Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 07, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

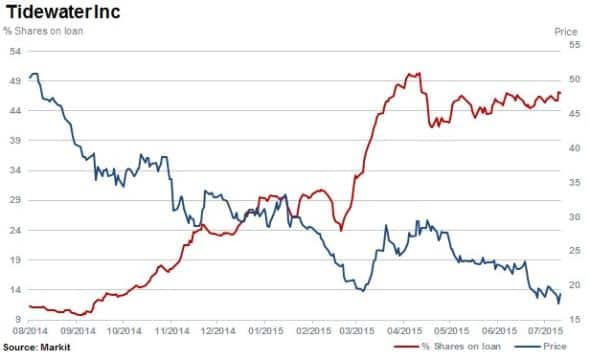

- Renewed short interest in Tidewater as shares continue to fall as the oil price hits fresh lows

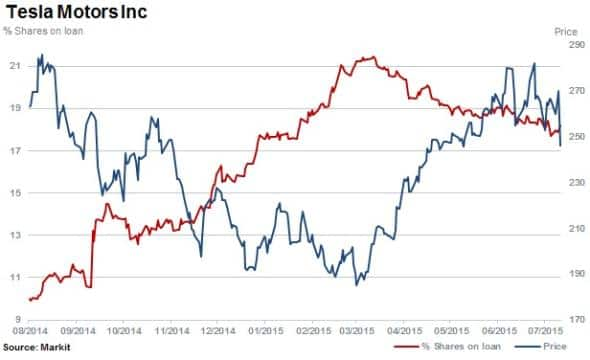

- Poised to squeeze Tesla sees shorts benefit from company lowering production guidance

- Short sellers take aim at Singapore's Noble and flee China Vanke ahead of results

North America

Most shorted ahead of earnings in North America this week is Tidewater with 46% of shares outstanding on loan. The company's stock has fallen over 60% in the last 12 months with short sellers in the offshore marine support services company increasing their positions.

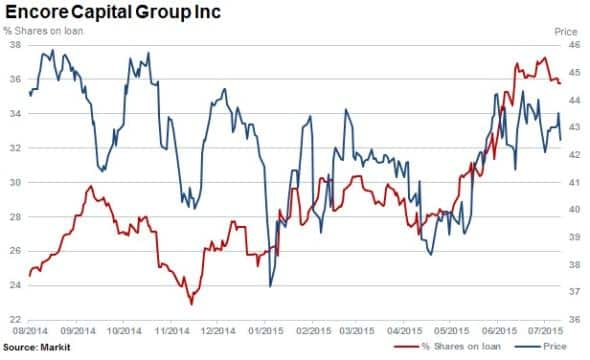

Second most shorted is Encore Capital Group with 36% of shares out on loan. The consumer debt recovery firm has seen short interest rise by 30% in the last three months as the US prepares for a possible interest rate rise in September.

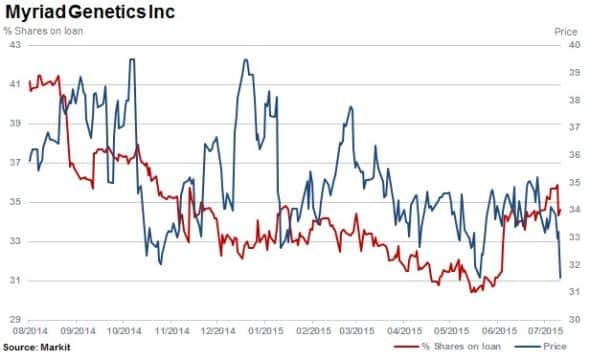

Myriad Genetics has frequently appeared the most shorted ahead of earnings and is in third place this week with 35% of shares out on loan. Short interest along with the share price has declined since April 2014 from highs above 45% and $45 respectively.

