Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2016

Egypt's economy suffers as inflation hits eight-year high amid weaker currency

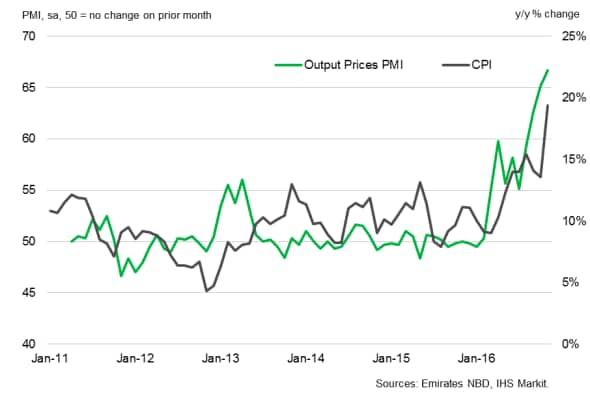

Official inflation figures released on Thursday by the government-run statistics body CAPMAS showed a steep rise in price pressures during November. The rate of consumer price inflation in Egypt accelerated to 19.4% on an annual basis, the fastest in eight years.

Egypt Inflation: Output Prices PMI vs CPI

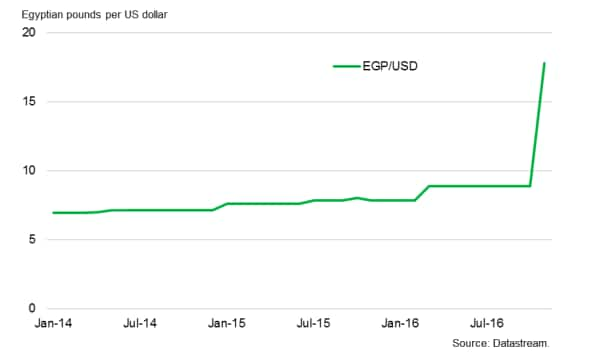

The rise was partly a result of government policy. As part of an IMF-supported reform program designed to boost investor confidence, Egypt's policymakers have freed the exchange rate in order to let the pound reach its true value. The extent of the depreciation showed how the currency had previously been overvalued; the pound has already lost 50% of its value against the US dollar.

Exchange Rate

Other factors behind the sharp rise in inflation include higher fuel prices and the introduction of a value-added tax. Together, these price pressures have combined to drive the rate of inflation up from 13.6% in October to November's eight-year high.

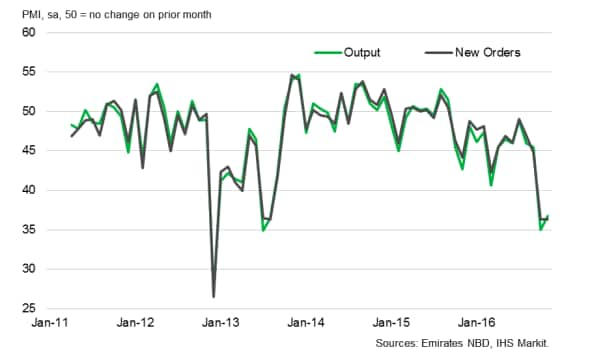

PMI signals economic woes

While the government's measures are all part of a long-term commitment to the IMF which is designed to ultimately help Egypt's economy in the long-run, they are arguably squeezing conditions in the short-term. The Emirates NBD Egypt PMI, a composite indicator of the health of the non-oil private sector, signalled a steep downturn in November.

Output, new orders and employment all fell substantially, according to the latest survey. Anecdotal evidence from panel members suggested that rising costs had placed pressure on both the supply and demand sides of the economy. The rate of input price inflation was the highest since data collection started in April 2011, often making raw materials unaffordable, and thus in short supply, at a number of firms. Greater cost burdens also led panellists to raise their charges sharply, which damaged client demand.

Output vs New Orders PMI

Currency freedom here to stay

Despite ongoing difficulties, Egypt's policymakers are likely to stick to their guns. The devaluation of the pound is seen as necessary to keep the economy competitive in the long-run. However, inflation is set to accelerate further for now, with IHS Markit forecasting a peak in excess of 21% in the opening quarter of 2017.

Philip Leake | Economist, Markit

Tel: +44 149 146 1014

philip.leake@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-Egypt-s-economy-suffers-as-inflation-hits-eight-year-high-amid-weaker-currency.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-Egypt-s-economy-suffers-as-inflation-hits-eight-year-high-amid-weaker-currency.html&text=Egypt%27s+economy+suffers+as+inflation+hits+eight-year+high+amid+weaker+currency","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-Egypt-s-economy-suffers-as-inflation-hits-eight-year-high-amid-weaker-currency.html","enabled":true},{"name":"email","url":"?subject=Egypt's economy suffers as inflation hits eight-year high amid weaker currency&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-Egypt-s-economy-suffers-as-inflation-hits-eight-year-high-amid-weaker-currency.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Egypt%27s+economy+suffers+as+inflation+hits+eight-year+high+amid+weaker+currency http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-Egypt-s-economy-suffers-as-inflation-hits-eight-year-high-amid-weaker-currency.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}