Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 08, 2015

Barbie on short seller's Christmas list

Barbie has fallen out of favour in recent years, helping Mattel's shares become the hot toymaker short heading into the final weeks of the holiday shopping season.

- Short sellers single out Mattel in the lead-up to December

- Last year's hot toymaker short Hasbro has seen short sellers retreat

- Electronic learning pressures sees Vtech shorts surge back above the 3% mark

With less than three weeks left in the crucial holiday shopping period short sellers have been busily shifting their positions across the two largest US listed toymakers

Last year's hot toymaker short was Hasbro, which has freshly inked a deal with Disney to licence the toys from the widely successful Frozen franchise.

The company has since been able to largely placate sceptics as its last fourth quarterly updates have come in above analyst expectations. This run of strong results sent its shares 15% higher in the last 12 months, largely beating the rest of the market. Short sellers have been actively closing out their positions in the wake of the recent strong results as the demand to borrow Hasbro shares has more than halved in the last 12 months to 4% of shares outstanding.

Mattel now targeted

The recent strong results from Hasbro have come at the expense of its arch rival Mattel.

Mattel's flagship Barbie line has come under pressure from the upstart Frozen franchise, meaning that the top selling toy saw its sales fall for the third year in a row. Short sellers are positioning for more headwinds for Mattel, with demand to borrow its shares surging to an all-time high of 22% of shares outstanding. This marks a staggering 20-fold jump in short interest from the same point last year.

Electronic learning also shorted

Another struggling segment of the toy market in recent years has been the educational entertainment segment.The segment's established ecosystem of interactive tablets and associated content is increasingly coming under pressure from traditional tablet manufacturers with their own app ecosystem.

This has left industry leader Leapfrog struggling for survival highlighted by a 40% yoy fall in its last quarterly sales results. Despite the company announcing a restructuring plan to cut a quarter of its workforce shares have continued to hover around their all-time lows, down by 86% in the last 12 months. Short sellers had been active in Leapfrog over the last few years, but its recent death throws have not seen much appetite from short sellers as only 2% of shares are now out on loan, half the level seen last year.

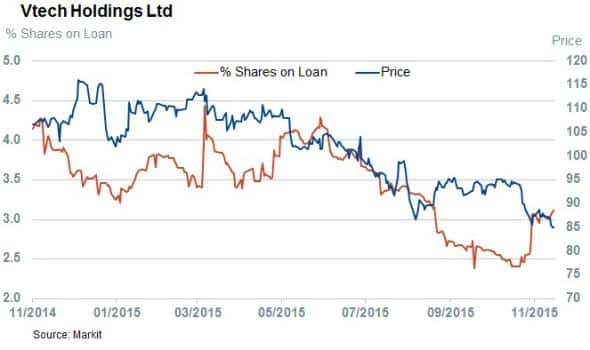

The other electronic learning player in the space, Hong Kong listed Vtech, has seen more demand to borrow in recent weeks jumping above the 3% mark. Recent allegations of lax security standards for some of the firm's products will no doubt spur on short sellers if they prove to have an effect on sales.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Equities-Barbie-on-short-seller-s-Christmas-list.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Equities-Barbie-on-short-seller-s-Christmas-list.html&text=Barbie+on+short+seller%27s+Christmas+list","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Equities-Barbie-on-short-seller-s-Christmas-list.html","enabled":true},{"name":"email","url":"?subject=Barbie on short seller's Christmas list&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Equities-Barbie-on-short-seller-s-Christmas-list.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Barbie+on+short+seller%27s+Christmas+list http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Equities-Barbie-on-short-seller-s-Christmas-list.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}