Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 08, 2025

Worldwide PMI survey data signal stubborn services sector price pressures

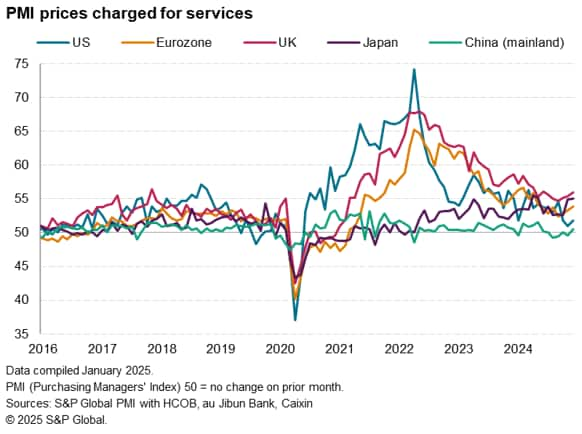

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - indicated a small uplift in global selling price pressures at the end of 2024. The upturn was fuelled by rising charges for services, notably in eurozone, where the data reveal a relatively greater issue with stubborn services inflation than in the US.

Global PMI selling price inflation edges up for second month from four-year low

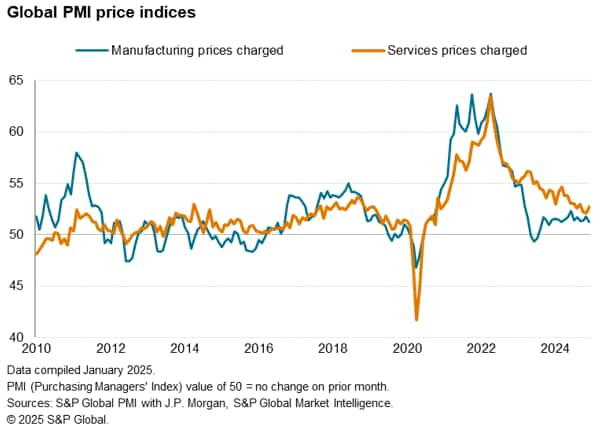

S&P Global Market Intelligence's PMI surveys indicated that global inflationary pressures ticked higher for a second successive month at the end of 2024. The J.P. Morgan Global Composite PMI® Prices Charged Index, covering manufacturing and services in over 40 economies, signalled the fastest price rise for three months in December. At 52.4, up from 52.1 in November, the latest reading is below levels of a year ago, and far below the pandemic peak, but remains stubbornly above its pre-pandemic decade average of 51.2.

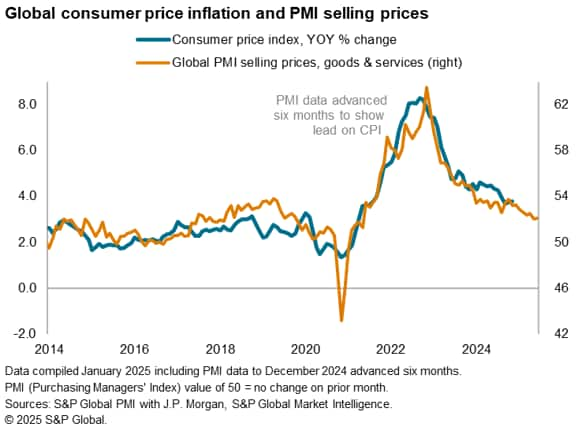

The PMI Prices Charged data - which tend to lead the official inflation data by around six months - hint that the annual rate of global consumer price inflation will moderate to just over 3% in the coming months, but that compares with a pre-pandemic decade average of just 2.7%.

