Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 07, 2015

Auto makers drive innovation at CES

2015's hottest technology trends were revealed at the recent Consumer Electronics Show in Las Vegas - piquing investor interest, as firms with the newest technology tend to see strong yields, according to Markit's Research Signals' findings.

- Firms with the newest tech yielded average returns of 15.3% in 2014

- In the auto sector, short sellers bet against Tesla with 15.6% short interest

- Elsewhere in tech, short sellers have targeted 3D Systems and Stratysys

Automakers dominate

Despite Apple continually shunning the event, the Consumer Electronics Show (CES), is an annual event for companies to showcase new variations of electronic products. Entirely new product launches are now rare; arguably since Nintendo released the NES in 1985 there have been few notable milestones, with trends surfacing instead. This year's main themes are automotive integration with technology and the "internet of things" (IoT).

Even though major automakers such as BMW, Daimler AG and Ford were present, relative newcomer Tesla was not. Panasonic's chairman did announce at the show that he expects Tesla to produce 500,000 vehicles by 2020; 15 times higher than current levels. These hopes are underpinned by the Panasonic and Tesla which are building the lithium-ion 'Gigagactory' in a joint venture in Nevada.

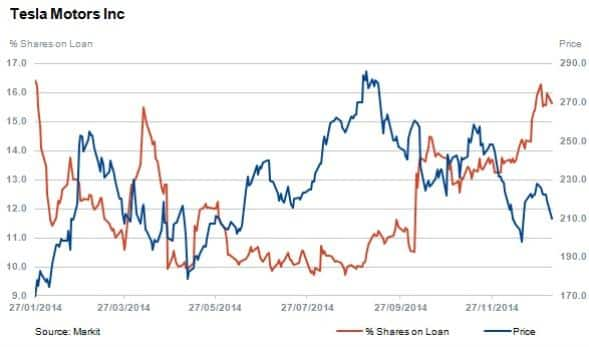

Short sellers have increased their positions in the electronic carmaker since the middle of 2014 and Tesla is currently the most shorted out of the major manufacturers, with 15.6% of shares outstanding on loan.

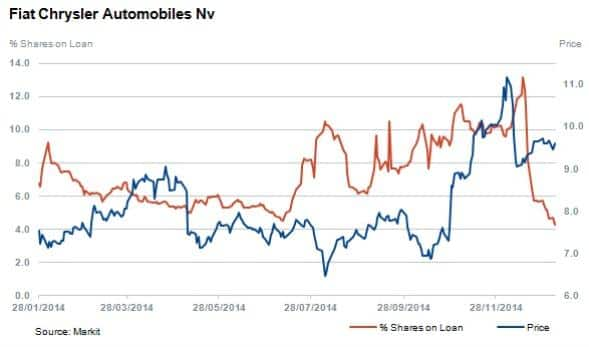

Fiat Chrysler, the second most shorted automaker, currently has 4.3% of its shares outstanding on loan after short sellers covered positions by 58% since early December 2014. This as shares slumped post an October listing on the NYSE as the firm continues to restructure operations globally.

The balance of the industry has exhibited generally low levels of shorting activity, with an average of just 0.5% of shares outstanding on loan among the large exhibitors.

Performance wise, besides Toyota whose share price has increased by 16% over the last 12 months, Fiat and Tesla are the stand out top performers with stock price increases of 44% and 41% respectively over the last 12 months perhaps explaining the continued interest and larger positions taken by short sellers.

Questionable returns from tech

A few new technologies have yet to deliver returns to investors, and a few have had a disastrous year in terms of share price performance.

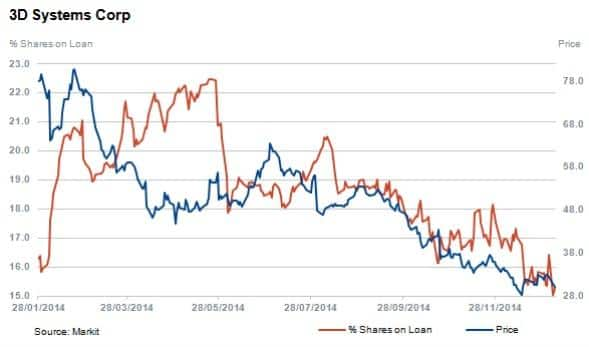

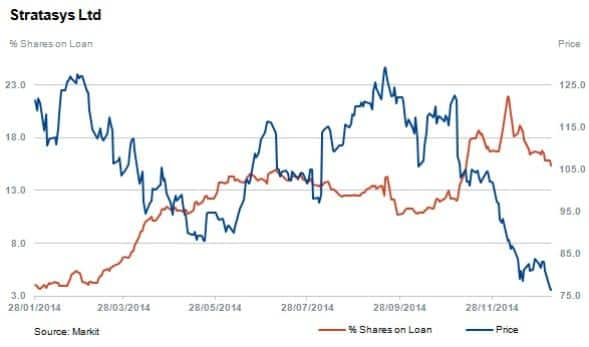

3D Systems and Stratysys, the owner of Makerbot, in particular are down 68% and 42% respectively. Both firms currently have 15.3% of shares outstanding on loan, although short sellers have been covering positions in recent months alongside declines in prices.

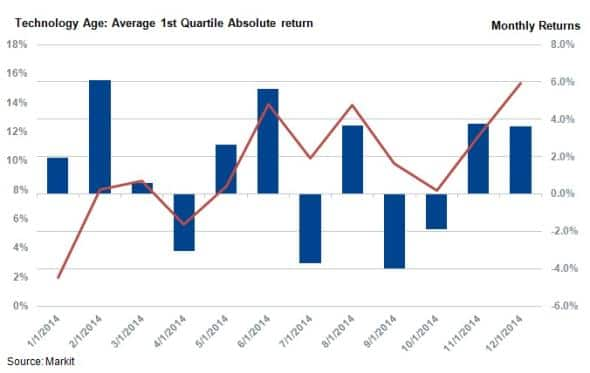

In terms of identifying winners, Markit's Research Signals IP Model, using Technology Age* as a factor, is able to identify and rank a universe of tech stocks by their respective age of technologies. The output reveals positive results over the last 12 months across the top ranked 'newer tech' companies.

The first quartile of the sample universe (relatively newer tech companies) would have yielded a 15.3% annual return or 1.27% per month on average from January 2014 to January 2015.

* TheTechnology Age* factor is defined as the industry relative median age of prior patent references.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012015-Equities-Auto-makers-drive-innovation-at-CES.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012015-Equities-Auto-makers-drive-innovation-at-CES.html&text=Auto+makers+drive+innovation+at+CES","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012015-Equities-Auto-makers-drive-innovation-at-CES.html","enabled":true},{"name":"email","url":"?subject=Auto makers drive innovation at CES&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012015-Equities-Auto-makers-drive-innovation-at-CES.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Auto+makers+drive+innovation+at+CES http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012015-Equities-Auto-makers-drive-innovation-at-CES.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}