Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 07, 2014

US labour market upturn still marred by lacklustre wage growth

US unemployment fell to a six-year low of 5.8% in October as companies continued to take on staff in impressive numbers. The data add to signs that the economy is enjoying another period of strong growth in the fourth quarter. However, lacklustre wage growth takes some of the shine off the improvement in the employment situation, and also acts as a bar to raising interest rates.

Still-strong hiring

Non-farm payrolls rose by 214,000 in October and the 248,000 rise previously reported for September was revised up to 256,000, according to the Bureau of Labor Statistics. August's data were also revised slightly higher to 203,000.

Anyone disappointed by the October number, which came in below expectations of a 231,000 rise, needs to bear in mind that payrolls have now risen by more than 200,000 in each of the past nine months. This means that, so far this year, the economy has added some 2.285 million jobs, of which 2.225 million were in the private sector. This has helped bring the jobless rate down sharply from 7.2% a year ago to 5.8% in October, its lowest for six years.

Slower (but still robust) growth in Q4

The sustained impressive rate of job creation has corresponded with a strong run of economic growth, which looks to have persisted into the fourth quarter, albeit with some signs of the pace of expansion easing.

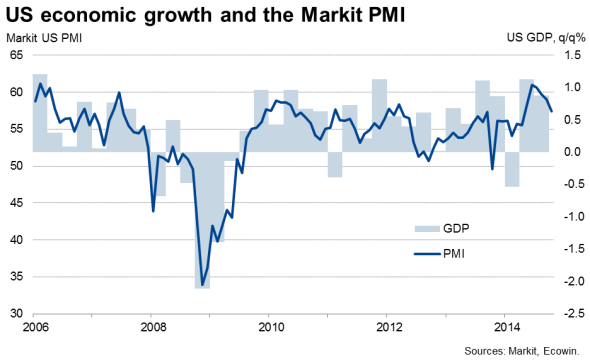

Markit's PMI surveys have been especially buoyant through much of the year to date, and anticipated the strong economic growth that was confirmed by the official GDP data in the second and third quarters. Encouragingly, the surveys indicated another robust pace of expansion in October, albeit with the pace of expansion having slowed to a six-month low.

However, despite this slowing, the surveys are running at a level consistent with approximately 2.5% annualised GDP growth, which is a reasonably robust pace of expansion by historical standards, and certainly a sufficiently strong pace to ensure a continued robust rate of job creation.

The PMI surveys in fact also pointed to ongoing resilient hiring despite the slowdown. The concern is that, with employment often acting as a lagging indicator, job creation could start to wane in coming months in line with the slower pace of economic growth.

The extent of any further slowdown in the pace of economic growth and job creation will be of key importance to policymakers weighing up when the US economy is ready to withstand higher interest rates.

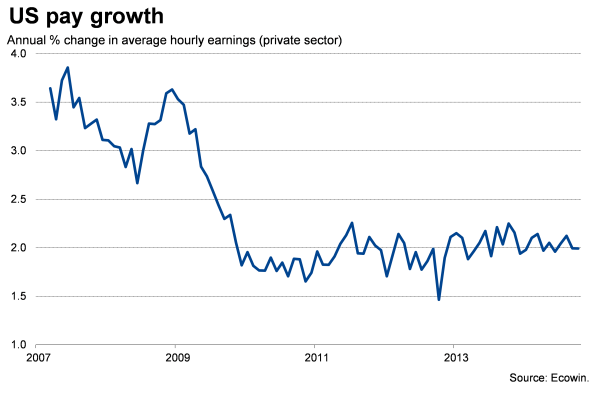

However, a further key (and probably essential) ingredient to any tightening of monetary policy is the return of wage growth. With average hourly wage growth stuck at just 2.0% per annum in October, a rate it has been more or less steady at over the past five years, policymakers will generally be in no rush to raise interest rates.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-economics-us-labour-market-upturn-still-marred-by-lacklustre-wage-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-economics-us-labour-market-upturn-still-marred-by-lacklustre-wage-growth.html&text=US+labour+market+upturn+still+marred+by+lacklustre+wage+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-economics-us-labour-market-upturn-still-marred-by-lacklustre-wage-growth.html","enabled":true},{"name":"email","url":"?subject=US labour market upturn still marred by lacklustre wage growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-economics-us-labour-market-upturn-still-marred-by-lacklustre-wage-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+labour+market+upturn+still+marred+by+lacklustre+wage+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-economics-us-labour-market-upturn-still-marred-by-lacklustre-wage-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}