Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 04, 2016

Non-Agency RMBS prices fall despite fundamentals

Despite a steady US housing recovery, recent liquidity pressures have led to a fall in Non-Agency RMBS prices.

- Primary dealer holdings of USD Non-Agency RMBS fell nearly 20% in 2015

- Markit iBoxx US RMBS Seniors index price level dropped 2.3% from highs reached in 2015

- Despite this, the index is up 7.86% since 2013, significantly outperforming corporate bonds

Volatility in global equity and commodity markets over the last six months has continued to beleaguer fixed income markets as investors shun risky assets in favour of safe havens. The selloff in fixed income has also spread out to the $600bn Non-Agency residential mortgage backed securities (RMBS) market.

Dealer holdings decline

The Non-Agency market is shrinking as the bonds are amortizing, and new issuance, remains small relative to the overall size of the market. However, during the 2nd half of 2015, primary dealer holdings of Non-Agency RMBS declined faster than the overall amount outstanding.

If dealers were to remain neutral, declines similar in proportions to the Non-Agency RMBS market would be observed. The fact holdings declined faster illustrates the weak technical backdrop of the market and risk aversion.

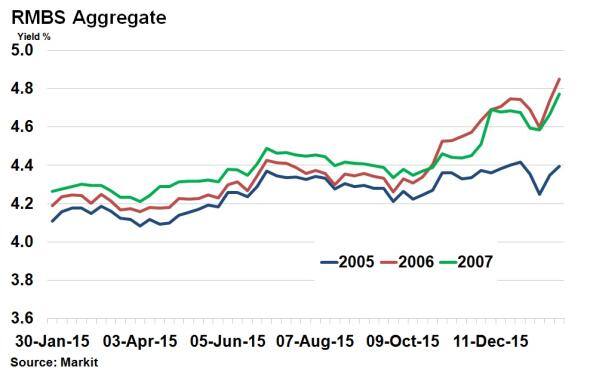

Spreads Widen

According to Markit's Non-Agency Weekly Yield Summary, the recent market pressures have led to spread levels moving to their widest in 14-months. The widening trend began in late April 2015 and escalated throughout the 2nd half of 2015, leading to aggregate RMBS sector spread movements of 60bps (14%). This rapid move wider breaks the consistent tightening experienced throughout 2013 and 2014.

Individual security performance

The 2nd half of 2015's broad based selloff in the Non-Agency RMBS market can be better showcased by reviewing the performance of a few representative securities. The price movement seen in select securities provided evidence of a change in prevailing trends. The following levels are aggregates of observed offerings or markets for individual securities over each quarter.

CWALT 2007-OA9 A1, a Super Senior tranche originated by Countrywide and backed by Option ARM (adjustable rate mortgage) collateral with recoveries pending from lawsuits. Bonds backed by Option ARM collateral outperform as housing prices rise and the S&P/Case-Shiller National Home Price Index was up 5.34% over the last 12 months ending in November 2015. With rising home prices and the potential for recoveries due from litigation, underlying fundamentals for this security remain strong, but recent price movements, from 80 in Q2 to 77 in Q4, are breaking such trends.

Next up, BALTA 2006-1 21A1, is Super Senior tranche originated by Bear Stearns that quickly burned through its credit support during the financial crisis. The security is backed by ALT-A collateral (considered riskier than "prime", and less risky than "subprime"). The ALT-A markets were very tight coming into 2015, and the price of this bond dropped from 77 to 74 while observing little deterioration in collateral performance. Similar to previous Countrywide bond, investor lawsuits have created the potential for recoveries.

Finally, MLCC 2007-1 M1, is a junior tranche, of a Prime deal issued by Merrill Lynch. Prime collateral represents the highest quality borrowers and performance has remained solid. However, the junior position in the capital structure increases the risk to this security, and price movements here highlight increasing risk aversion as observed levels dropped from 96 to 87 from Q1 to Q4, 2015.

RMBS Price Performance

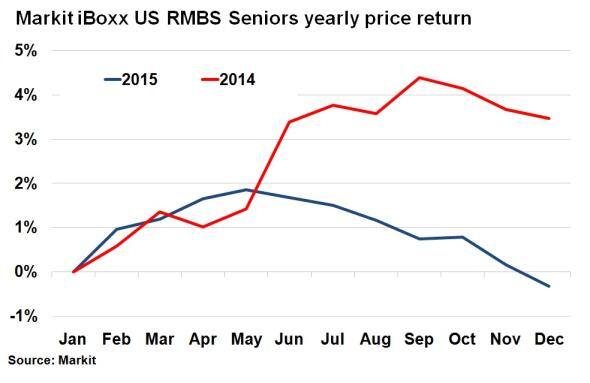

In recent years the Non Agency RMBS market has served investors well with healthy returns. The Markit iBoxx US RMBS Seniors index gained 3.23% and 3.48% on price level basis in 2013 and 2014 respectively. 2015 started well, aided by an improving US economy, the price level on the index rose nearly 2% by mid-May. But as commodity and cross asset volatility pressures surfaced price returns were wiped out by year end and ended in negative territory.

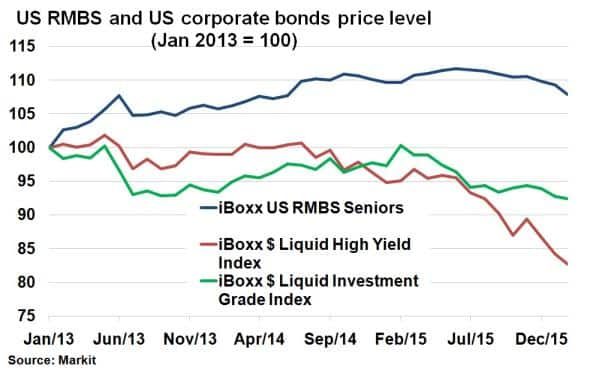

Despite the selloff, the Markit US RMBS Seniors index price levels remains close to 8% higher than it was at the beginning of 2013, significantly outperforming US high yield and investment grade corporate bonds, demonstrating its risk adjusted return qualities.

While many factors come into play when valuing Non-Agency RMBS, such as position in capital structure, collateral performance, and regulation, it has been the weak technical backdrop that has driven Non-Agency RMBS risk sentiment over the past year.

Despite this, current fundamentals remain robust, aided by a strong US housing market recovery post financial crisis. Early indications of deteriorating collateral performance, such as delinquencies have not increased significantly. New issuance has also picked up since 2012, and CRT (credit risk transfer) deals predominately originated by agencies have demonstrated increasing investor appetite.

Markit's securitised products pricing service provides independent evaluated pricing, sector level time series and transparency metrics across agency pass through, agency CMO, agency CMBS, non-agency RMBS, consumer ABS, European ABS, CMBS, CDO and CLO asset classes.

For further information please email:

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-Non-Agency-RMBS-prices-fall-despite-fundamentals.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-Non-Agency-RMBS-prices-fall-despite-fundamentals.html&text=Non-Agency+RMBS+prices+fall+despite+fundamentals","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-Non-Agency-RMBS-prices-fall-despite-fundamentals.html","enabled":true},{"name":"email","url":"?subject=Non-Agency RMBS prices fall despite fundamentals&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-Non-Agency-RMBS-prices-fall-despite-fundamentals.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Non-Agency+RMBS+prices+fall+despite+fundamentals http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Credit-Non-Agency-RMBS-prices-fall-despite-fundamentals.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}