Service sector drives price upturn

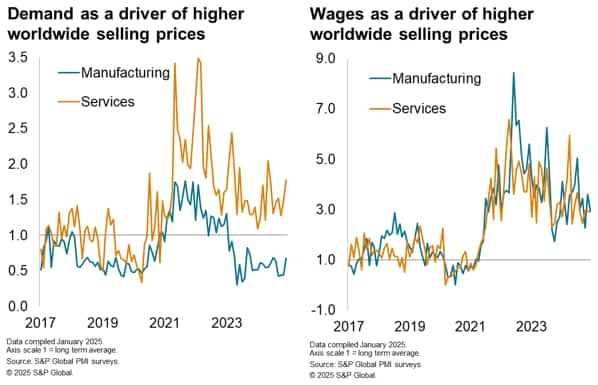

Manufacturing selling price inflation remained especially moderate, dipping in December below its pre-pandemic decade average to the joint-lowest rate seen over the past year amid a combination of weak demand and few supply constraints.

In contrast, service sector inflation edged higher, further above its pre-pandemic average, up to the highest since September. Companies most commonly reported that services inflation was buoyed as pricing power was facilitated by strong demand and salary costs, though the latter remained low (globally) by standards seen since the pandemic.

Rates of inflation lift higher in the US, UK and eurozone

There were some notable variations in price trends among the major economies, however, signalling the potential for different policy responses.

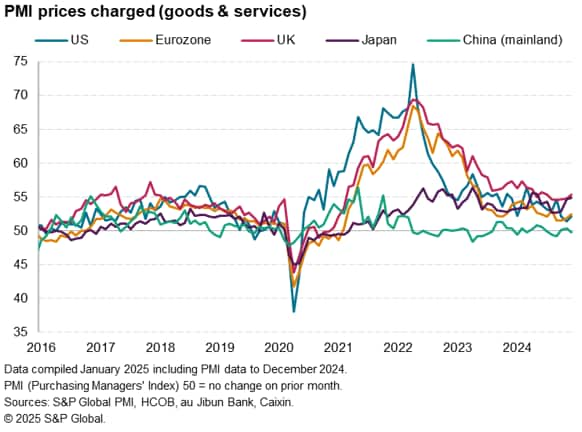

Looking at inflation trends in the major economies, average prices charged again rose to the greatest extents in the UK and Japan, though higher rates of inflation were also seen in both the US and eurozone.

The rate of increase in the UK hit a six-month high, reflecting especially stubbornly-elevated services inflation and a further modest rise in goods prices.

The rate of increase also edged up in Japan to reach a seven-month high, driven by a further marked rise in services prices alongside a marked and steepening rate of manufacturing inflation, the latter at a five-month high.

More moderate rates of inflation were reported in the US and eurozone, though in both cases the rate of increase accelerated on November. In the US, prices charged for both goods and services rose at increased rates. In the eurozone, goods prices continued to fall, but prices charged for services rose at the steepest rate since last May.

Prices charged in mainland China fell, albeit marginally in December, a slight shift from the marginal upticks in October and November. A slight rise in charges for services was offset by the sharpest fall in goods prices recorded for nine months.

Honing in on services inflation, which is the most sensitive area of pricing where central bank policy has typically been concerned in recent years, the UK continued to report relatively high and accelerating selling price inflation in December, with the rate of inflation also gathering pace in both the eurozone and holding steady in Japan. The respective seasonally adjusted Prices Charged index in all three economies recorded well above its pre-pandemic averages.

In contrast, the rate of service inflation in the US - while ticking higher in December - remains below its pre-pandemic average.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmi-survey-data-signal-stubborn-services-sector-price-pressures-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmi-survey-data-signal-stubborn-services-sector-price-pressures-Jan25.html&text=Worldwide+PMI+survey+data+signal+stubborn+services+sector+price+pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmi-survey-data-signal-stubborn-services-sector-price-pressures-Jan25.html","enabled":true},{"name":"email","url":"?subject=Worldwide PMI survey data signal stubborn services sector price pressures | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmi-survey-data-signal-stubborn-services-sector-price-pressures-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+PMI+survey+data+signal+stubborn+services+sector+price+pressures+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmi-survey-data-signal-stubborn-services-sector-price-pressures-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}