Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 09, 2016

Technology and the European Syndicated Loan Market

Trade settlement issues have caught up with the syndicated loan market and, while regulators have not forced the hand of the industry, there is growing urgency to improve the trade settlement process, in part to pre-empt regulatory action.

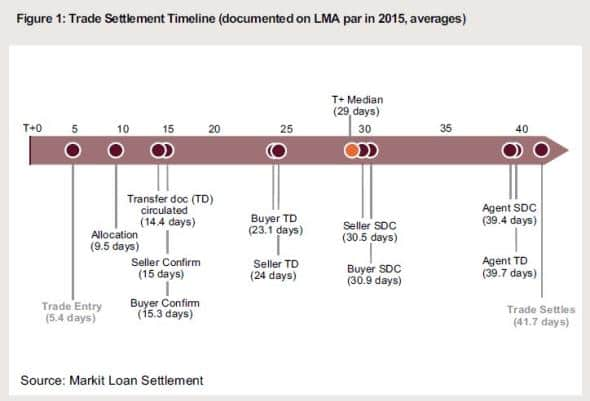

Whilst systems have been put in place to facilitate high degrees of efficiency in the loan trading process (meaning there is no technological reason why trades cannot settle as quickly as T+1), the drivers of settlement times ('T+') are primarily behavioural. For example, looking at the component steps within trade settlement, it becomes clear how improving performance in areas such as trade entry and allocation, processes not contingent on actions by other parties, can greatly accelerate the process (see Figure 1).

One area to benefit from recent automation is the document exchange between lenders and custodians and fund administrators. Bringing this 'last mile' into an electronic framework creates significant efficiency, especially when one considers that many firms estimate they spend over 10 minutes per allocation per transaction to send documents to their custodians and trustees. Greater efficiency in this area is clearly achievable - several years ago, the OTC derivatives markets overcame similar complexity and dramatically improved its operations related to trade confirmation.

Internal Integration

Outside behavioural limitations, creating electronic links between agent banks, lenders and trade settlement technology is a significant catalyst for improving efficiency in the market. To facilitate this, in early 2016, Markit acquired systems integration software developed by J.P. Morgan. This software will be available to sell-side and buy-side institutions seeking to integrate with major systems used in the syndicated loan market, including agent servicing platforms and Markit's trade settlement services, advancing the STP of loan transactions and lifecycle events that have already been discussed in this chapter. Off the shelf solutions such as these are also an alternative to expensive and risky software builds, and expedite industry adoption of risk and cost-reducing initiatives.

In addition, Markit also recently acquired the Loan/SERV Position Reconcilement Service and, by integrating it with its existing trade settlement services, can offer a product which will help lenders operate more efficiently, by reducing the number of systems required to manage loan assets. The ultimate goal is to enable fully automated, real-time position reconciliation.

Within asset management, operational friction between front, middle and back office teams is a hurdle for most firms. A survey carried out by Markit in October 2015 showed that exchanging data within the asset management enterprise continues to be the biggest operational pain point for loan managers. To succeed in this, firms need to modernise credit data management systems to achieve a new level of front-to-back office integration. Asset managers are focusing their automation efforts on two key areas: real-time monitoring of performance and risk for investment teams, and enhanced reporting to improve client service and keep pace with changing client expectations.

Solutions for the front office (such as Markit's Credit Manager software) centralise information to help investment teams screen the market to evaluate opportunities, track changes in credit quality and easily gauge credit performance. The result is faster decision making and more precise response to changes in market conditions. From pipeline management, to investment approval, to communication about amendments and performance issues that affect asset values, keeping the right people in the loop about investment decisions, status of trades and events affecting positions are key to streamlining operations and optimising performance.

Client reporting challenges

At the same time as overcoming front-to-back office integration issues (specifically transfer of information from back and middle office to their investment teams), clients are also raising the bar for real-time assessment of performance and risk. The Markit survey showed coping with investor requests and reporting requirements as the number one focus area of front-to-back office integration. 39% of respondents say that accuracy in reporting is a challenge, whilst 27% cite the challenge as being able to respond to ad hoc requests.

There was a time when efficient reporting was primarily a concern for large asset managers, but now even small firms face pressure from clients who expect more transparency and a more holistic view of the market. Volatility, liquidity and credit performance are among the complex metrics that are increasingly important to investors. The growing preference among investors for separately managed accounts also exacerbates the reporting challenges for asset managers of all sizes.

