Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2016

ECB sets out plan to trim monthly asset purchases but extend QE duration

The European Central Bank's Governing Council voted to extend its asset purchase programme by at least a further nine months, but to reduce the monthly purchases from April onwards.

The stimulus is designed to provide a further boost the region's recovery in the face of elevated levels of political uncertainty, but also recognises the encouraging recent economic data flow and the growing constraint on the amount of assets eligible for purchase.

Buying less for longer

The ECB will keep buying assets beyond the previous cut-off point of March, extending monthly purchases to "the end of December 2017 or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim". However, while the duration of the extension is longer than the six months that markets had been anticipating, there was a surprise in that the amount of monthly purchases will be scaled back from "80bn to "60bn, representing a 'tapering' (though this is not a word that was used by the ECB) that will be occurring earlier than many had expected.

Today's decision is in fact not altogether surprising. Economic growth appears to be gaining strength despite Brexit and widespread concerns about the potential for upcoming elections in France, the Netherlands and Germany to destabilise the economy. The November PMI surveys signalled the fastest rate of business activity growth so far this year, providing especially good news on how the upturn in the economy is feeding through to the job market. The surveys showed one of the highest rates of job creation seen over the past five years.

The Eurozone PMI has moved up to signal 0.4% GDP growth in the fourth quarter, and a level broadly consistent with a neutral policy stance...

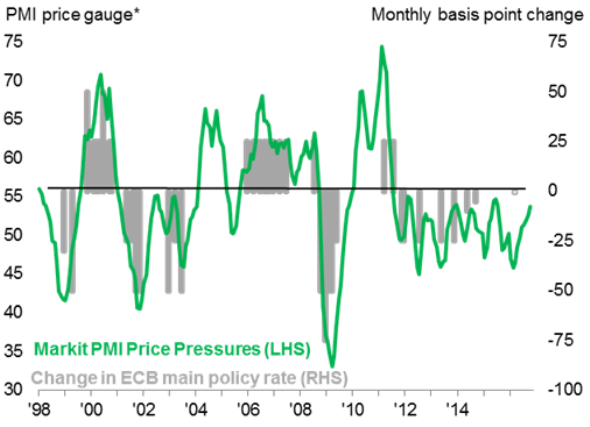

The PMI measure of input prices and supplier delays (capacity constraints) has also moved to a level consistent with tapering the stimulus...

* Derived from Manufacturing PMI price & supplier delivery times indices.

Sources: IHS Markit, ECB.

Rising employment should therefore feed through to improved consumer confidence and household spending over the course of next year. At the same time, the weakened euro is providing a much needed stimulus to export sales. Four of the top six countries in terms of improvements in manufacturing conditions were found in the eurozone, according to November's global PMI data. Price pressures have also picked up. The surveys show manufacturing output price inflation running at its highest for over five years, which will inevitably translate into higher consumer prices in coming months.

The Eurozone PMI has moved up to signal 0.4% GDP growth in the fourth quarter, and a level that is broadly consistent with a neutral policy stance according to historical comparisons. The survey measures of input prices and supplier delays (which act as a gauge of capacity constraints) have also moved to a level consistent with tapering the stimulus (see charts).

Tapering while not tapering

While the ECB's official updated forecasts were largely unchanged, prospects for next year have therefore arguably improved, though there's a clear potential for political instability to derail the upturn. The additional stimulus from the central bank should help foster a foundation for stronger growth as the region heads into a busy election year.

Anyone worried about whether the latest decision represents a 'tapering' should meanwhile note that the ECB stated that the monthly amount of asset purchases, or the length of the programme, will be extended if conditions do deteriorate.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-ECB-sets-out-plan-to-trim-monthly-asset-purchases-but-extend-QE-duration.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-ECB-sets-out-plan-to-trim-monthly-asset-purchases-but-extend-QE-duration.html&text=ECB+sets+out+plan+to+trim+monthly+asset+purchases+but+extend+QE+duration","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-ECB-sets-out-plan-to-trim-monthly-asset-purchases-but-extend-QE-duration.html","enabled":true},{"name":"email","url":"?subject=ECB sets out plan to trim monthly asset purchases but extend QE duration&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-ECB-sets-out-plan-to-trim-monthly-asset-purchases-but-extend-QE-duration.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+sets+out+plan+to+trim+monthly+asset+purchases+but+extend+QE+duration http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122016-Economics-ECB-sets-out-plan-to-trim-monthly-asset-purchases-but-extend-QE-duration.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}