Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 08, 2015

Review of fixed income markets in 2015

As 2015 draws to a close, we highlight some of the key takeaways from credit and fixed income markets across the year.

- IG corporate bond credit risk in Europe/US reached 2012 highs, while EM sovereign credit was stifled by slowing global trade

- Idiosyncratic risk provided plenty of surprises but it did provide pockets of CDS liquidity

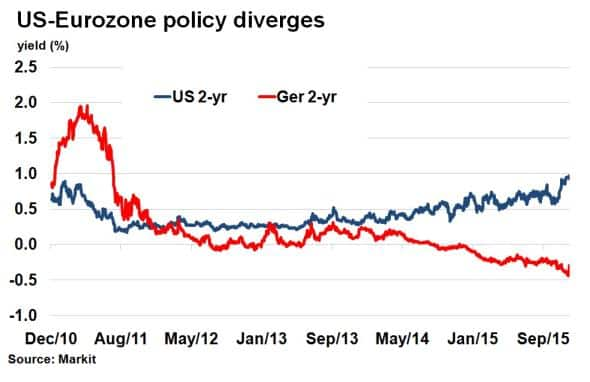

- US/eurozone central bank policy diverged causing the basis between short term bond yields to widen.

After being largely insulated from the downturn in oil prices at the beginning of the year, the broader commodities market was dragged down in the second half.

Triggered by concerns of a slowing Chinese economy and consequently lower demand for raw materials, the market volatility that ensued saw the Markit iBoxx " Basic Materials index suffer its biggest one day negative return on record.

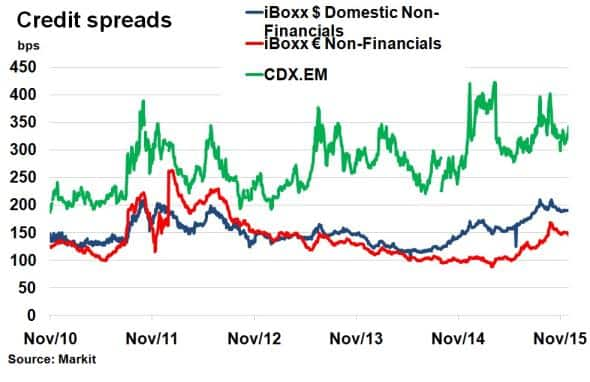

The heightened volatility also caused ripples in the broader corporate bond world, with IG bond spreads widening to 2012 highs in both US and Europe.

Commodity exposed emerging market sovereigns were also caught up in the volatility, with the CDX EM index widening to over 400bps in September. Brazil, South Africa and Malaysia were just some of the prominent names that saw credit risk soar during the year.

Individual credit risk

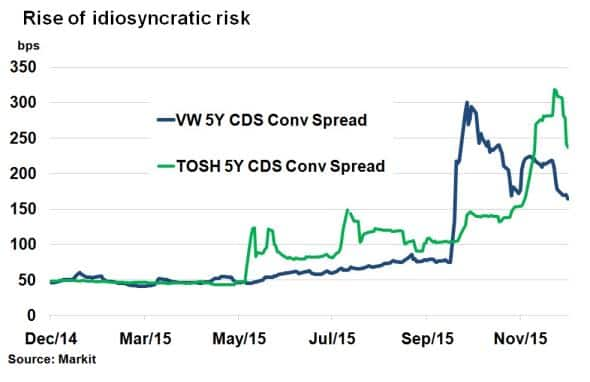

The second half of the year also gave rise to a heightened degree of idiosyncratic risk in credit markets, where individual corporations saw creditworthiness deteriorate rapidly.

German automaker Volkswagen saw CDS spreads quadruple in September amid an emissions scandal, scattering contagion in the European autos sector. It was a similar story in healthcare with US pharmaceutical firm Valeant. Japanese electronics giant Toshiba's CDS spread multiplied six-fold as it faced a probe into a multibillion dollar accounting scandal.

Political risk was also a reoccurring theme throughout the year among sovereigns, with Turkey, Greece and Brazil marred by economic uncertainty arising from shifts in political power.

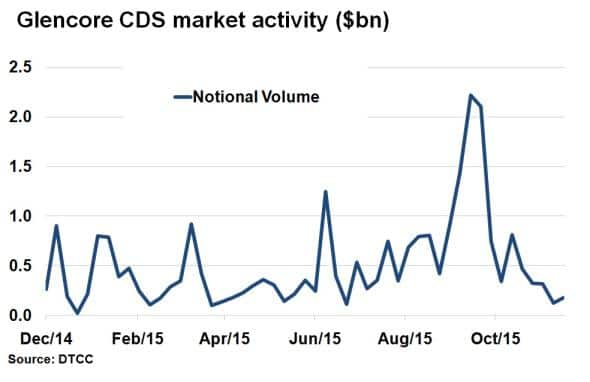

CDS liquidity came in pockets during times of volatility, as investors sought to hedge risk exposure and gauge counter party risk in the energy sector. Glencore's CDS trading activity spiked, with notional trading activity quadrupling as the downfall in commodity prices raised questions about the firm's future operating structure.

Liquidity concerns were staved

Lingering concerns over liquidity in the cash bond, especially after 2014's treasury "flash crash", meant 2015 was going to be under even more scrutiny. Even in August and September's volatile environment, there were no such similar cases, although dealers were quoting corporate bonds less, with UK market running very thin.

Fixed income ETFs also remained resolute during the period of volatility and outflows (tracking error in $LQD and $HYG remained below 2.5bps).

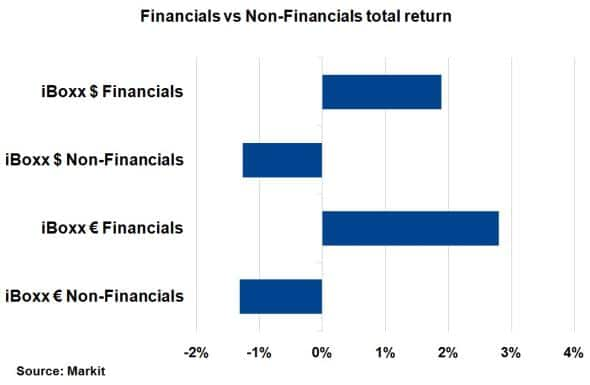

Financials lead

The best performing sector of 2015 (to December 7th) has been financials. A strong regulatory backdrop, plenty of supply and promise of higher lending margins in 2016 has seen spreads perform better than the broader corporate bond market. Investors enjoyed positive returns in Europe and the US, as opposed to negative total returns for non-financials.

US/Euro policy diverges

When volatility came to the wayside, as it did at the start of the year and in October, central bank policy dictated credit risk sentiment. In Europe, QE saw peripheral sovereign spreads reach new lows and corporate credit spreads tighten. In the US, the threat of higher rates had mixed reactions, a signal of a stronger economy but also higher future borrowing costs.

Diverging policy led to a widening in the basis between short term bond yields in the US and eurozone, and the rise of instruments such as the 'reverse yankee'.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Credit-Review-of-fixed-income-markets-in-2015.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Credit-Review-of-fixed-income-markets-in-2015.html&text=Review+of+fixed+income+markets+in+2015","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Credit-Review-of-fixed-income-markets-in-2015.html","enabled":true},{"name":"email","url":"?subject=Review of fixed income markets in 2015&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Credit-Review-of-fixed-income-markets-in-2015.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Review+of+fixed+income+markets+in+2015 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122015-Credit-Review-of-fixed-income-markets-in-2015.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}