Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 07, 2014

Positive outlook for dividends

Markit forecasts a bright future for dividends across the major markets of the US, Europe and the UK. However there are a number of areas experiencing turbulence.

- 85% of S&P 500 companies are forecast to pay dividends this fiscal year; the highest level since 1997

- Dividend payments across Europe (ex UK) are expected to rise by almost 8% led by Belgium, Germany, and Switzerland

- In the UK dividends are expected to increase by over 4% but exchange rates are an important consideration

To receive a copy of the full US, UK, Europe (ex UK) quarterly dividend analysis, please contact dividendsupport@markit.com

US

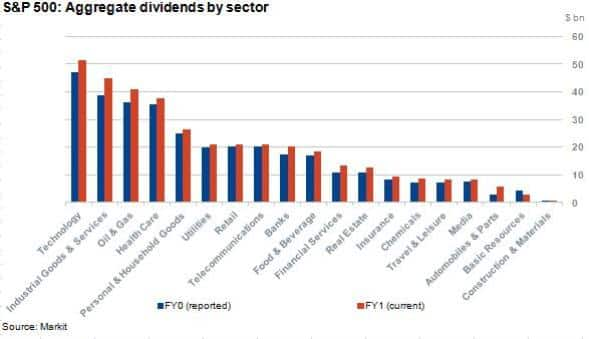

Our projection for S&P 500 dividend payments this fiscal year is $373bn, with a yield of 2.15%. The sectors contributing the most are Technology, Industrial Goods & Services, and Oil & Gas. Overall the outlook is positive, and we forecast that 75 companies in the index will increase quarterly payments in Q4.

For the full year, the Automobiles & Parts sector is expected to post the highest growth at 90%. This is mainly down to General Motors Co reinstating dividends and a projected 25% increase from Ford Motor Co. The Technology sector is likely to make up the biggest portion of S&P 500 cash distributions at $51bn, up 8.8% on the previous year.

A number of significant increases are predicted within the Industrial Goods & Services sector. We expect General Electric to increase its dividend from $0.22 to $0.25 in Q4, based on guidance that the payout would drift higher in future. The team also expects a dividend increase of 11% from Boeing which plans to return more than 80% of its free cash flow to shareholders via dividends and share repurchases. Oil & Gas stocks are expected deliver a 13.4% increase to return $40.9bn, with 41 out of 36 companies expected to pay dividends to their shareholders.

UK

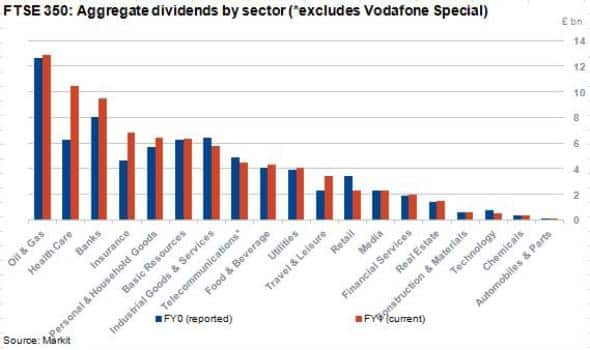

Based on our projections the basket of FTSE 350 companies offer a yield of around 3.8% and are expected to increase regular dividend payouts by 4.4% to "74.5bn. When exceptional payments are taken into account the number rises to "84.1bn, up 18% on last year (excluding Vodafone's Capital Return).

The relative strength of sterling compared to the dollar is extremely important for UK shareholders receiving dividends in pounds. In total of 53 companies in the FTSE 350 set dividends in dollars, accounting for 37% of the total projected payout.

Negative news from incumbent supermarkets has dominated business headlines and Tesco has already announced a 75% cut in its dividend. We expect others to reduce payments as they continue to lose market share. There have also been profit warnings across other sectors raging from construction (Balfour Beatty) to Food & Beverage (Tate & Lyle and Associated British Foods).

The oil majors continue to be key providers of income from UK listed stocks. The biggest names, BP and Royal Dutch Shell, are currently offering 12 month forward yields of over 5%. Although the fallout from the Deepwater Horizon spill continues to cast a shadow over BP's dividends we don't see any immediate risk to the dividend.. Royal Dutch Shell is planning $30bn of distributions to shareholders in the 2014-2015 period, made up of dividends and buybacks.

Banks are benefiting from improvements in asset quality, reporting better ratios on higher capital requirements and seeing improving profitability as a result of lower impairments. On average we expect growth of 7% in declared payouts, but the results of stress tests in December will be decisive.

EU

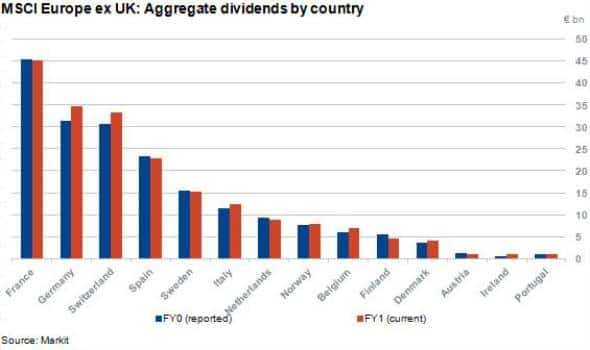

Across the universe of MSCI Europe (ex UK) companies we expect payments to rise by 7.7% to €196.4bn in this reporting year. The strongest growth is expected in Belgium (15.1%), Germany (10.4%) and Switzerland (8.1%).

The fallout from the crisis in Ukraine is seen having the biggest impact on payments from Austrian banks Erste and Raiffeisen, which we expect will suspend dividends. As a result of Russian sanctions we have lowered dividend forecasts for almost a quarter of German index constituents in the past quarter.

French companies are expected to pay €318m less this year, mainly due to projected cuts from Vivendi (-72%) and GDF Suez. Estimates for alcohol manufactures have also been revised downward as they struggle with European conflict and slowing Chinese demand. Our forecasts for Remy Cointreau and Carlsberg have been lowered 25% and 20%.Switzerland, the third biggest contributor to MSCI Europe ex UK index, is expected to grow dividends by 8% to €33bn. The largest dividend boost comes from UBS where we expect the ordinary dividend to increase 120% to CHF 0.55. There is also positive news for Italy where a change of 9% is forecast.

Ryan Bransfield | Dividend Analyst, Markit

Tel: +44 207 2602024

ryan.bransfield@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102014-Equities-Positive-outlook-for-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102014-Equities-Positive-outlook-for-dividends.html&text=Positive+outlook+for+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102014-Equities-Positive-outlook-for-dividends.html","enabled":true},{"name":"email","url":"?subject=Positive outlook for dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102014-Equities-Positive-outlook-for-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Positive+outlook+for+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102014-Equities-Positive-outlook-for-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}