Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 08, 2014

ETPs and the falling yen

As Japan's currency falls to its lowest level in over five years against the dollar, we look at strategies used by ETF investors to play this currency trend.

- Japanese investors have piled over $670m in non-Japanese exposed ETFs over the last five quarters

- Precious metals products have proved popular with Japanese investors over the last two years

- Currency investors have been busy taking profits from yen short ETPs

The macro level exposure afforded by ETF investing gives insights into foreign exchange expectations as currency swings can have large impacts on underlying asset price returns. By looking at asset flows in and out of certain products, one can gauge investor reactions to currency shift, and gain insights on future expectations.

Looking at Japanese listed ETFs we see that the country's recent plunging currency has seen investors add to internationally exposed products, which benefit from a falling yen. This comes as the country's recent lacklustre economic numbers have seen the dollar outperform the Nikkei 225 by over 7% since the start of the year.

Appetite strong for foreign exposure

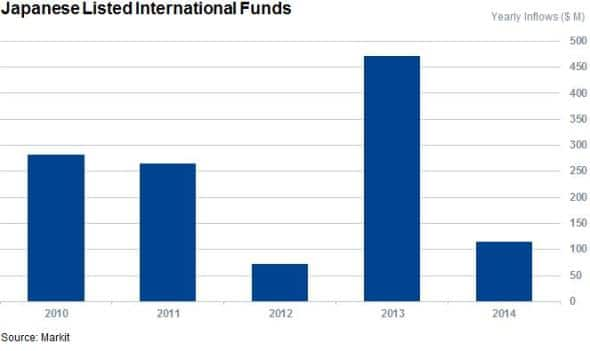

The last two years, which have seen Japanese listed ETPs which invest in international markets prove popular in the wake of the falling yen. While the asset class has grown for every year in since the first international fund was launched in 2007, last year's onset of Abenomics saw Japanese ETP investors add $470m to their international exposure.

This looks set to continue in the current year as these funds have seen $114m of inflows in the first nine months of the year, nearly twice their 2012 total inflow.

This growth in AUM is driven by both new inflows into existing funds and new fund launches as the number of Japanese products with international exposure has more than doubled in the last five years to 64.

Precious metals buck global trend

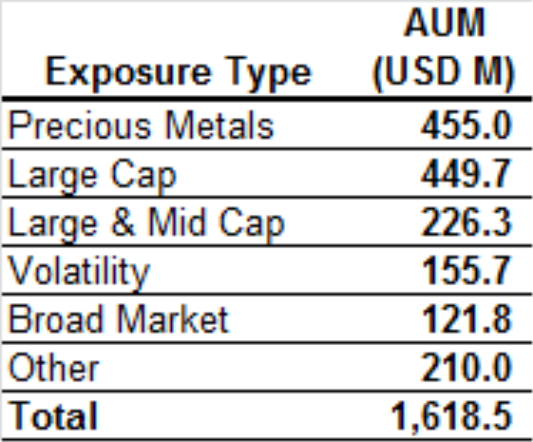

Precious metals, which tend to be denominated in dollars, have proven to be the most popular asset class investments within the non-Japan exposed arena.

Note that Japanese investors added to their precious metal portfolio on the whole in 2013, with just under $60m of inflows into Japanese listed precious metal funds.

This runs against global appetite as investors worldwide pulled over $40bn for products which track gold and other precious metals in 2013, a trend which looks set to continue this year as precious metal products have seen $1.9bn of outflows.

Yen ETP investing

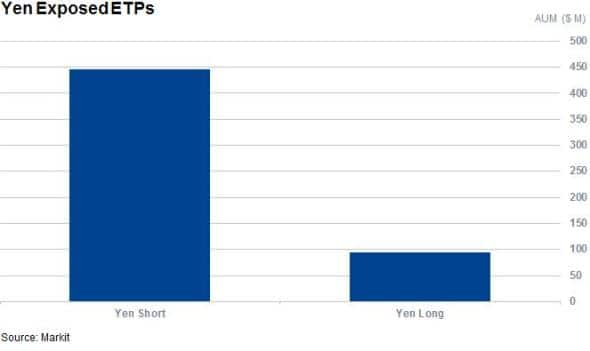

On a pure play basis, ETP investors look to be in no hurry to reverse their bearish views on the yen, as the aggregate assets managed by funds benefit from a further fall in the yen outperform those which rise when the opposite occurs by over five to one. There is currently $445m held by the three bearish yen funds, while their bullish peers have seen their AUM base atrophy to $95m in the last seven years from over $1bn in 2007

Yen bulls can take some solace from the fact that investors have been paring back some of their bearish views in the last few months as the nine yen short ETPs have seen over $200m of outflows since the start of the year. This is mostly led by the ProShares UltraShort Yen, which has seen its AUM base fall by a third to $403m.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-equities-etps-and-the-falling-yen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-equities-etps-and-the-falling-yen.html&text=ETPs+and+the+falling+yen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-equities-etps-and-the-falling-yen.html","enabled":true},{"name":"email","url":"?subject=ETPs and the falling yen&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-equities-etps-and-the-falling-yen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETPs+and+the+falling+yen http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102014-equities-etps-and-the-falling-yen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}