Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 12, 2015

US retail sales trend worst since 2009

US economic data are turning ugly, and not just because of the weather. Retail sales in the latest three months have suffered the steepest fall since the first quarter of 2009, when the global financial crisis was at its peak.

A 0.6% deterioration in sales in February was possibly due to severe weather affecting many parts of the country in the second half of the month, but this was not a one-off fall. Sales have now fallen in each of the past three months, which rings alarm bells about the health of the US economy. The latest decline follows a 0.8% drop in January and a 0.9% decline in December. Over the past three months, sales are down 1.2% on the previous three months.

So far in the first quarter, retail sales are down 1.6% on the fourth quarter of last year.

Total retail sales

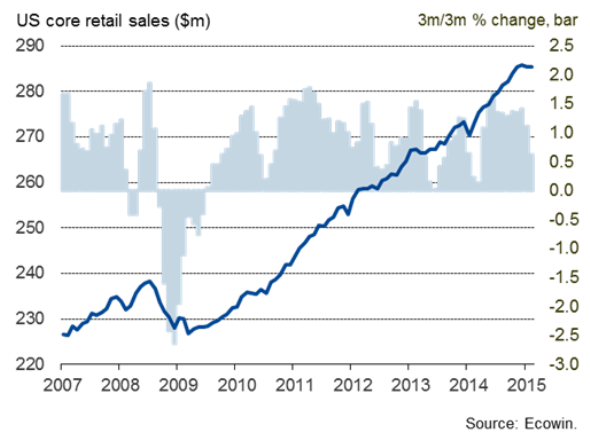

Core sales stagnating

Once gasoline, autos, food and building materials were excluded, so-called 'core' sales were unchanged after a 0.1% decline in January, which is clearly better than the trend in headline sales numbers but nevertheless bodes ill for first quarter GDP.

Core sales are so far up just 0.1% in the first quarter (yes, that's an annualised rate of just 0.4%), which means we're probably going to see some substantial downward revisions to first quarter GDP estimates. The three-month trend rate in core sales is looking firm still, however, showing a robust 0.6% increase and giving the optimists something to hold on to.

Core retail sales

Speculation has risen that policymakers will start hiking interest rates as early as June. However, these worrying retail sales numbers, alongside weak inflation and wage growth trends, mean it's likely that the Fed will delay any tightening of policy until a clearer picture of the economy emerges later in the year.

We should see some stabilisation in the retail sales trend once the impact of the bad weather passes, and - like the three-month trend in core retail sales - business survey data suggest the underlying trend in the economy is merely slowing to a more modest and sustainable pace rather than collapsing. As such, the US remains on course to be the first major economy to see higher interest rates.

With the Fed on course to hike interest rates at the same time as the ECB has started printing money to the tune of €60bn per month, driving the euro close to parity with the dollar, overseas investors have pulled over $650m out of US equity products over the past six weeks. US-exposed equity ETFs suffered their first monthly outflow in over a year-and-a-half in February, led by an exodus by European investors, according to research published today. Based on these retail sales numbers, the souring of investor sentiment from US equities looks vindicated.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Economics-US-retail-sales-trend-worst-since-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Economics-US-retail-sales-trend-worst-since-2009.html&text=US+retail+sales+trend+worst+since+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Economics-US-retail-sales-trend-worst-since-2009.html","enabled":true},{"name":"email","url":"?subject=US retail sales trend worst since 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Economics-US-retail-sales-trend-worst-since-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+trend+worst+since+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-Economics-US-retail-sales-trend-worst-since-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}