Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 13, 2016

Global investment downturn signalled as business optimism wanes amid uncertainty

Global economic growth was stuck in a low gear at the end of the second quarter, and data suggest that worse may be yet to come. Latest PMI numbers point to near-stagnant production at manufacturers worldwide, as well as subdued expansions in activity at services firms operating across consumer and corporate markets. Most worrying of all was the first drop in production of investment goods for three and a half years.

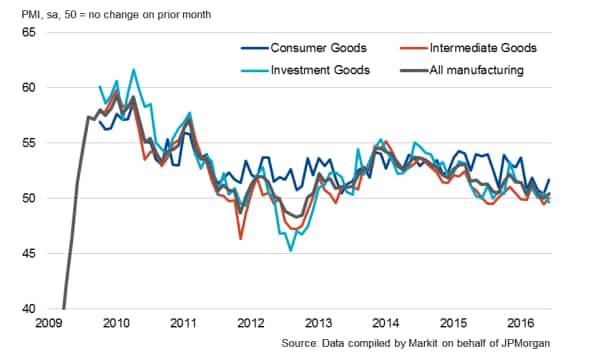

Global manufacturing: output

The global economy has failed to gather any momentum following a slowdown in February. The Global Composite Output PMI dropped to a 40-month low of 50.8 in February, and has since remained largely unchanged. June's reading of 51.1 confirmed that the second quarter had been the weakest on average (51.3) since the fourth quarter of 2012.

Over the past few months, the cloud of uncertainty hanging over the global economy has darkened. The UK's referendum on European Union membership in particular has raised doubts about near-term growth prospects.

These doubts are exacerbated by the nature of slowdown in global growth signalled by the latest release of JPMorgan PMI sector data. The numbers, which provide deeper insight into global economic trends, highlighted a drop in investment goods production for the first time since December 2012. With intermediate goods output broadly stagnant, manufacturers face challenging times ahead.

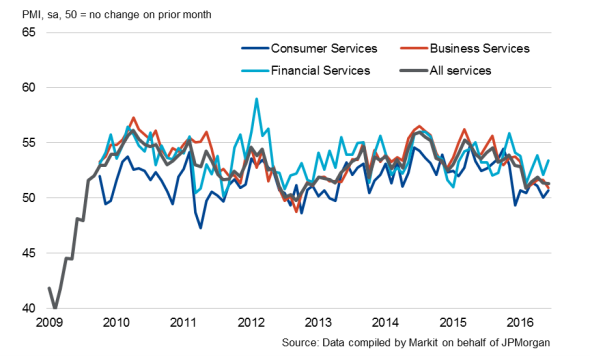

Similarly, consumer and business services showed barely any signs of growth. Only financial services posted a rise in activity of any note.

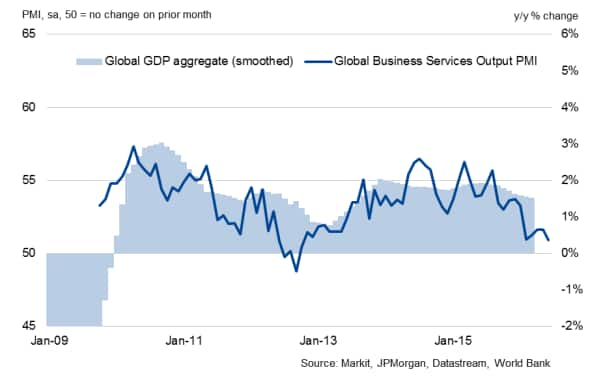

Global services: output

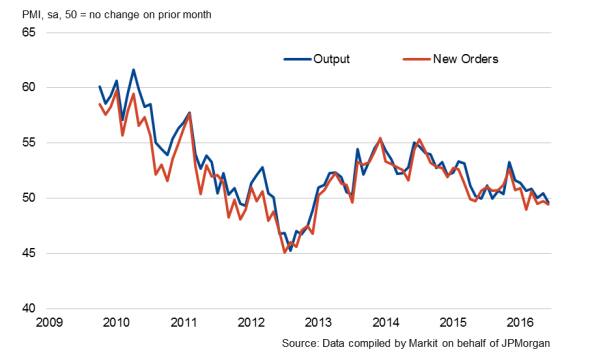

Investment goods output declines

Lower output at investment goods producers was a key area of concern in June. The fall was the first in three-and-a-half years, raising the possibility of a downturn in expenditure on plant & machinery. This is particularly worrying considering that falling investment goods production was the main driver of the manufacturing contraction during the eurozone debt crisis of 2012.

