Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 12, 2015

Eurozone industry sees best production trend for a year

Despite a setback in January, the trend in euro area industrial production is picking up. This upturn adds to the growing stream of better economic data for the region, and is likely to lead to further upward revisions to euro area growth in 2015. Investor sentiment also continues to move from the US to the eurozone in the light of growth prospects and central bank policy divergences.

Underlying production trend on the up

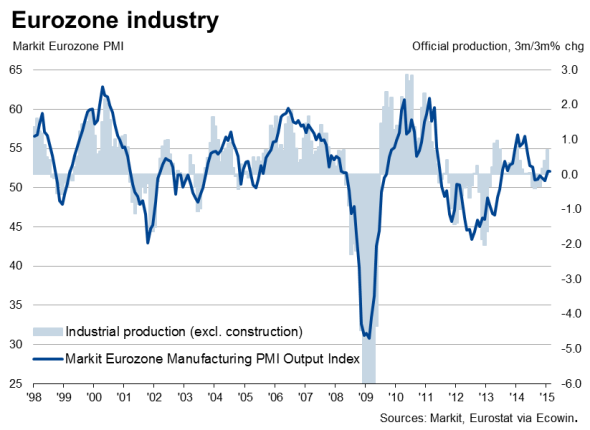

Industrial production in the euro area fell 0.1% in January, a disappointing reading compared to economists' average expectations of a 0.2% rise. But looking through the volatile monthly data reveals that the underlying trend is showing signs of picking up momentum.

In the latest three months, production rose 0.7% compared to the previous three months, which is the best performance seen for a year, according to official data from Eurostat. Note also that an initially-estimated fall in production in December has now been revised to show an increase.

This stronger production trend corresponds with the recent upturn as shown by survey data. Markit's manufacturing PMI for the region has signalled a welcome revival in the pace of expansion so far this year compared to the weakness seen in the second half of last year.

The survey evidence highlights how companies have become more upbeat about the business outlook, linked in part to the ECB's bond-buying programme and the weakening of the euro, which has slumped to a 12-year low in recent sessions. The weaker euro not only boosts the region's manufacturers by making exports cheaper in foreign markets, but also makes imported goods more expensive, meaning domestic buyers will tend to favour homemade goods.

The production data therefore add to the flow of increasingly positive data for the euro area, and will no doubt prompt further upward revisions to growth prospects for the region. The ECB has already upgraded its forecasts for eurozone GDP to rise 1.5% in 2015 followed by 1.9% in 2016.

Improved investor sentiment

Investors have also been seeking greater exposure to the region in the light of the improved prospects, especially when the growing likelihood of the US Fed hiking interest rate paints a darker picture of future corporate earnings potential in the United States.

Markit's data on exchange-traded funds show sharply rising inflows into euro area and Japanese exposed investments, front-running looser central bank policy, with US-exposed equity funds suffering steep outflows. Overseas investors have pulled over $650m out of US equity products over the past six weeks, with US-exposed equity ETFs showing their first monthly outflow in over a year-and-a-half in February, led by an exodus by European investors.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-eurozone-industry-sees-best-production-trend-for-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-eurozone-industry-sees-best-production-trend-for-a-year.html&text=Eurozone+industry+sees+best+production+trend+for+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-eurozone-industry-sees-best-production-trend-for-a-year.html","enabled":true},{"name":"email","url":"?subject=Eurozone industry sees best production trend for a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-eurozone-industry-sees-best-production-trend-for-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+industry+sees+best+production+trend+for+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12032015-economics-eurozone-industry-sees-best-production-trend-for-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}