Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 11, 2014

EU autos sector moves into reverse gear at start of final quarter

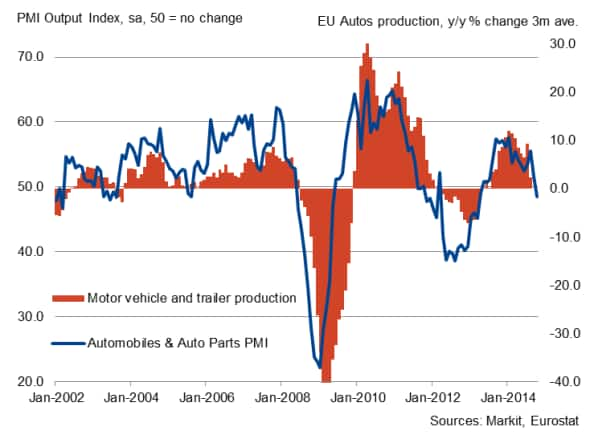

Markit's automobiles & auto parts PMI for Europe showed a decrease in production for the first time in 18 months in October. The contraction represented a marked turnaround from the strong performance seen in the sector at the start of the year when output growth was the fastest for over two-and-a-half years.

Weighing on activity levels in the second half of the year has been renewed weakness in incoming new orders at autos firms. New orders have fallen in four of the past six months, dropping in October to the greatest extent since March 2013. New export business* also fell in October, down for the second month running.

Renewed weakness in autos sector

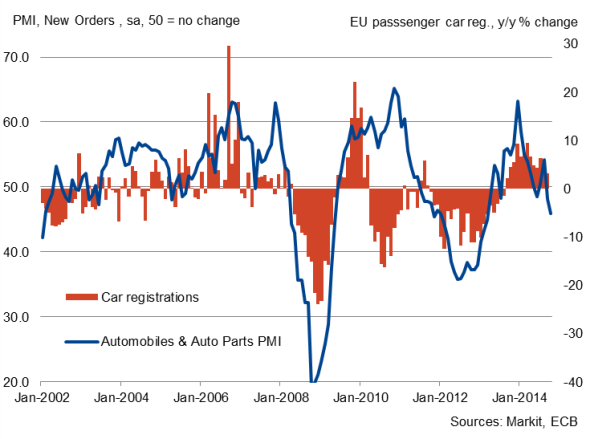

Signs of weakness in car registrations

These latest gloomy PMI figures follow data from the ECB showing new passenger car registrations rising at the slowest annual rate for 12 months in September. Adjusted for working days, car registrations rose just 3.2%, down from a 5.9% year-on-year increase in August. With latest PMI data pointing to weak demand and renewed job losses in the euro area and economic growth at a 16-month low in the UK in October, the likelihood is that the slowdown has continued into the final quarter.

New car registrations set to fall?

Autos firms in retrenchment mode

Facing falling orders and rapidly shrinking backlogs of work, autos firms in Europe have begun taking up more defensive positions. October saw input buying fall for the second month in a row, contributing to a further drop in inventories. Employment across the industry ticked up slightly during the month following little change in September, though the rate of job creation paled in comparison with that seen earlier in the year. Meanwhile, the survey pointed to a drop in average output prices by auto producers, in a sign that businesses are lacking pricing power and having to offer discounts in order to encourage sales.

*including intra-Europe trade.

For a full overview of Markit Europe Sector PMI data in October click here.

Phil Smith | Economist, Markit

Tel: +44 149 1461009

phil.smith@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-Economics-EU-autos-sector-moves-into-reverse-gear-at-start-of-final-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-Economics-EU-autos-sector-moves-into-reverse-gear-at-start-of-final-quarter.html&text=EU+autos+sector+moves+into+reverse+gear+at+start+of+final+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-Economics-EU-autos-sector-moves-into-reverse-gear-at-start-of-final-quarter.html","enabled":true},{"name":"email","url":"?subject=EU autos sector moves into reverse gear at start of final quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-Economics-EU-autos-sector-moves-into-reverse-gear-at-start-of-final-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EU+autos+sector+moves+into+reverse+gear+at+start+of+final+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112014-Economics-EU-autos-sector-moves-into-reverse-gear-at-start-of-final-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}