Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 09, 2014

Short appetite for US IPOs

We are on track to make 2014 the most active year for US IPOs since 2000. But a review of short interest in recently floated firms finds some investors willing to pay over 100% of value to place a negative bet.

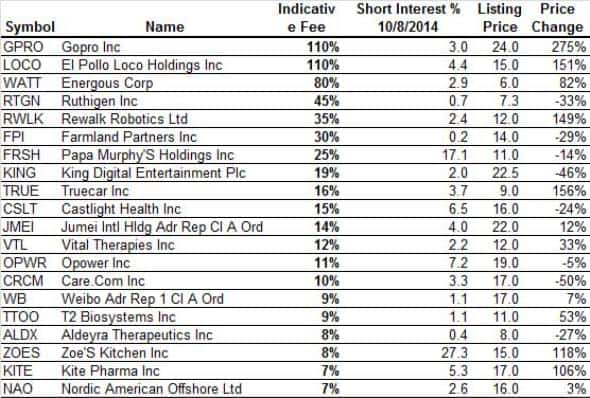

- Go Pro and El Pollo Loco remain the most expensive stocks to borrow with investors willing to pay over 100% in order to gain short exposure

- Around a quarter of this year's listings cost more than 4% to short

- Ali Baba has quickly become one of the least expensive stocks among 2014 IPOs

$37 billion was raised for US IPOs in the third quarter of 2014, making it the most successful quarter since Q4 in 1999. While this number is skewed somewhat by Ali Baba's recent $22 billion listing, large one day spikes from several key headline listings show demand for new listings is strong amongst investors. Although short sellers have largely avoided the Chinese ecommerce giant, the same can't be said for many of this year's crop of newly listed shares.

The chart below ranks the 20 most expensive IPOs by the indicative fee which estimates the cost for a buyside firm to borrow these securities. While the short interest percentage varies, the fee can be the most revealing aspect regarding appetite to short as it represents how much investors are willing to pay to gain short exposure.

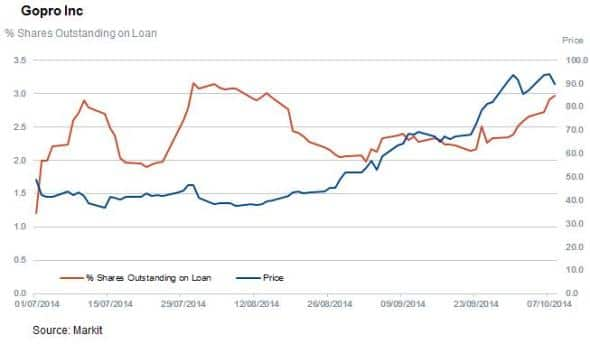

Go Pro and El Pollo Loco remain the most expensive to borrow of the lot with fees approaching 100% of the borrowed value. Note that keeping this position open for a full year at this current rate would essentially ensure a loss, so these are more than likely short time trades after strong price rises.

These fees can get extremely high even when short interest remains relatively low due to supply constraints in the securities lending market. This can be especially true for IPOs at it often takes time for shares to make their way to custodian banks where they are made available to borrow. The 20 firms which cost the most to borrow amongst this year's listing have an average of 5% of their shares outstanding sitting in lending programs, a fifth of the average availability seen among S&P 500 constituents.

Go Pro and El Pollo Loco are excellent examples of this as the have 1.8% and 2.8% of their shares outstanding in lending programs respectively.

Large deals generally not shorted

Note that the larger listing hitting the market have generally not been the target of short sellers as the seven of the nine deals which offered raised more than $1bn this year to date all command less than 1%. The only two exceptions in this field are recent listing Grupo Avl and jd.com.

Headline-grabbing Alibaba continues to see little appetite from short sellers with less than a fifth of available shares out on loan which ensures that its shares command less than 0.5% a year to borrow.

IPO appetite from ETF world

This year's rush in new deals has also seen investors flock to ETFs which track newly listed shares with the two IPO tracking funds seeing assets under management rise to an all-time high of $567m at the end of last quarter. This is driven by a combination of strong inflows, over $145m year to date, and strong returns. Leading this strong return is the First Trust IPOX-100 which has returned 5% year to date, 10% more than the return seen in the Russell 2000 index.

Andrew Laird | Securities Finance Analyst, Markit

Tel: +1 646-312-8990

andrew.laird@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Equities-Short-appetite-for-US-IPOs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Equities-Short-appetite-for-US-IPOs.html&text=Short+appetite+for+US+IPOs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Equities-Short-appetite-for-US-IPOs.html","enabled":true},{"name":"email","url":"?subject=Short appetite for US IPOs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Equities-Short-appetite-for-US-IPOs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+appetite+for+US+IPOs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Equities-Short-appetite-for-US-IPOs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}