Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 13, 2016

Eurozone industrial production drop adds to signs of second quarter slowdown

Euro area factories saw output fall in May in a further sign of the single currency area failing to maintain growth momentum this year. The disappointing data follow survey evidence showing business optimism in the currency bloc sliding to the lowest since 2014 as political uncertainty intensified in June.

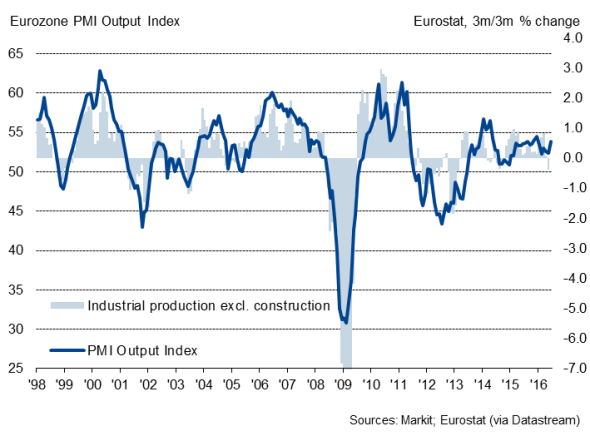

Industrial production has now fallen in five of the past seven months, with the three-month trend rate - a better guide to underlying trends than the volatile monthly data - slipping to the weakest since August 2014.

A 1.2% drop in industrial production in May reversed much of the 1.4% rise seen in April, leaving output running 0.4% lower so far in the second quarter compared with the first quarter. The potential contraction of the industrial sector in the second quarter therefore means the economy is likely to struggle to see anything like the 0.6% expansion of GDP recorded in the opening three months of the year.

The latest downturn was led by a 4.3% plunge in energy production, but the deterioration was broad-based. Production of capital goods such as plant and machinery slumped 2.3% and output of long-lasting consumer goods fell 1.4%. Intermediate goods and non-durable consumer goods saw more modest declines of 0.4% and 0.1% respectively.

Eurozone industrial output vs manufacturing PMI

Deteriorating outlook

An upturn is signalled for June, with Markit's Eurozone PMI pointing to a modest revival in the rate of factory output growth to the strongest seen so far this year, which suggests May's fall in production may overstate the current weakness of the industrial sector. But the business outlook has since deteriorated, in part due to uncertainty created by the UK's EU referendum.

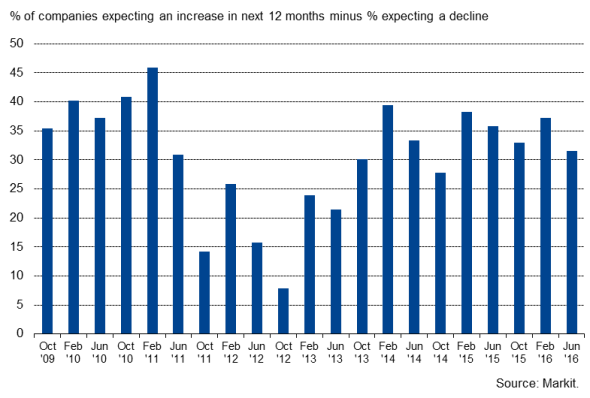

Survey data from Markit, collected in June showed euro area business optimism about the year ahead dropping to the lowest since late-2014, with uncertainty created by 'Brexit' (and possible contagion to other countries) being the most commonly cited threat to future prospects by companies across the region.

Markit Eurozone Business Outlook Survey:

expected business activity

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-industrial-production-drop-adds-to-signs-of-second-quarter-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-industrial-production-drop-adds-to-signs-of-second-quarter-slowdown.html&text=Eurozone+industrial+production+drop+adds+to+signs+of+second+quarter+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-industrial-production-drop-adds-to-signs-of-second-quarter-slowdown.html","enabled":true},{"name":"email","url":"?subject=Eurozone industrial production drop adds to signs of second quarter slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-industrial-production-drop-adds-to-signs-of-second-quarter-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+industrial+production+drop+adds+to+signs+of+second+quarter+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-industrial-production-drop-adds-to-signs-of-second-quarter-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}