Investment goods: output vs new orders

Intermediate goods production was meanwhile broadly unchanged in June, having fallen in May. As suppliers of the wider manufacturing sector, little or no growth in intermediate goods points to destocking activities across the economy as a whole. Notably, near-stagnant output of intermediate goods has been a trend throughout the year so far.

Consumer goods propped up the manufacturing sector midway through 2016. Output growth accelerated to a three-month high, supported by a faster rise in new work and a renewed increase in new business from abroad. That said, the respective rates of expansion remained only modest.

Financial services outperform

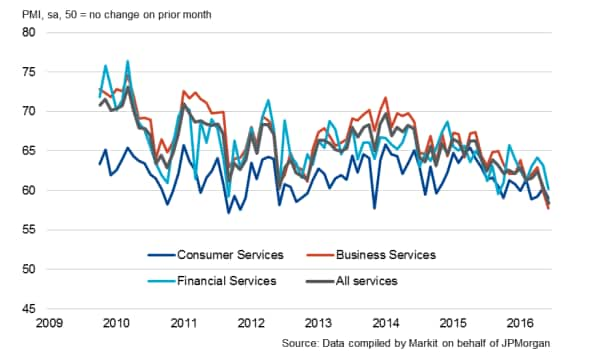

Growth of financial services activity picked up to a solid pace in June. The expansion was by far the quickest out of the three monitored service sectors. Both new business and employment increased, contributing to the brightest outlook among the three sectors. However, sentiment about the year ahead was the weakest since last September, suggesting that growth may ease in light of global economic uncertainty.

Business services activity rose at the joint-slowest rate since October 2012. This pointed to subdued demand from corporate clients - a sign that recent political uncertainty has led some customers to postpone orders. Expectations for growth were at a survey-record low.

Consumer service providers also struggled, with output increasing only slightly. Job losses were seen for the first time in over two years.

Global services: future expectations

Business services and GDP

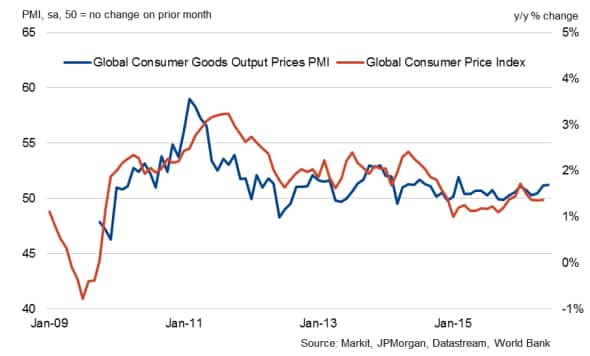

Modest cost inflation

Continuing the trend observed throughout the second quarter, input prices rose in all six surveyed sub-sectors. The increase was largely the result of higher oil and fuel prices, albeit with some signs of wage pressures also rising. However, only consumer goods and consumer services companies reflected this in their charges during June, as other firms sought to attract new clients through stable or lower selling prices.

Consumer goods output prices

Philip Leake | Economist, Markit

Tel: +44 149 146 1014

philip.leake@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Global-investment-downturn-signalled-as-business-optimism-wanes-amid-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Global-investment-downturn-signalled-as-business-optimism-wanes-amid-uncertainty.html&text=Global+investment+downturn+signalled+as+business+optimism+wanes+amid+uncertainty","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Global-investment-downturn-signalled-as-business-optimism-wanes-amid-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Global investment downturn signalled as business optimism wanes amid uncertainty&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Global-investment-downturn-signalled-as-business-optimism-wanes-amid-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+investment+downturn+signalled+as+business+optimism+wanes+amid+uncertainty http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Global-investment-downturn-signalled-as-business-optimism-wanes-amid-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}