What is required to produce the data for client reporting shares key components with the modern credit data management system described above. It starts with controlling data through a central electronic data management framework. Business intelligence tools make report design and creation straightforward for non-technical users. Incorporating workflow management tools ensures control over the report lifecycle.

On the horizon

Mobile technology is helping portfolio managers and traders in the leveraged loan market access portfolio information on their mobile devices. HTML5 sites are the new benchmark, making it realistic to view, present and analyse portfolios on mobile devices 24/7. It is expected that trade settlement workflow will also go mobile.

Of course, Blockchain is an important topic, and the potential for distributed ledgers and smart contracts to streamline asset servicing, transfer and tracking ownership is interesting. Over time, it is expected that Blockchain will help loans and other markets address operational risk, improve balance sheet utilisation and ultimately change the risk profile of complex financial products and promote market liquidity.

Improvements in the market

There are encouraging signs that the industry is working proactively to become more efficient and improve T+. In Europe, trade volume is increasing, yet average T+ is falling. Over the last two years, average T+ for LMA trades (settled on Markit's platform) has declined from a high of nearly 53 days to around 38 days.

The reduction in settlement times can be attributed to enhanced technology, coupled with

important behavioural shifts in the industry. These behavioural shifts challenge the status quo, and focus on improving operational processes directly under the control of individual firms. The main drivers leading to improved settlement times in Europe and globally include:

Enhanced functionality

- Increased sell-side integration with trade settlement platforms accelerates the settlement process - it takes from five to 10 working days for non-integrated institutions to complete trade entry;

- 'Last mile' improvements: last year 39,000 documents were delivered from 400 funds to custodians via automated systems;

- Automating multiple forms of transfer: ClearPar now supports novation vs. assignment and differing primary and secondary forms of transfer; and

- Standardised LMA administrative details forms (ADFs): standardisation has made it possible to manage ADFs electronically, thus streamlining workflow.

Improved behaviour

- A total of 37 independent agent banks in EMEA settled trades electronically in 2015, demonstrating growing preference for electronic workflow;

- 58% of ClearPar EMEA trades in 2015 were settled electronically end-to-end, compared with 20% in 2013;

- In Europe, more agent banks are performing KYC as soon as the trade is allocated (rather than waiting for signed transfer documents); and

- The market is benefiting from more transparency as more institutions are sharing trade settlement data with the LMA.

Conclusion

Banks have been moving towards STP in the syndicated loan market for a number of years. Regulatory demands, IT security and cost pressures have been driving many new initiatives. Events like the collapse of Lehman Brothers exposed many of the deficiencies within banks, and the past few years have been focused on increased transparency and control, as well as greater efficiency.

With a high degree of automation and systems integration already available to the market, there are few technical barriers to improving efficiency in the loan market today. Whilst behavioural factors still need to be overcome, the enhanced functionality available via a whole host of technological solutions will greatly assist in increasing the attractiveness of the loan product to an even broader investor base.

This article was originally published in the LMA's "20 Years in the Loan Market" book.

IHS Markit offers a comprehensive set of front, middle and back office services to buy-side and sell-side firms active in the syndicated loan market. The Markit ClearPar loan product helps to facilitate the process by linking buyers, sellers, counsel and agent banks to enable efficient electronic settlement of par and distressed loan trades. Other products include: Markit Loan Pricing, which provides valuations, analytics and liquidity metrics for more than 6,400 leveraged loan facilities in North America and Europe; Markit WSO, an end-to-end platform for portfolio management and asset servicing; and Markit's iBoxx USD Leveraged Loan indices, which gauge total returns in real time. Through a messaging hub and data services, IHS Markit provides real-time reference and transaction information on syndicated loans to clients worldwide.

David Jesson, Director, Markit Loan Settlement

Tel: +44 207 2602082

david.jesson@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-In-My-Opinion-Technology-and-the-European-Syndicated-Loan-Market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-In-My-Opinion-Technology-and-the-European-Syndicated-Loan-Market.html&text=Technology+and+the+European+Syndicated+Loan+Market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-In-My-Opinion-Technology-and-the-European-Syndicated-Loan-Market.html","enabled":true},{"name":"email","url":"?subject=Technology and the European Syndicated Loan Market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-In-My-Opinion-Technology-and-the-European-Syndicated-Loan-Market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Technology+and+the+European+Syndicated+Loan+Market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-In-My-Opinion-Technology-and-the-European-Syndicated-Loan-Market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}