Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 12, 2015

Oil price fall helps bring down UK trade deficit, but export weakness persists

Lower oil imports, linked to the 50% slump in the price of crude over the past six months, are helping to reduce the UK trade deficit. However, dig deeper into the numbers and a more disappointing picture of the UK's export performance emerges. The export trend for manufacturers has weakened in a sign that the strong pound is hitting demand for UK goods in overseas markets. Further export losses look likely in coming months, dealing another blow to hopes that the UK economy is rebalancing away from domestic consumption towards exports.

Trade deficit smallest since 2000

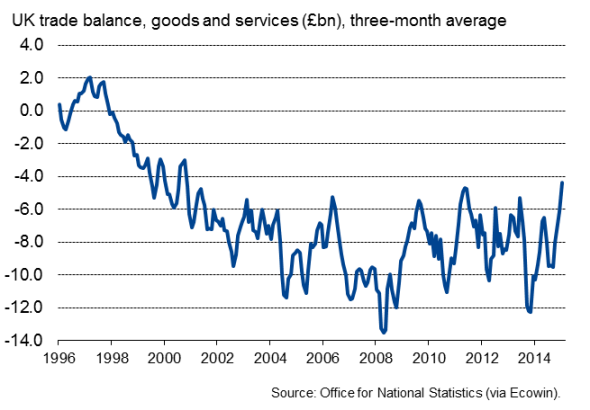

In the three months to January the deficit on trade in goods and services was "4.4 billion; the smallest since the three months to October 2000, according to data from the Office for National Statistics.

Trade balance

The narrowing of the deficit reflected a "2.5 billion drop in imports, almost half of which was due to lower imports of oil. A record surplus in services trade in January also helped bring the overall deficit down.

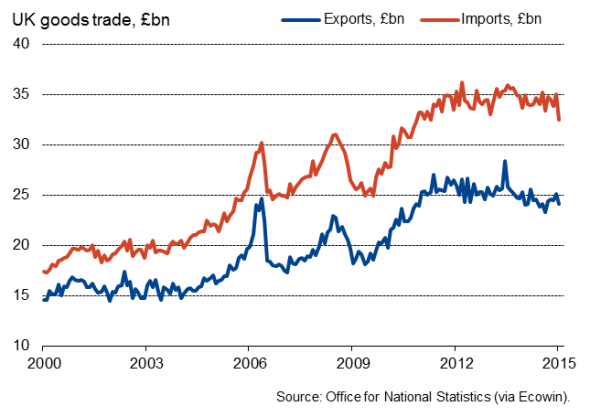

Exports of goods fell sharply in January, however, down 4.1% compared to December to register the steepest monthly decline since last April. In the latest three months, goods exports growth slowed to 2.0%, down from 3.3% in the three months to December. Non-oil goods exports were down 1.0% in January, their first decline since last August.

Goods trade

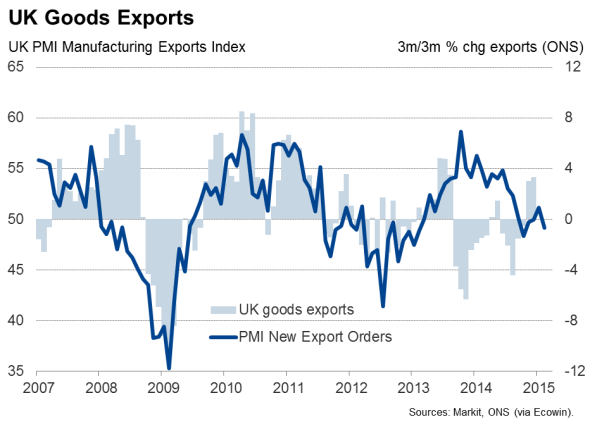

Exports are likely to have continued to suffer in February, with PMI survey data showing a decline for the fourth time in the past five months. Companies reported that the strengthening of the pound, notably against the euro, has hit competitiveness and resulted in lost orders.

On a trade weighted basis, sterling has risen to its highest since 2008, up 5% so far this year.

Strong currency impact offset by rising demand in key overseas markets

However, while the stronger pound is bad news for UK exporters, its impact is likely to be offset to some extent by an upturn in the eurozone economy this year, which means demand will pick up in key markets. The ECB, along with an increasing numbers of private sector economists, are upgrading their forecasts for the euro area this year and next. At the same time, the US economy is widely expected to expand at a robust pace, providing an important source of export demand.

It's clear, though, that emerging markets look set for another year of underperformance compared to pre-crisis trends, which will constrain UK export growth. China is set for just 7% growth at best this year, the weakest for a quarter of a century. Moreover, a deepening downturn is evident in Russia, and Brazil's economy appears to be moving into a state of crisis.

UK exporters therefore face a challenging year, battling against a strong currency and weakness in emerging markets. Rising demand in the euro area and the US, on the other hand, are likely to be important sources of export sales growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-oil-price-fall-helps.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-oil-price-fall-helps.html&text=Oil+price+fall+helps+bring+down+UK+trade+deficit%2c+but+export+weakness+persists","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-oil-price-fall-helps.html","enabled":true},{"name":"email","url":"?subject=Oil price fall helps bring down UK trade deficit, but export weakness persists&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-oil-price-fall-helps.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+price+fall+helps+bring+down+UK+trade+deficit%2c+but+export+weakness+persists http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-oil-price-fall-helps.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}