Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2015

Markit economic overview

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

Global growth holds close to March's six-month high

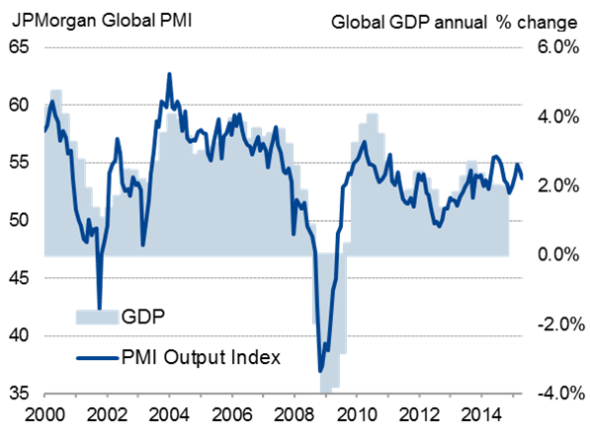

Global economic growth remained robust in April, slowing only slightly from March's six-month high. The JPMorgan Global PMI, compiled by Markit, fell from 54.8 to 54.2, broadly consistent with annual worldwide GDP growth of 2.5% in Q1, up from 2.0% late last year. The expansion was again led by the developed world, with emerging market growth slipping to a three-month low.

Global PMI and economic growth

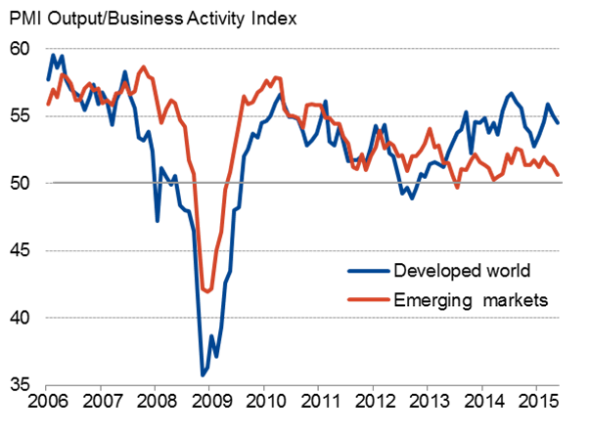

Developed v. emerging markets

Asia and emerging markets remain key areas of global weakness

The US and UK once again led the global expansion, and the euro area also continued to expand at a robust pace by recent standards, albeit with all three seeing some moderation in the rate of growth. Asia remained a key source of global weakness, however, with Japan and China remaining close to stagnation, and growth slowing in India. Of the BRICs, Brazil fared the worst amid signs of stabilisation in Russia.

Developed world

Emerging markets

France acts as drag on Eurozone recovery

The rate of growth dipped in the eurozone in April but remained one of the fastest seen since 2011, signalling a 0.3-0.4% quarterly rate of GDP growth. Firms in Spain are seeing the largest inflows of new work for 15 years, Italy is meanwhile seeing an improvement in growth and a steady rate of expansion continues in Germany. France, however, remains a major concern, seeing growth slow to near-stagnation.

Eurozone economic growth (GDP v PMI)

Eurozone's big-four member states

Use the download link below to access a full overview of the April PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-Markit-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-Markit-economic-overview.html&text=Markit+economic+overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-Markit-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Markit economic overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-Markit-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+economic+overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-Markit-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}