Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 12, 2014

UK construction sector growth more vigorous than previously thought

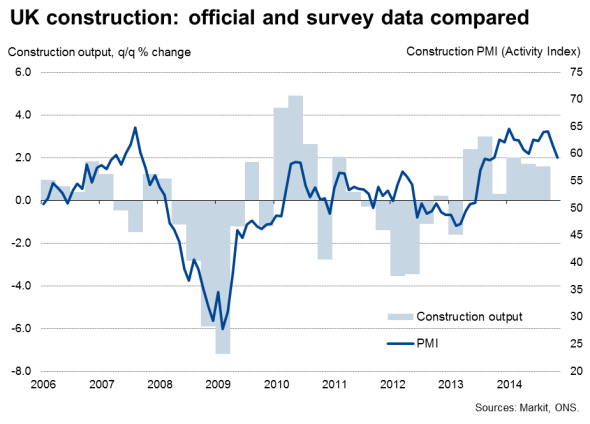

The construction sector has grown faster than previously thought so far this year, and especially in the third quarter, adding further to signs of a booming economy. Survey data suggest the sector is continuing to enjoy further robust growth in the fourth quarter.

The data will be a concern to those policymakers who are worried that the amount of slack in the sector is being reduced to an extent that could drive up inflationary pressures, therefore adding to calls for earlier rate rises.

Better than previously thought

The updated data from the Office for National Statistics showed output growth in the construction industry revised up sharply in the third quarter, doubling from 0.8% to 1.6%. Although only accounting for 7% of GDP, the scale of the upward revision is estimated to add 0.1% to the original estimate of a 0.7% increase in GDP. Data for the second quarter were also revised higher, up from 1.0% to 1.7% (and up from an initial estimate of no growth whatsoever). First quarter growth is now also estimated at some 2.0%.

The upgraded performance of the construction sector brings the official data more into line with buoyant business survey evidence of a building sector boom this year, led by a surge in house building.

Growth likely to have been strong, but slower, in fourth quarter

There is more uncertainty about the health of the sector in the fourth quarter. With output estimated to have fallen by 2.2% in October, the ONS data suggest the sector saw a poor start to the final quarter of the year. However, history tells us that the most recent data are subject to substantial revision, and most likely will be revised upwards, based on the signals from the business surveys.

The Markit/CIPS Construction PMI showed ongoing strong growth of activity in both October and November. While signalling the weakest growth of building activity for 13 months in November, the rate of expansion has remained impressively strong by historical standards in recent months, buoyed by increased house building and commercial construction in particular. Although growth is showing signs of cooling in all major sub-sectors of the construction industry, the sector clearly continues to boom.

Data quality

It should also be noted that the construction output and new orders data from the ONS are no longer classified as official 'National Statistics' due to concerns from the UK Statistics Authority watchdog over the accuracy of the data. The concerns over quality relate to data supplied by the Department for Business Innovation and Skills (used to deflate the output and orders data) rather than the data collected by the ONS.

The data quality concerns mean the construction data should be treated with additional caution when seeking to determine the actual performance and health of the sector, and possibly explains why the ONS data have diverged so markedly at times from the business survey data this year.

The fact that, according to the ONS, the "construction estimates are a key component of the output approach to measuring GDP" means that the data are nevertheless still useful in seeking to predict GDP numbers, but does little to instil confidence in the accuracy of GDP estimates and will inevitably raise further questions about whether there is sufficient government spending on national statistics.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-economics-uk-construction-sector-growth-more-vigorous-than-previously-thought.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-economics-uk-construction-sector-growth-more-vigorous-than-previously-thought.html&text=UK+construction+sector+growth+more+vigorous+than+previously+thought","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-economics-uk-construction-sector-growth-more-vigorous-than-previously-thought.html","enabled":true},{"name":"email","url":"?subject=UK construction sector growth more vigorous than previously thought&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-economics-uk-construction-sector-growth-more-vigorous-than-previously-thought.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+sector+growth+more+vigorous+than+previously+thought http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-economics-uk-construction-sector-growth-more-vigorous-than-previously-thought.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}