Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 12, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Sanderson Farms heavily shorted ahead of earnings

- 7% of airline SAS's shares are on loan on the eve of results

- Short sellers cover positions in Digital China and Kimia Chemical before earnings

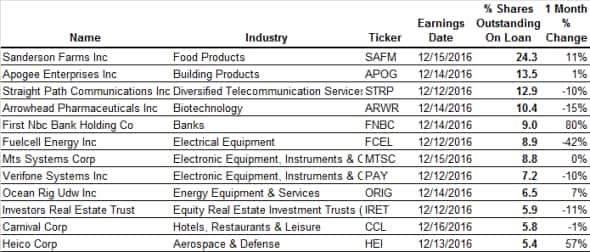

North America

Poultry supplier Sanderson Farms is by far the most shorted company announcing earnings this week. The current demand to borrow Sanderson Farm shares stands at just under a quarter of outstanding shares which puts shorting activity in the firm at the highest in over 10 months. While it's hard to nail down the specific cause for the surge in short interest, the large jump in demand to borrow Sanderson shares has been mirrored by its peer Pilgrims Pride over the last few weeks, indicating that short sellers are playing a wider trend across chicken producers.

Another company to watch out next week, as evidenced by a recent surge in short interest, is First NBC Bank which has seen an 80% increase in the demand to borrow its shares in the last month. The surge in shorting activity has come after US regulators deemed the firm to be in "troubled condition" which has, among other things, restricted its ability to access additional debt funding. This unsurprisingly sent First NBC shares tumbling although they have gone on to bounce back by over 60% from the lows registered in early November. Short sellers have shown no faith in this rally however as the demand to borrow the bank's shares has jumped by over four fold over the same period of time.

Fuelcell Energy's shares have seen the opposite trend in shorting activity as short sellers have returned over 40% of their borrow in the last four weeks. This decrease in bearish sentiment will bring little solace to Fuelcell's long suffering shareholders however as the distributed power generation firm has seen its share price tumble by over 60% this year to date.

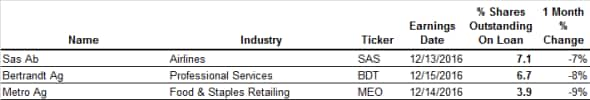

Europe

Scandinavian airline Sas finds itself at the top of a relatively small list of European firms experiencing high short interest in the lead up to earnings. Sas shares have halved in the last 12 months as the firm battled against upstart Norwegian Air Shuttle, whose shares have proven relatively more resilient. Short sellers have been eager to take profit off their recent success as demand to borrow SAS shares has steadily decreased in line with its share price.

The other two relatively heavily shorted firms announcing earnings in Europe this week, Bertrandt and Metro, have also experienced covering in the month leading up to earnings, as demand to borrow their shares is down by 8% and 9% respectively.

Asia

Short sellers have also been covering their positions in the majority of their high conviction plays in Asia heading into earning as five of the four firms which see more than 4% of their shares out on loan have seen a decrease in demand to borrow. This covering is most evident in the two most shorted companies, Digital China and Kumiai Chemical, which have seen 11% and 15% decreases in shorting activity respectively in the last month.

Biotech Pharma Foods is the exception to the rule however as it has seen demand to borrow its shares jump by a third in the last month to hit 4% of shares outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}