Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 05, 2016

The ETF launch debate

ETF issuance has increased exponentially as issuers rush to grab a piece of the ETF pie, but new launches have struggled to lure investors in an increasingly crowded field.

- Over 1000 US ETFs have launched since 2010; now command 15% of aggregate AUM

- One in five of funds launched since 2010 has closed, average life expectancy of 2.5 years

- Less than 30% of funds listed in last five years breached the $100m AUM threshold

Casting a wide net

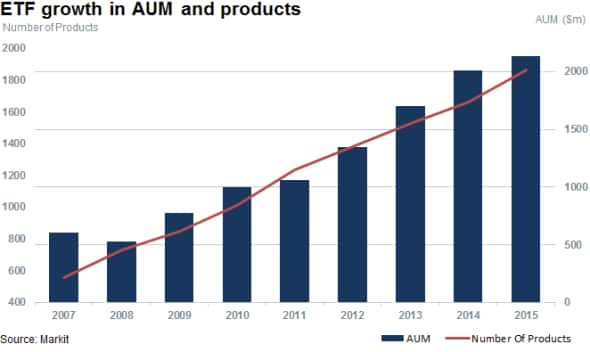

The growing popularity of ETFs saw the AUM managed by the asset class surpass the $3trn AUM mark last year, with over 6300 exchange traded products (ETP) in existence as of latest count. US investors were the first to be offered ETFs, and funds listed in the country now manage two thirds of the entire industry's AUM.

Issuers have been eager to grab a piece of the action as the number of US listed ETFs has swelled to 1880, up from 1000 in 2010. This net increase in new listings, combined with the fact that the industry has shut over 260 funds since the start of 2010, means that over 1000 funds have launched in the last five years; twice the count seen at the start of this period.

This has led some industry watchers to ponder whether the ETF industry becoming too crowded. This holds especially true given that the 1000 plus funds launched in the last five years now manage roughly $300bn of AUM or roughly 15% of the US listed total. Essentially, the bulk of $1trn of net AUM growth over the last five years has gone to existing incumbent products.

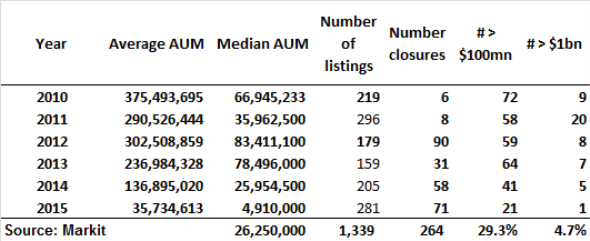

One sobering statistic for the industry is that only one-third of funds launched in the last five years now manage more than $100m, a number thrown around as a reasonable benchmark for performance. The $1bn mark is even more elusive, with less than one in 20 funds launched breaching that threshold.

While the average AUM figure for funds launched into the US market since 2010 stands above the key $100m mark for every year with the exception of last year, this number is distorted by the few funds which manage to attract large numbers of new assets. Amazingly, the ten largest ETFs launched since 2010 manage over $100bn, a third of the total gathered by their peers of the same vintage.

The median AUM by funds launched in the last five years stands at a much sobering $26m. This indicates that a handful of funds are able to grab the bulk investors' attentions and therefore the lion's share of fund flows.

The industry seems to be proactive at culling underperforming funds that fail to take off as it has closed almost a fifth of the newly listed funds that came to life in the last five years. The average length of time given to funds to prove themselves before closure was 2.5 years.

Less vanilla launches

Another strategy employed to stand out from the ever crowded field is to eschew "plain vanilla" launches. This is evidenced in the 17 US ETFs launched so far in 2016. Of these funds only 8 are categorized as general broad market funds but even these are not merely vanilla equity tracking funds. Five of the eight broad funds provide a currency hedge to investors with the remaining three providing specific equity strategies focused on the US, emerging markets and developed markets excluding the US.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Equities-The-ETF-launch-debate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Equities-The-ETF-launch-debate.html&text=The+ETF+launch+debate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Equities-The-ETF-launch-debate.html","enabled":true},{"name":"email","url":"?subject=The ETF launch debate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Equities-The-ETF-launch-debate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+ETF+launch+debate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Equities-The-ETF-launch-debate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}