Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2016

Week Ahead Economic Overview

Analysts will get a better idea of second quarter GDP trends in Europe when industrial production numbers are released across the eurozone and the UK. Meanwhile, central banks in Brazil and Russia announce their latest monetary policy decisions and Fed boss Janet Yellen gives an important speech in Philadelphia.

With expectations mounting of a possible summer rate hike in the US, every data point and speech will be monitored closely. The week's data highlights include mortgage application numbers from the Mortgage Bankers Association and consumer sentiment data, published by Reuters and the University of Michigan. The data will be viewed by Fed policy makers ahead of their meeting on June 15th, who have recently become more bullish about the US economy after retail sales surprised on the upside and inflation started to pick up.

Fed chair Janet Yellen is also due to give a speech before the World Affairs Council of Philadelphia on June 6th that will be important in setting rate hike expectations.

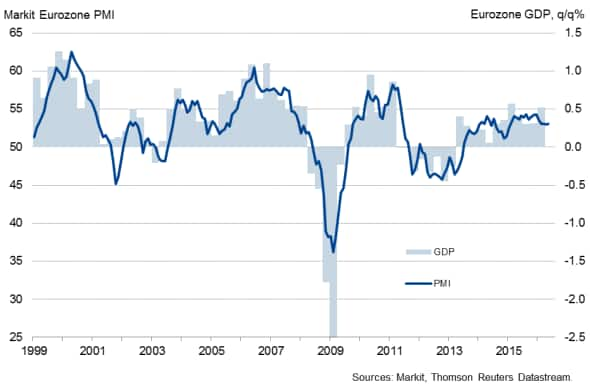

A number of countries within the eurozone see the release of industrial production numbers in a week that also sees the ECB starting their corporate bond purchases. The data will provide analysts with important information on assessing the health of the region's economy in the second quarter. Markit's PMI results signalled that manufacturing in the euro area remained stuck in a low gear in May, with France and Greece key areas of concern. Worryingly, previously fast-growing countries such as Spain and Italy also showed some weakness. It is therefore likely that industry will dampen GDP growth in the second quarter after a surprisingly brisk start to the year. Eurostat releases updated GDP numbers for the first quarter on Tuesday.

Eurozone GDP and the PMI

Markit's Retail PMI results will meanwhile provide insight into consumer spending trends midway through the second quarter, while inflation updates in Germany, Greece and the Netherlands are viewed for price trends.

Policy makers and economists in the UK will be watching economic data releases carefully in the weeks leading up to the EU referendum for signs of a potential impact of the Brexit uncertainty on the economy.

The ONS releases official industrial production data on Wednesday, after survey data signalled that the UK manufacturing sector continued its lacklustre start of the year in May. The weak performance of the sector was at least partly attributed by panellists to uncertainty resulting from the forthcoming EU referendum. The Markit/CIPS PMI data are consistent with a 0.8% quarterly decline in the official ONS measure for manufacturing output. The trend for construction looks bleak too, with survey data signalling the slowest growth for almost three years in May. Official construction numbers are issued by the ONS at the end of the week and will provide further information on the sector's performance in the second quarter.

UK manufacturing production and the PMI

A number of central banks announce their latest monetary policy decisions, including the Bank of Russia and the Banco Central do Brasil.

Although Brazil's economy shrank 5.4% on an annual basis during the first quarter and latest PMI results signalled the steepest decline in manufacturing since early-2009 during the second quarter, it is unlikely that the bank's new president Ilan Goldfein will announce a cut in interest rates from their current high. Brazil's economy is currently facing a dangerous combination of high inflation and contracting GDP, and a cut in interest rates could potentially lead to even higher inflation.

Over in Russia, it also seems that interest rates will be kept unchanged after central bank governor Elvira Nabiullina on Monday said that a reduction in the key rate would not lead to growth, but could spur inflation. The Bank of Russia has kept its interest rates on hold at 11% for nearly a year now, following five reductions since the rate was raised to 17% in December 2014. The bank aims to bring inflation down from currently 7.3% to 4% by the end of 2017.

Monday 6 June

In Russia, latest consumer price numbers are published.

The latest Eurozone Sentix Index and Markit's Eurozone Retail PMI are released.

Germany's statistics office Destatis issues industrial orders data, while Markit publishes its latest Construction PMI results.

Halifax house price information are updated in the UK.

Tuesday 7 June

Global sector PMI results are released.

The AIG Construction Index is released in Australia. Meanwhile, the Reserve Banks of Australia and India announce their latest monetary policy decisions.

Business confidence numbers are published in South Africa.

Revised first quarter GDP figures are out in the eurozone.

Germany and Spain see the release of industrial output numbers.

Current account and trade data are meanwhile issued in France.

The British Retail Consortium publishes latest retail sales figures.

The US Bureau of Labor Statistics issues unit labor costs and productivity data.

Wednesday 8 June

Mortgage lending data are issued in Australia.

Revised first quarter GDP results, bank lending numbers and current account figures are out in Japan.

In India, M3 money supply information are published.

Trade data are issued by the National Bureau of Statistics of China.

First quarter GDP results are updated in South Africa.

The Office for National Statistics releases industrial output numbers for the UK. Moreover, the latest Markit/ REC Report on Jobs is out.

Meanwhile, the Central Bank of Brazil announces its latest monetary policy decision.

Housing starts and building permit data are out in Canada.

The US sees the release of consumer credit and mortgage application figures.

Thursday 9 June

Japan sees the release of machinery orders numbers.

The National Bureau of Statistics of China publishes latest inflation data.

Manufacturing and mining output figures are meanwhile out in South Africa.

In Germany and the UK, trade data are issued, while France sees the release of non-farm payroll numbers.

Consumer price data are out in the Netherlands and Greece, with the latter also seeing the release of industrial output and unemployment numbers.

Canada sees the publication of capacity utilisation data.

Initial jobless claims and wholesale inventory figures are out in the US.

Friday 10 June

Industrial output and trade data are issued in India.

China sees the release of M2 money supply information.

The Bank of Russia announces its latest monetary policy decision. Trade data are also released.

Final consumer price data are meanwhile out in Germany.

In France and Italy, industrial production numbers are updated.

UK construction output figures are released by the Office for National Statistics.

A labour market update is published in Canada.

The latest US Reuters/Michigan Consumer Sentiment Index is published.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}