Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 02, 2016

Astute shorts benefit as 'January effect' fades

Shares with good earnings momentum heading into January were not immune to the recent sell off, but their performance still managed to outperform stocks with the worst analyst consensus heading into the first month of the year.

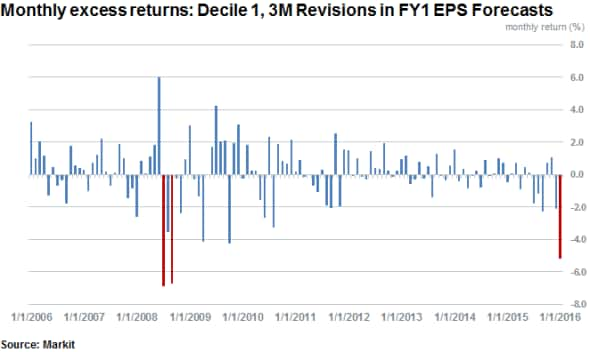

- Firms with positive analyst revisions heading into January had their worst month since 2008

- Shorts timed January's correction well as short interest was elevated across the board

- Long-short strategy based on earnings revisions heading into January outperformed the market by ~4%

Earnings, revised

Earnings season is well under way with companies reporting for the last months of 2015, a year which saw a narrow performance delivered from US equities. Any hopes of a possible 'January effect' were short lived with both the wider market and small caps selling off strongly. The S&P500 ended 3.6% down and the Russell 2000 shifted lower by 8.8%.

Recent high profile earnings misses from Amazon and Apple and beats from Facebook and Google saw dramatic swings in equity prices as investors and analysts grappled to digest reported numbers and revise future forecasts. To gain insight into how changing earnings forecasts impact overall returns over the longer term, we revisit Markit Research Signal's 3M Revision in FY1 EPS Forecasts factor*.

January's sell off will be hard to forget for most investors but perhaps more so for optimistic analysts.

Stocks with the most positive earnings expectations heading into January, as ranked by the factor (decile 1 names above), fell by the widest monthly margin seen since September 2008. The market was effectively blind sighted by last month's correction.

However the 3M Revision in FY1 EPS factor was still able to deliver market beating returns of 0.4% in January. This was achieved by correctly identifying the relatively better ranked companies according to earnings revisions.

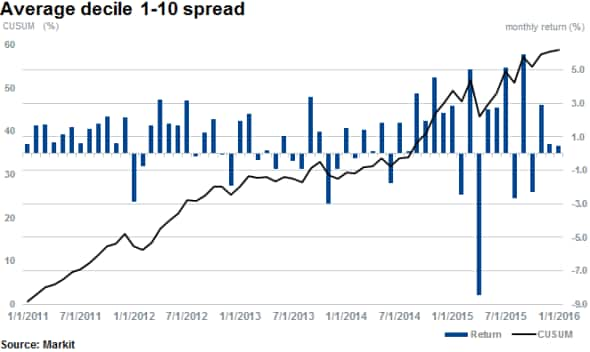

The above implies that analysts correctly anticipated the comparable earnings growth expectations of companies but were perhaps too optimistic on those receiving the most positive revisions - decile 1 company names. This strategy has proved profitable benchmarked against the wider market which underperformed by a wide spread of over ~4%.

Shorts and analysts in sync

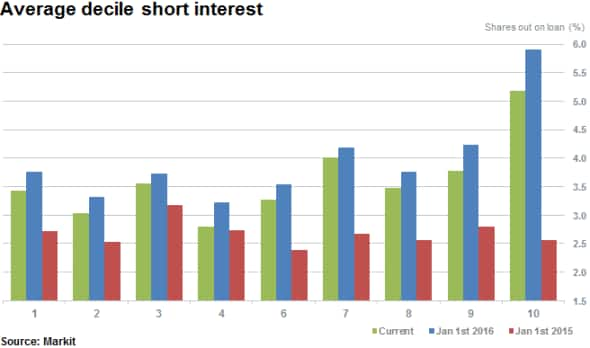

The relative earnings revisions, as provided by the factors' ranks reveal that short sellers have successfully targeted companies with a relatively worse outlook in terms of earnings expectations, compared to their peers.

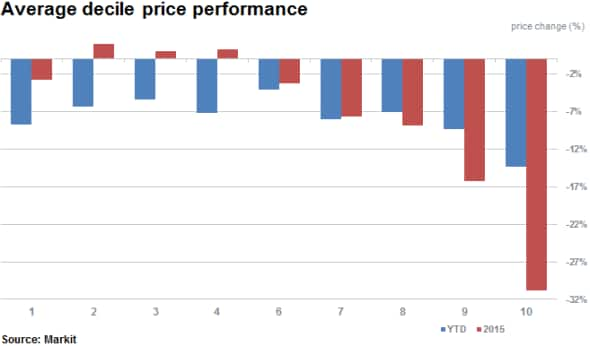

In 2015, short interest in decile 10 names (those with the worst revisions to earnings estimates) saw an increase of almost threefold in average shares outstanding on loan. These names on average have declined by 30% in 2015 and a further 14% year to date. In 2016 short sellers have covered positions across all deciles on average by 8% year to date.

The most shorted name in the 10th decile of names receiving the worst revisions to earnings is United States Steel Corp with 31% of shares outstanding on loan. The company recently featured the most shorted ahead of earnings and posted net losses of almost $1bn for the fourth quarter of 2015.

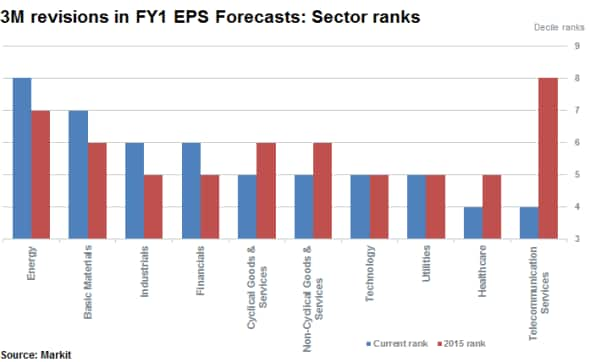

Sector outlooks

The only sector that has seen rankings rise (attain a lower rank) year on year on average has been Cyclical and Non-Cyclical Goods & Services. Not surprisingly the worst ranked sectors remain Energy and Basic Materials, both of which have seen their rankings decline in 2016 as energy and commodity prices continue to remain depressed.

With the sell off still fresh in investors' minds, on reflection returns indicate that the sell off may not be as bad as perceived; not even making the top 25 worst trading months in US market history. Based on the 3M Revision to FY1 Forecasts factor, besides short sellers who were well positioned coming into the year, analysts and investors may have been caught slightly off guard by the severity of the sell off.

*3M Revision in FY1 EPS Forecasts factor is defined as the change in the current mean consensus earnings estimate for fiscal year 1 less that of three months ago, deflated by its trading price. Markit ranks this factor in descending order.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-Equities-Astute-shorts-benefit-as-January-effect-fades.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-Equities-Astute-shorts-benefit-as-January-effect-fades.html&text=Astute+shorts+benefit+as+%27January+effect%27+fades","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-Equities-Astute-shorts-benefit-as-January-effect-fades.html","enabled":true},{"name":"email","url":"?subject=Astute shorts benefit as 'January effect' fades&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-Equities-Astute-shorts-benefit-as-January-effect-fades.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Astute+shorts+benefit+as+%27January+effect%27+fades http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-Equities-Astute-shorts-benefit-as-January-effect-fades.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}