Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 10, 2015

Greek banks' bonds fare better than equity

Last week's reopening of the Greek stock exchange saw the country's banks lead the worst selloff on record. But these same institutions' bonds have proved much more resilient, with several bonds actually advancing over the last week.

- Greek banks' equity values fell by nearly 60% last week

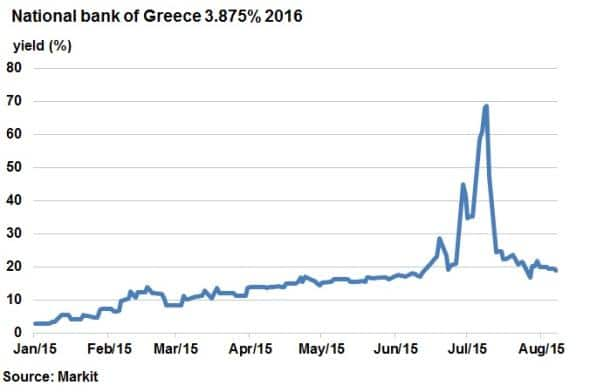

- National Bank of Greece's 2016 bonds now yielding less than 20%; lowest in six weeks

- Smaller banks Piraeus and Alpha banks have also seen their bond recover from lows

The four week trading hiatus imposed on Greek stocks in the wake of the country's ongoing debt crisis has hit banks hardest of all, as seen by the fact that the FTSE/ATHEX-CSE Banking Index fell by nearly 40% in the week after the ban was lifted. This slump compounded the sector's fall for the year so far to 71.3%; three times that seen in the constituents of the FTSE/ATHEX Large Cap index.

While the slump was partly driven by pent up selling demand, the fact that the National Bank of Greece's ADRs, which continued to trade over the recent market shutdown, fell by a further 16% to a record low indicates that the price swing was partly driven by a continued deterioration of investor sentiment towards Greek banks.

Fixed income bucks the trend

Interestingly, the pain of Greek bank equity investors last week has not been felt by fixed income investors, as Greek bank bonds tracked by Markit have continued to see their yields fall.

Greece's largest bank, National Bank of Greece, has seen the yield on its short term bond due 2016 plummet since the bailout was agreed on July 12th. These bonds yielded as much as 70% on July 8th but have since tightened to below 19% as of last Friday's close; a level last seen in mid-June.

As an agreement for a third bailout package is set in motion, credit investors have become more bullish on National Bank of Greece's credit risk, but yields are still a far cry away from those seen pre-Syriza.

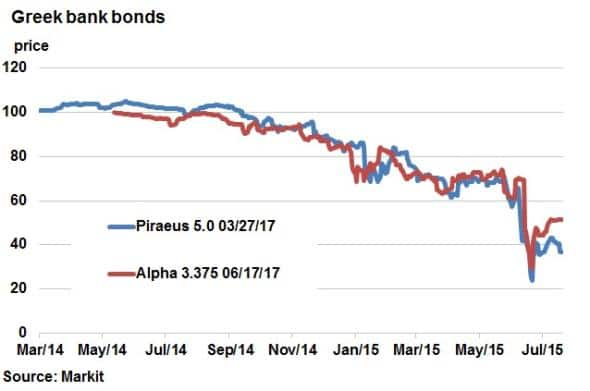

This is trend is not limited to National bank of Greece, as smaller Greek banks have also seen bond prices bounce back from the sharp selloff seen in early July. Alpha Bank and Piraeus Bank have both seen their two year bonds make significant gains in price from their recent lows. Alphas Bank's bond due 2017 has gained 22pts (cash basis to par) since July 7th and currently trades at 51.5. Piraeus's bonds of the same maturity have also tightened significantly from their lows seen on the same day.

While both Alpha's and Piraeus' bonds continue to trade at distressed levels (49% and 95% respectively) the fact that their prices have recovered strongly from the lows seen at the crux of the crisis indicates that bond investors are placing more faith in the continuing negotiations. This marks an interesting contrast to the treatment of these banks' equities, as demonstrated by the recent all-time lows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082015-Credit-Greek-banks-bonds-fare-better-than-equity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082015-Credit-Greek-banks-bonds-fare-better-than-equity.html&text=Greek+banks%27+bonds+fare+better+than+equity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082015-Credit-Greek-banks-bonds-fare-better-than-equity.html","enabled":true},{"name":"email","url":"?subject=Greek banks' bonds fare better than equity&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082015-Credit-Greek-banks-bonds-fare-better-than-equity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+banks%27+bonds+fare+better+than+equity http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082015-Credit-Greek-banks-bonds-fare-better-than-equity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}