Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 08, 2015

TV makers look to diversify at 2015's CES

Television manufacturers displayed their wares at this year's CES but despite the fanfare, market leaders Samsung and LG are searching for profits in other devices as sales volumes stagnate and profits decline in the mass consumer segment.

- Sony and Panasonic look set to be niche high end players

- Short sellers have covered positions in Sony from 2014's short interest highs

- Sharp Electronics the most shorted television manufacturer with 12% shares on loan

Curves versus pixels

CES' most perennially present product has undoubtedly been the television set. Since manufacturers cashed in on large swathes of consumers upgrading from old CRT sets to plasma and LED almost a decade ago, each year now sees new features revealed in a bid to entice consumers to refresh their living rooms in order to drive sales volumes. This year is no different with 4K and ultra-high definition (UHD) flat screens being touted by major manufacturers.

Japanese manufacturers Sony and Panasonic came under pressure to play catch up in 2011 and struggled, despite pioneering flat screen technology first. South Korean rivals Samsung and LG were able to manufacture screens at a much lower cost and are now clear leaders in market share, but profits on Televisions are getting flat too, industry wide.

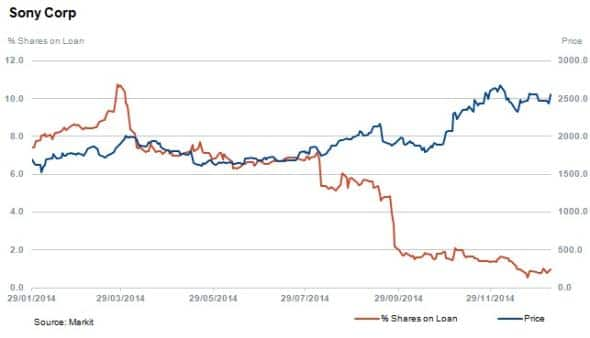

Sony's share price is up 40% over the last 12 months, with short sellers moving to cover their positions, as shares outstanding on loan declined from an 8% high in March 2014 to 1% currently. This could be due to the group deciding to restructure and refocus the television and PC business divisions, but perhaps more likely due to a successful launch of the PlayStation 4 with over 10 million units sold.

After warning investors last year of profit declines, Samsung recently confirmed the first decline for the company since 2011. Among other factors impacting results the company cited the television business facing a rise in dollar denominated costs and weak demand in key markets which was compounded by weaker currencies in Europe, Brazil and Russia. Samsung shares however are flat on the year with the stock seeing minimal levels or short selling activity historically.

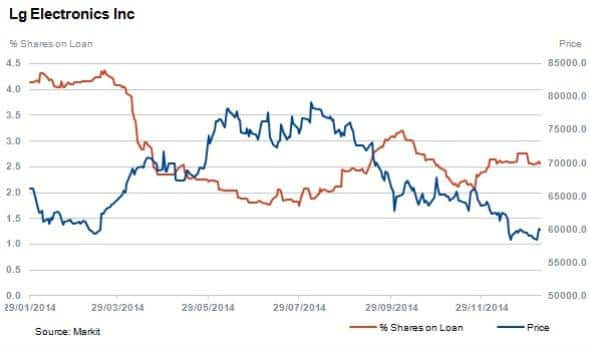

In contrast to Samsung, rival LG reported more than a double rise in operating profit in October 2014. Analysts reported that the performance was largely due to growth in the mobile division representing 36% of earnings but the television division also delivered 5.2% growth in operating profit as strong sales of UHD TVs came through. The company did however state that their plasma TV business would be wound down by the end of year due to falling demand.

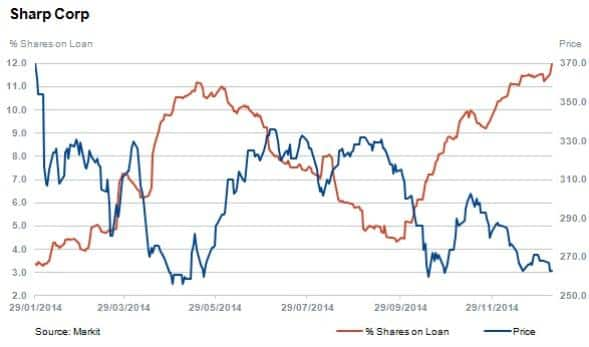

The most targeted television manufacturer is Japanese-based Sharp whose share price is down 21% year to date despite exporters generally benefiting from yen weakness. This is due to the firm manufacturing outside of Japan working against them as Abenomics begin to take hold. The company has already begun to bring back domestic production as of December 2014. There are 12% of shares outstanding out on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Equities-TV-makers-look-to-diversify-at-2015-s-CES.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Equities-TV-makers-look-to-diversify-at-2015-s-CES.html&text=TV+makers+look+to+diversify+at+2015%27s+CES","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Equities-TV-makers-look-to-diversify-at-2015-s-CES.html","enabled":true},{"name":"email","url":"?subject=TV makers look to diversify at 2015's CES&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Equities-TV-makers-look-to-diversify-at-2015-s-CES.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=TV+makers+look+to+diversify+at+2015%27s+CES http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Equities-TV-makers-look-to-diversify-at-2015-s-CES.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}