Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 11, 2015

UK manufacturing output set to revive after weak start to the year

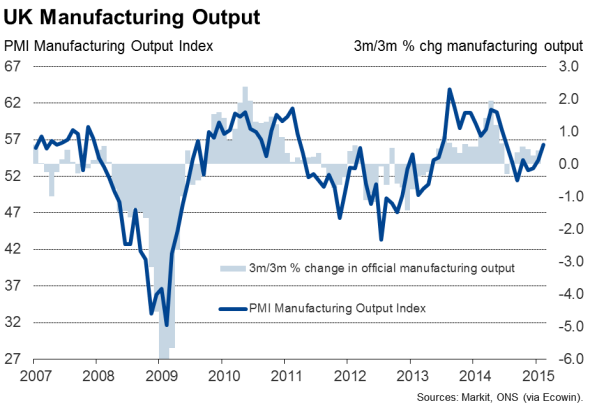

Looking through the volatile official data, which showed factory output falling in January, the underlying trend in manufacturing remains positive and looks set to gather strength in coming months. Survey data pointed to faster factory output growth in February and financial conditions have become more favourable, helping the goods-producing sector drive faster economic growth in the first quarter.

Weaker factory output at start of year

UK factory output slipped 0.5% in January, according to data from the Office for National Statistics, dropping for the first time in three months.

The decline was driven by an unusually severe plunge in production of ‘hi-tech’ computer, electronic and optical equipment, which slumped 9.5% compared to December, as well as lower output of goods used for power production, perhaps reflecting reduced spending in the oil sector.

The data are clearly volatile, and it would be dangerous to read too much into the decline. Encouragingly, the less volatile three-month trend showed manufacturing output growth picking up to 0.4% in January from 0.3% in December.

The wider measure of industrial production, which includes energy output, fell 0.1% against expectations of 0.2% rise, according to a poll by Reuters. Industrial production was flat in the three months to January, having risen 0.2% in the three months to December.

Growth reviving

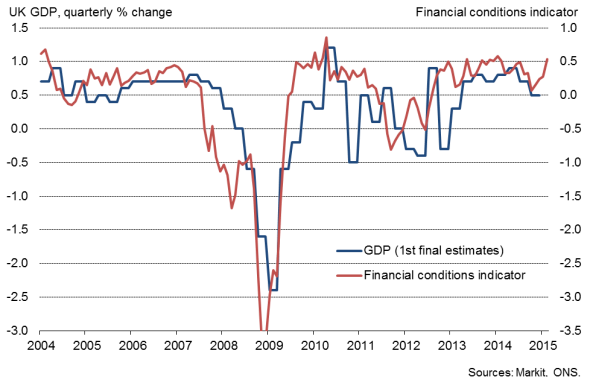

This weaker industrial production reading bodes ill for GDP in the first quarter, but growth looks poised to revive, based on both survey evidence and indicators of financial conditions facing households and businesses.

Financial conditions and economic growth

The PMI surveys signalled stronger growth in February and, alongside the official data that are so far available, point to GDP rising by 0.6% in the first quarter, up from 0.5% in the final three months of last year. Weaker service sector expansion in February was offset by faster growth in manufacturing and construction. Indeed, manufacturing output growth hit an eight- month high in February.

The improved performance of manufacturing has come despite the appreciation of sterling which, against a trade-weighted basket of currencies, has risen to its highest since 2008, up almost 5% so far this year. The stronger currency is damaging export performance, with the PMI showing overseas sales falling slightly in February.

However, other factors are helping to offset the competitive loss arising from the strong currency. The Markit iTraxx index, which measures the cost of insuring against bond market defaults via CDS spreads, is signalling a reduced chance of default in recent weeks, as worries about the eurozone in particular have eased.

Financial markets are also rallying, linked to the ECB’s bond buying programme, which should also benefit UK companies. Equity prices continue to rise, albeit showing some signs of wavering in recent sessions, and corporate bonds continue to soar. Markit’s iBoxx index of UK corporate bonds rose in February to its highest since May 2007.

Bond market data are also indicating that interest rate expectations have been pulled down in recent months, linked to the lower oil prices, which augurs well for economic growth in the year ahead.

Political uncertainty weighs against improved financial conditions

Our barometer of financial conditions has consequently risen, signalling the most favourable financial environment for economic growth since January of last year.

Against this more favourable financial backdrop, however, there are signs that political and economic uncertainty remains elevated, which is constraining risk appetite and economic growth. Although immediate concerns over Greece have receded, the eurozone’s crisis is by no means over. Businesses also remain concerned over the ongoing situation with Russia. Closer to home, worries are mounting in relation to the General Election.

There is, therefore, much that can potentially destabilise the UK economy in 2015, and this uncertainty is hitting risk appetite, which is in turn driving business investment lower and leaving the recovery reliant on consumers. However, there is no sign yet of the recovery stalling.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-Economics-UK-manufacturing-output-set-to-revive-after-weak-start-to-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-Economics-UK-manufacturing-output-set-to-revive-after-weak-start-to-the-year.html&text=UK+manufacturing+output+set+to+revive+after+weak+start+to+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-Economics-UK-manufacturing-output-set-to-revive-after-weak-start-to-the-year.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing output set to revive after weak start to the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-Economics-UK-manufacturing-output-set-to-revive-after-weak-start-to-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+output+set+to+revive+after+weak+start+to+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-Economics-UK-manufacturing-output-set-to-revive-after-weak-start-to-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}