilience-looks-set-to-fade.html&text=UK+labour+market+resilience+looks+set+to+fade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092016-Economics-UK-labour-market-resilience-looks-set-to-fade.html","enabled":true},{"name":"email","url":"?subject=UK labour market resilience looks set to fade&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092016-Economics-UK-labour-market-resilience-looks-set-to-fade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+labour+market+resilience+looks+set+to+fade http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092016-Economics-UK-labour-market-resilience-looks-set-to-fade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}