Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 07, 2015

Venezuela on the brink; Asia faces headwinds

The first sovereign casualty of the oil price slump may be on the horizon, while emerging markets face a three-pronged threat from the strong dollar, weakening China and slumping commodity prices.

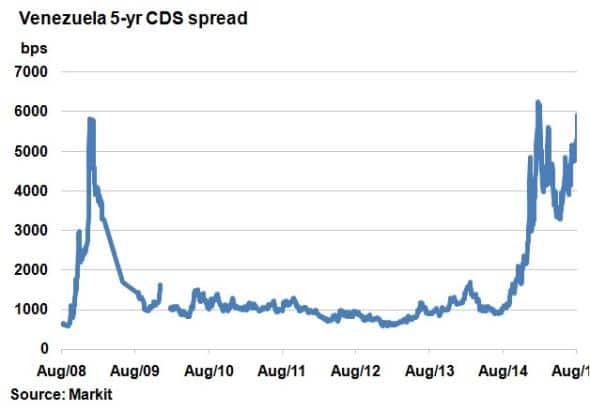

- Venezuela's 5-yr CDS spread has widened to 5,925bps, approaching new record high

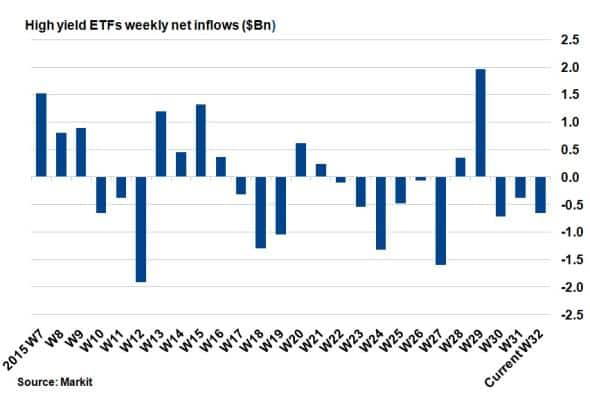

- HY bond ETFs have experienced outflows totalling $1.7bn over the past three weeks

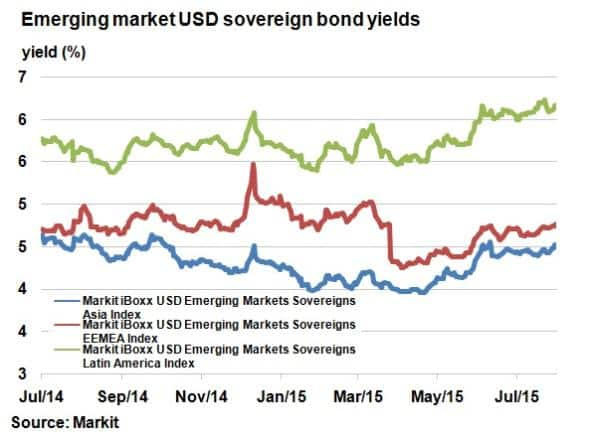

- Markit iBoxx USD Emerging Markets Sovereigns Asia Index's yield has surpassed 4.5%

On the brink

The cost to protect against Venezuelan bonds defaulting is approaching record highs again. The oil rich South American nation has seen its 5-yr CDS spread widen over 1,000bps in the past week to 5,925bps. The level is fast approaching the record widest level of 6,254bps reached in January this year when the price of oil was in freefall.

Venezuela, a country that depends heavily on oil exports for revenue, has seen its credit risk soar for the second time in the last 12 months as the price of WTI crude oil has fallen to $45. The only previous occasion that spreads were at comparable levels was in December 2008 at the height of the financial crisis, when the price of WTI oil crashed to $33. Since then Venezuela has done little to diversify its economy away from oil dependence and a strong dollar has crushed its currency and imported inflation. The latest oil slump has pushed the economy to the brink of bankruptcy and investors are demanding more to hedge against the risk.

HY shunned

Investor sentiment around high yield (HY) bonds has turned negative again after ETFs tracking HY bonds saw three weeks of consecutive outflows totalling $1.7bn. These outflows followed what was the best week for HY ETF inflows on the week starting July 13th, when $1.96bn was poured into the sector after Greek tensions eased. But renewed pressure from a slowing China and weak commodity prices has prompted investors to look elsewhere.

The negativity around HY bonds can also be represented by widening bond spreads. One rating bucket in particular, CCC, has seen its spread over treasuries reach over 1,000bps according to the Markit iBoxx USD Liquid High Yield CCC Index. The last time the 1,000bps level was breached was over three years ago and the current annual yield, 12.49%, has risen over 1% over the past month; a new four year high.

Asia

A strong dollar, falling commodity prices and a slowing China is wreaking havoc in Latam credit. Brazil, Colombia and Chile have all seen sovereign credit spreads widen drastically over the past month. But Latam isn't the only emerging market region susceptible to such headwinds; some Asian nations might face similar challenges.

The yield on the Markit iBoxx USD Emerging Markets Sovereigns Asia Index has surpassed 4.5%, 50bps higher than levels seen in April. A strong dollar has severely dampened the Indonesian rupiah and the Malaysian ringgit, making it harder for debtors to service debt in US dollars. With the US Fed ready to increases interest rates later this year, the situation has the potential to get worse.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Credit-Venezuela-on-the.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Credit-Venezuela-on-the.html&text=Venezuela+on+the+brink%3b+Asia+faces+headwinds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Credit-Venezuela-on-the.html","enabled":true},{"name":"email","url":"?subject=Venezuela on the brink; Asia faces headwinds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Credit-Venezuela-on-the.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Venezuela+on+the+brink%3b+Asia+faces+headwinds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Credit-Venezuela-on-the.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}