Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 12, 2014

Near-stagnant industrial production puts extra pressure on ECB

Industrial production in the euro area barely grew in October, confirming the disappointingly weak picture painted by the business surveys. Alongside only meagre employment gains, fears over falling prices and weak take-up by banks of the ECB's cheap loan offering in December, the near-stagnant state of euro area industry will add to calls for the central bank not to hesitate in doing more to revive the economy.

The ECB has stated that it will reassess the economic situation in the first quarter of next year and consider further stimulus in the light of that assessment. However, it is not clear what form that stimulus may take, and whether it will include sovereign debt purchases, which are seen by many as essential to providing a meaningful kick start to the economy.

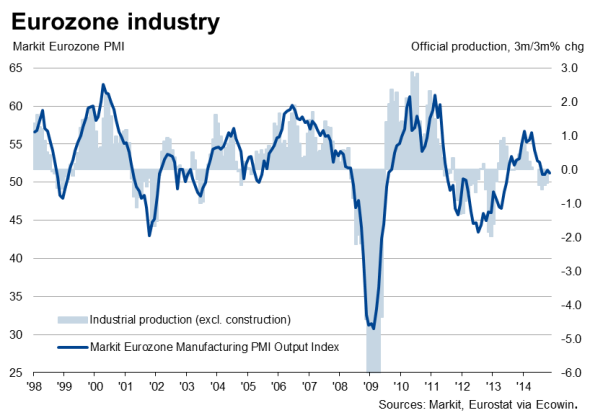

Near-stagnant production

Industrial production across the 18 euro countries rose just 0.1% in October. The near-stagnation follows a fall of 0.5% in the third quarter and no growth in the second quarter. The industrial sector consequently remains 12.2% smaller than its pre-crisis peak, highlighting how policy has been ineffective in inducing a recovery for the region's goods producers.

The official data from Eurostat correspond with PMI business surveys which have likewise shown a near-stagnation of factory output in recent months. The surveys also indicate that the malaise has extended into November.

Production was flat in Germany in October but fell 0.9% in France and the Netherlands, with smaller falls of 0.4% and 0.1% seen in Spain and Italy respectively. Greece, Portugal and Ireland all saw production spike higher, however, bucking against the wider trend of gloominess, although all three countries have seen volatile output growth in recent months.

Weak job growth

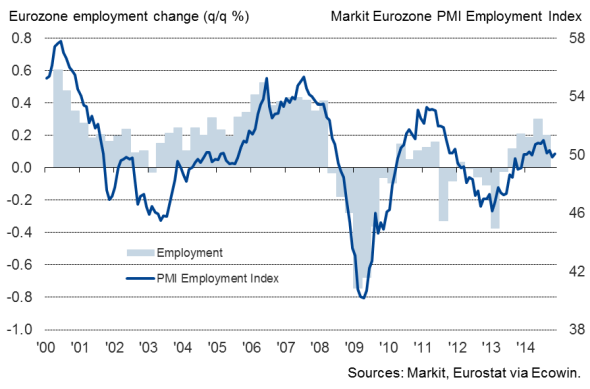

Other data from Eurostat meanwhile showed employment growing 0.2% in the euro area in the third quarter. The upturn follows a 0.3% rise in the second quarter, leaving employment 0.6% higher than a year ago in the three months to September. Stagnant payroll numbers in France meant it lagged behind its peers. Employment was up 0.2% in German, 1.5% in Spain and 0.1% in Italy in the third quarter.

The mild encouragement from these modest employment gains may soon fade. Business survey data indicate that labour market growth probably deteriorated again in the fourth quarter. The PMI data, available up to November, are so far pointing to a mere 0.1% increase in fourth quarter employment.

Employment

Inflation set to fall further

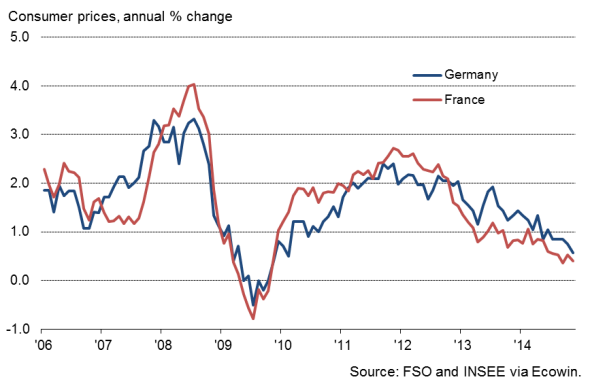

The employment and production data follow news that core inflation in France went negative for the first time since comparable data were first available in 1990. Prices excluding taxes volatile components such as energy fell 0.2% on a year ago in November. At just 0.3%, headline inflation in France is likely to fall in coming months as prior tax rises fall out of the annual comparisons and lower oil prices feed through to consumers.

Inflation meanwhile fell to 0.6% in Germany, its lowest since February 2010, adding to deflationary worries.

Inflation is consequently running at just 0.3% across the Eurozone as a whole, well below the ECB's target of close to but below 2.0% and most likely set to fall further due to the impact of lower oil prices.

Inflation

ECB lacking fire power

One of the ECB's weapons to tackle the growing threat of deflation has been to launch a new series of cheap four-year loans to banks, targeted at businesses and households. But the take up of the second tranche of these loans fell far below expectations on Thursday, suggesting there is a lack of appetite for banks to extend loans due to weak demand in the economy. The auction saw take up of just €130 billion after €83 billion at the first auction.

These so called TLTROs are part of the ECB's plan to boost its balance sheet by €1 trillion. Other measures include buying assets, currently limited to covered bonds and asset backed securities. The limited size of these asset markets, and the disappointing take up of cheap loan packages by banks, mean many see the ECB as lacking fire power in the fight against deflation and having to resort to government bond purchases in order to provide a sufficiently high liquidity boost to have a material impact on demand and inflation. However, it is clear that such controversial debt buying and quantitative easing of this nature is still by no means assured.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Economics-Near-stagnant-industrial-production-puts-extra-pressure-on-ECB.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Economics-Near-stagnant-industrial-production-puts-extra-pressure-on-ECB.html&text=Near-stagnant+industrial+production+puts+extra+pressure+on+ECB","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Economics-Near-stagnant-industrial-production-puts-extra-pressure-on-ECB.html","enabled":true},{"name":"email","url":"?subject=Near-stagnant industrial production puts extra pressure on ECB&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Economics-Near-stagnant-industrial-production-puts-extra-pressure-on-ECB.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Near-stagnant+industrial+production+puts+extra+pressure+on+ECB http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12122014-Economics-Near-stagnant-industrial-production-puts-extra-pressure-on-ECB.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}