Tesla shares fell by 9% yesterday as the company guided annual vehicle production targets lower, benefiting short sellers as the stock was poised to squeeze, according to Markit Research Signal's Short Squeeze model. The model identifies companies at risk or highly likely to suffer a squeeze. Another top ranked company currently is Ubiquiti Networks (UBNT), which released results after yesterday's close

Europe

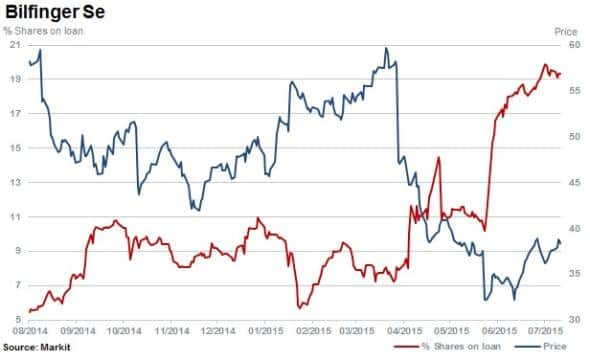

Most shorted ahead of earnings in Europe is German based Bilfinger which provides industrial power, building and facilities services. Short interest currently stands at 19% after jumping 75% in the last three months. Shares in the company plummeted in April 2015 as the company issued its fifth profit warning in under a year.

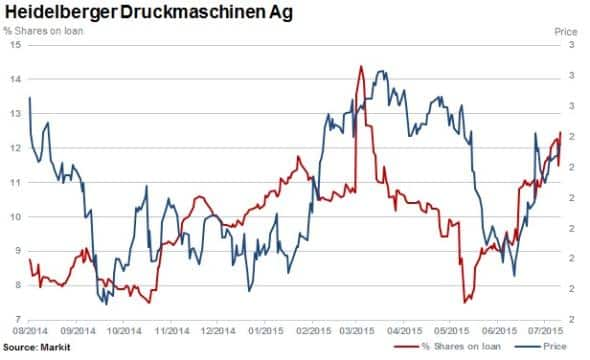

Shares in the third most shorted ahead of earnings in Europe, Heidelberger Druckmaschinen,, have rallied by 36% in the last month. Short sellers have followed the rise in price with short interest in the printing services and equipment firm increasing by 19% to 13% of shares out on loan.

Apac

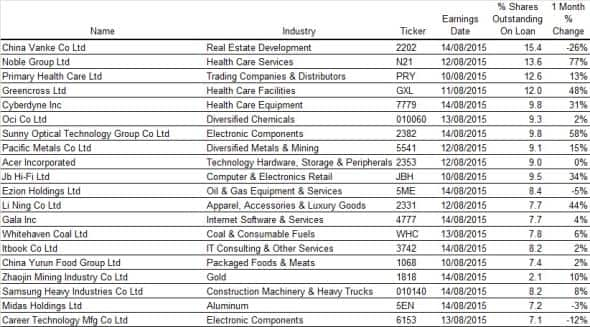

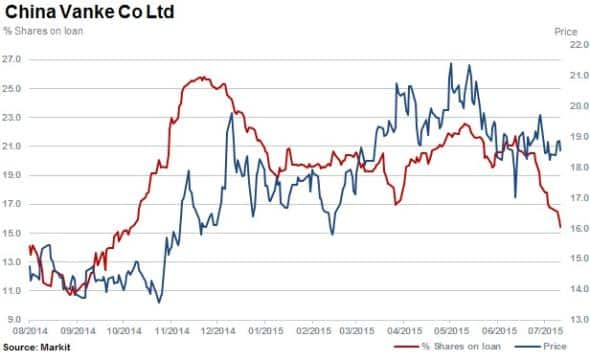

Most shorted ahead of earnings in Apac is residential property developer China Vanke with 15% of shares out on loan. Short sellers have reduced positions by 25% in the last three months as the company's board approved a share buyback programme to prop up shares in early July.

Short sellers have continued to rush to Noble Group in the last few days ahead of earnings, with shares out on loan increasing by 77% in the last month to reach 13.6%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}