Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 05, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Canadian mortgage lender Home Capital has a third of shares sold short ahead of earnings

- Short interest in Tesla Motors reaches record levels ahead of anticipated Q4 results

- Markit Dividend Forecasting expects cut at Bilfinger, fourth most shorted ahead of earnings

North America

Most shorted ahead of earnings in North America is Knowles Corp with 36% of shares outstanding on loan. However the maker of electronic components recently guided revenue and margins higher.

Second most shorted is mortgage lender Home Capital Group who has seen short interest decline slightly to 27% of shares outstanding on loan. This is while the stock has fallen over 15% in the last three months. Home Capital led the most shorted lenders in Canada in late 2015. Short sellers continue to target the firm (and the Canadian property bubble) with demand to short remaining high with a cost to borrow currently above 5%.

Third most shorted ahead of earnings is Ligand Pharmaceuticals with 26.6% of shares outstanding on loan. The stock has surged 70% in the last 12 months with short interest rising by 40%. Ligand's recent rally is against a backdrop of a continued strong sell off in US biotech stocks, with the sector attracting increased scrutiny from regulators in 2016.

Fourth most shorted ahead of earnings, and the most shorted automaker globally is Tesla Motors with 25.3% of shares outstanding on loan. Results from Tesla are eagerly anticipated after the company launched the Model X in the last quarter of 2015. However many risks have attracted short sellers with current levels hitting an all-time high short interest for the stock.

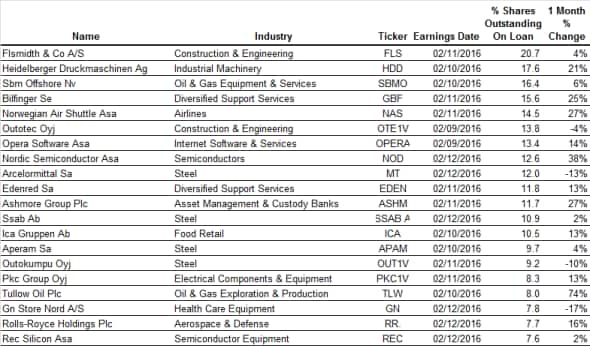

Europe

Flsmidth is once again shorted ahead of earnings. However short interest has almost doubled since May 2015 with 20.7% of shares currently outstanding on loan. The Danish supplier of engineering and industrial equipment to the cement and mineral sectors has seen its stock decline 21% in the last 12 months.

Shares in the printing services and equipment firm Heidelberger Druckmaschinen have fallen over 30% in the last three months, while short sellers have added 70% to positions with 17.6% of shares outstanding on loan.

Short interest in Bilfinger briefly spiked above 20% in the past few weeks, with shares outstanding on loan currently at 15.6%. The German civil and construction firm continues to struggle in the current environment and has issued six profit warnings since 2014. Markit Dividend Forecasting expects the company's dividend to be suspended this year, having been cut by a third last year.

Apac

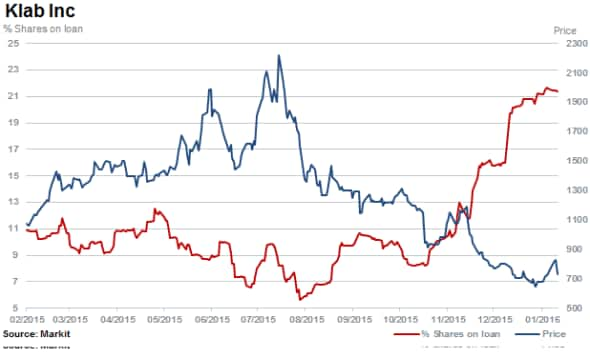

Most shorted ahead of earnings in Apac is Japanese mobile game developer Klab Inc. Short interest has surged since the end of October 2015, currently reaching 21.4%,while shares in the firm have fallen 60% in the last six months.

Second most shorted in Apac is Australian electronics retailer Jb Hi-Fi with 14.4% of shares outstanding on loan. Short sellers have covered positions by 23% in the last three months as the shares have rallied by 22%.

Third most shorted is Pacific Metals with 13.4% of shares outstanding on loan. Shares in the Japanese maker of steel products have fallen by a third in the last 12 months as base commodities and steel prices continue to hover at decade lows.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}