Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2016

UK recruitment hits nine-month high as employers brush off Brexit uncertainty

November saw UK recruitment activity step up another gear as employers continued to shrug off Brexit uncertainty and focus on hiring.

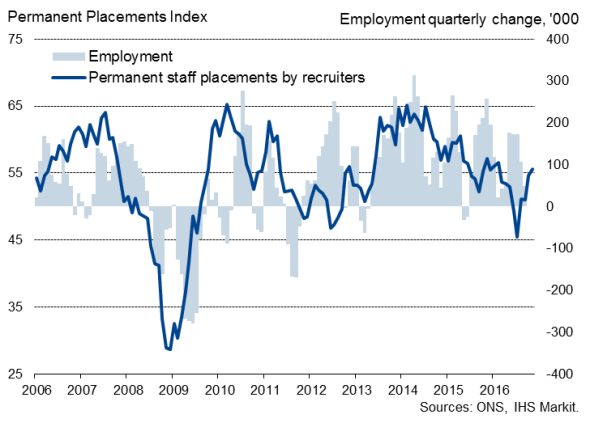

The monthly REC survey of recruitment consultancies, compiled by Markit, found the number of people placed in permanent jobs by agencies to have risen at the fastest rate since February. The latest increase marks a further improvement in hiring after the hiatus caused by the EU referendum.

The survey found that the recruitment trend slowed in the spring, with the number of people placed in jobs then falling in both June and July, the latter seeing the steepest decline since mid-2009. However, hiring has since steadily picked up again, with the latest rate of increase recovering to approach the robust pace seen at the start of the year.

Billings received by agencies for people employed in temporary and contract work also rose markedly in November, showing the largest gain for seven months.

Recruitment and employment

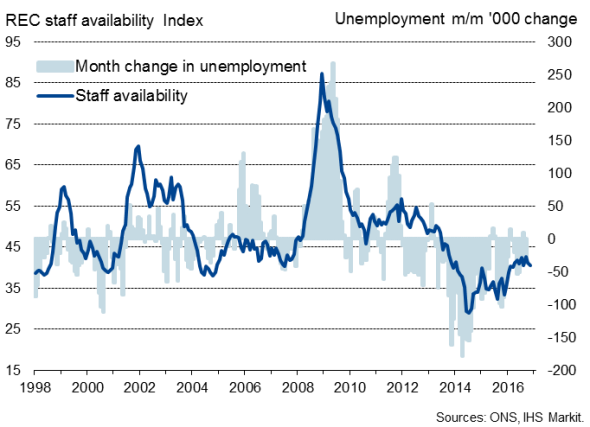

Staff availability deteriorating markedly

The November surveys meanwhile highlighted how the unemployment rate, currently at an 11-year low, continued to present problems for recruiters. Agencies reported that the availability of staff for permanent roles deteriorated to the greatest extent since March.

Upward pay pressures

Staff availability has deteriorated in every month bar one over the past four years as employment has risen and the pool of unemployed labour has steadily evaporated. The need to offer higher pay to attract suitable staff and wage bargaining power has risen accordingly.

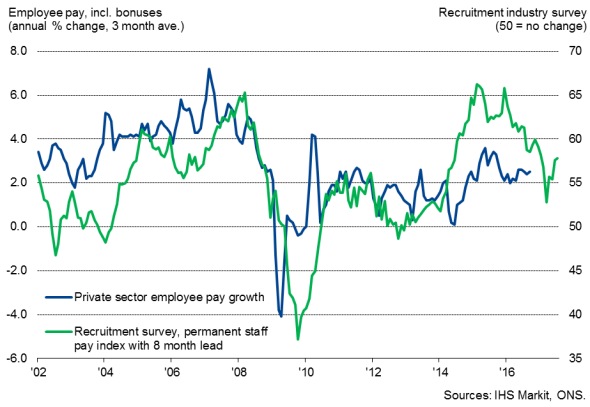

Pay growth

Having slowed to its weakest for just over three years in July, the rate of growth of average salaries awarded to people taking up new permanent positions hit a six-month high in November, albeit remaining well below the average seen over the past three years.

National pay growth has lagged behind the REC survey measure of wages, however, as the latter looks only at people taking up new jobs (rather than also including wage reviews of people already in jobs). However, the REC survey tends to lead the direction in which national pay growth is travelling, and the latest improvements in the survey gauge therefore point to rising pay growth.

The latest official data for the three months to September showed average pay (excluding bonuses) increasing at an annual rate of 2.4%, with pay in the private sector up by 2.7%.

Resilience still uncertain

With recent growth of consumer prices likely to further fuel workers' demands for higher pay, the upturn in the labour market and accompanying upturn in salary growth signalled by the REC survey will add to concerns about rising inflationary pressures. Much will likely depend on the extent to which resilient business confidence and hiring can be sustained amid ongoing uncertainty surrounding Brexit negotiations.

However, while the November survey data point to an encouraging picture of labour market strength, it remains likely that hiring (and consequently wage growth) will wane in 2017 as uncertainty surrounding Brexit leads business to take a more cautious approach to employment.

Staff availability and unemployment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-UK-recruitment-hits-nine-month-high-as-employers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-UK-recruitment-hits-nine-month-high-as-employers.html&text=UK+recruitment+hits+nine-month+high+as+employers+brush+off+Brexit+uncertainty","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-UK-recruitment-hits-nine-month-high-as-employers.html","enabled":true},{"name":"email","url":"?subject=UK recruitment hits nine-month high as employers brush off Brexit uncertainty&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-UK-recruitment-hits-nine-month-high-as-employers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+recruitment+hits+nine-month+high+as+employers+brush+off+Brexit+uncertainty http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-UK-recruitment-hits-nine-month-high-as-employers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}