Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 14, 2015

Week Ahead Economic Overview

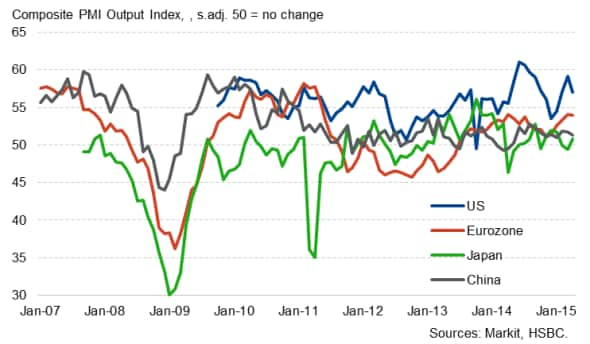

The release of flash PMI results will provide first insights into global economic trends in May, while Japan sees the publication of first quarter GDP numbers. Inflation figures are meanwhile out in the eurozone, the UK plus the US while the Bank of England and the Federal Open Market Committee publish notes from its latest policy meetings.

Composite PMI Output Index

The Bank of England releases minutes from its May monetary policy meeting, in which the Bank held interest rates steady at 0.5%. The minutes are likely to show that all nine Monetary Policy Committee members again voted to keep policy on hold. The lack of action at the Bank does not come as a surprise.

UKeconomic growth stuttered to a two-year low in the first quarter of 2015, and the Bank of England lowered its growth forecast for the year to 2.4% (previous forecast was +2.9%). The Bank further stated that interest rates are unlikely to rise before mid-2016. However, PMI data for April point to a rebound in the pace of economic growth at the start of the second quarter. Retail sales and consumer price numbers will also be updated in the UK, after official data showed zero inflation in February and March.

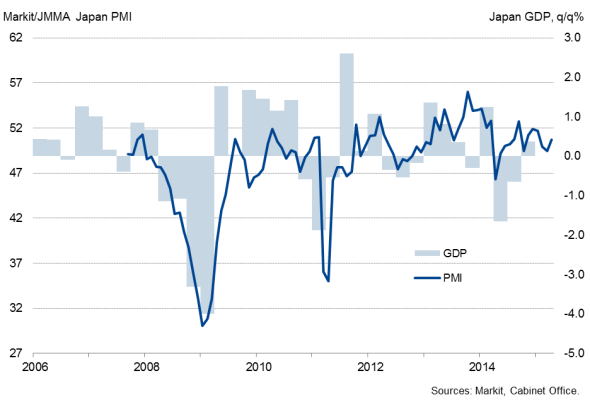

Japan meanwhile sees the release of first quarter GDP numbers. PMI data for 2015 so far have signalled a weakening of economic growth, after GDP rose 0.4% in the final three months of last year. The survey data furthermore raise the possibility of the Japanese economy sliding back into recession in the second quarter. As such, the PMI survey calls into question the Bank of Japan's latest assessment of the economy enjoying a "moderate recovery trend". More insights into Japan's performance in the second quarter will be provided by flash manufacturing PMI results, released on Thursday.

Japan GDP and the PMI

Amid the ongoing debt crisis in Greece, eurozone market watchers will be eagerly awaiting flash PMI data for the currency union. The euro area economy expanded by 0.4%, slightly below expectations as economic growth in Germany slowed dramatically since the previous quarter. Spain continued to grow strongly and France surprised on the upside, while Greece has slid back into recession.

April's PMI data showed economic growth in the currency bloc continue, with all of the four largest member states in expansion. The survey data for May will be eyed to see if the ECB's policy of quantitative easing is continuing to boost the economy, or whether growth is being hit by risk aversion arising from 'Grexit' worries. Meanwhile, final consumer price numbers for April will be released by Eurostat on Tuesday, after a flash estimate showed zero inflation.

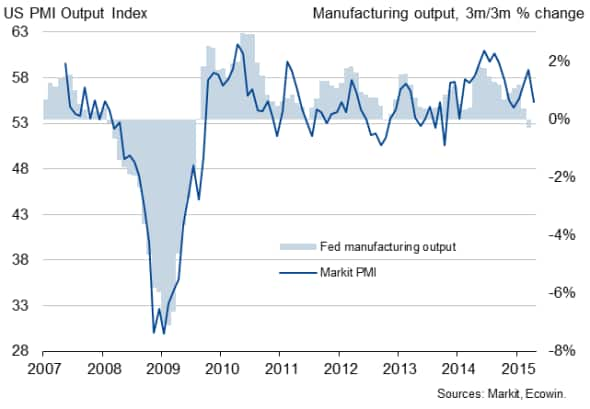

The Federal Open Market Committee releases minutes from its latest meeting, in which monetary policy was left unchanged. Given the recent US data flow, with GDP growth slowing sharply, it is likely that policy makers will wait until at least September before starting to raise interest rates, providing of course that the economy bounces back in coming months.

Flash manufacturing PMI results are also released for the US, and will be eyed for any signs that growth in the goods-producing sector has picked up again. In April, US manufacturing saw output growth at a four-month low, as a strong dollar resulted in the first fall in new export orders since last November. Consumer price data for April are also updated in the US. In March, prices were down 0.1% on a year ago, but core inflation rose to a five-month high of 1.8%. A further upturn in the core rate would add to pressure on policy makers to start hiking interest rates this year rather than delaying any tightening of policy into 2016.

US manufacturing output and the PMI

Having cut banks' reserve ratio requirements again in early February, policymakers will be hoping to see renewed signs of life in China's manufacturing sector. May's flash survey results will give first insights into the performance of China's economy at the start of the second quarter, after economic growth slowed to the weakest in six years in the opening three months of the year.

Monday 18 May

The Bank of Scotland Report on Jobs is published.

House price information are meanwhile updated in China.

In Japan, revised industrial output numbers for March are issued.

Italy sees the publication of trade balance data.

Payroll job growth figures are released in Brazil.

The National Association of Home Builders updates its Housing Market Index.

Tuesday 19 May

Inflation numbers are issued in the UK and eurozone, with the latter also seeing the publication of trade data.

In Germany, ZEW release economic sentiment numbers.

Unemployment figures are updated in South Africa.

Building permit data are meanwhile out in the US.

Wednesday 20 May

Consumer sentiment data are released in Australia.

First quarter GDP numbers are out in Japan.

In Russia, industrial production figures are issued.

Germany sees the release of producer price information while Greece updates its current account numbers.

The Bank of England and the Federal Open Market Committee publish minutes from its latest meetings.

Inflation and retail sales data are meanwhile out in South Africa.

In Canada, wholesale trade numbers are issued.

Thursday 21 May

Flash PMI results are released by Markit for Japan, China, the eurozone and the US.

Current account data are issued for the eurozone.

In the UK, retail sales numbers and CBI industrial orders data are published.

Russia sees the release of monthly GDP figures and inflation numbers.

In Italy, wage inflation data are updated.

The South African Reserve Bank announces its latest interest rate decision.

Unemployment numbers are meanwhile released in Brazil.

In the US, initial jobless claims numbers and the National Activity Index are out.

Friday 22 May

The Reuters/Tankan Index is released in Japan.

In Russia, real wages data, retail sales numbers and unemployment figures are updated.

Italy sees the publication of industrial orders and retail sales numbers.

Detailed first quarter GDP numbers and the Ifo Business Climate Index are out in Germany.

In the UK, public sector borrowing data and the Knight Frank UK House Price Sentiment Index are issued.

Business confidence numbers are meanwhile released in France.

Inflation numbers are out in Brazil, the US and Canada, with the latter also seeing the publication of retail sales figures.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}