Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2016

US labour market gloom adds to PMI signal of second quarter malaise

A sharp slowing in the pace of hiring in the US, and an all-round gloomy employment report for May, raises serious doubts about whether the Fed will vote to hike interest rates again in the summer.

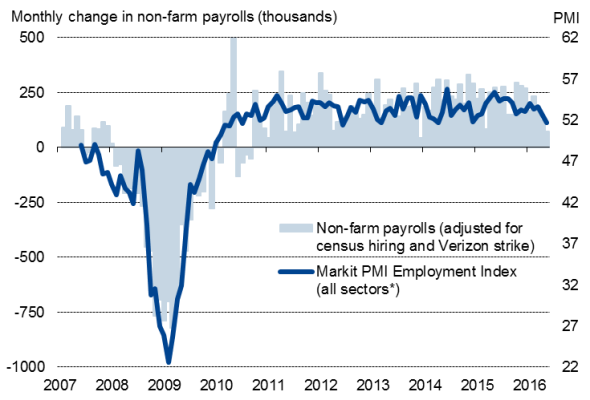

Non-farm payrolls rose by just 38,000 in May, below consensus expectations of a 164,000 increase and the smallest rise since September 2010.

The increase for April was also revised down from 160,000 to 123,000, adding to the sense that the hiring trend is firmly on the wane in the second quarter.

Non-farm payrolls v Markit PMI Employment Index

* Manufacturing only pre-October 2009.

Sources: Markit, ISM, Bureau of Labor Statistics.

An extended strike by Verizon employees is thought to have cut 34,000 jobs from the May total (the striking workers having being classified as unemployed as they received no pay during the month), meaning the true figure was probably more like 72,000, but that's still below the 100,000 needed to keep the labour market tightening.

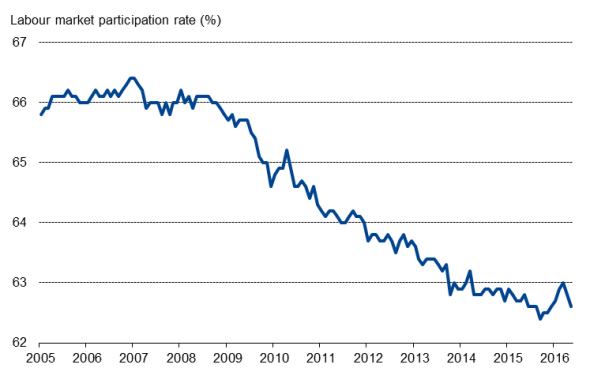

Labour market participation falls

The unemployment rate meanwhile fell to 4.7%, its lowest since November 2007, and down from 5.0% in April. However, even this brighter looking headline number came with a twist, as the improvement was largely due to people dropping out of the labour market, rather than more people being employed.

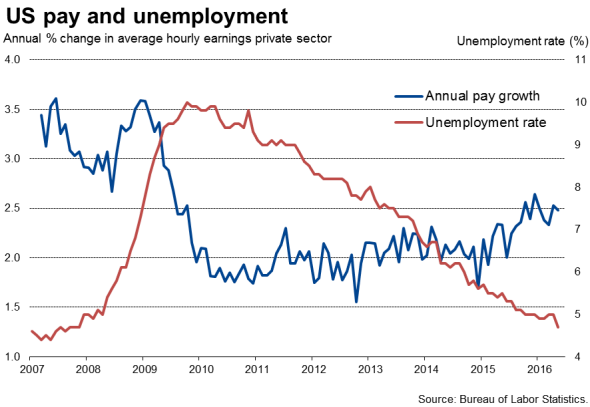

Pay also disappointed, rising just 0.2% in May, down from 0.4% in April and keeping the annual rate at just 2.5%. While the exchange rate and oil prices are starting to exert upward pressure on inflation, the subdued wage growth suggests there are no signs of 'second round' inflationary pressures building to anything like an extent which would normally worry policymakers.

Manufacturing and mining each lost 10,000 jobs and the construction sector shed 15,000 workers. The retail sector and government sectors added 11,400 and 13,000 staff respectively.

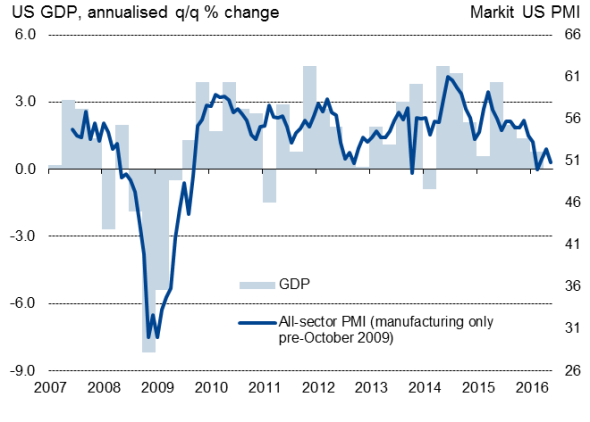

The disappointing payrolls report casts doubt on the widely held view that the US economy is rebounding strongly in the second quarter after a dismal start to the year. Gross domestic product grew at an annualised rate of just 0.8% in the first quarter, but growth has been commonly expected to revive to over 2% in the second quarter. Markit's flash PMI data have, however, already signalled that any rebound lost momentum in May, leaving the economy on course for another weak quarter of just 0.7% growth. The survey also showed a growing reluctance for hiring as firms saw disappointing order book inflows and grew increasingly cautious about the economic outlook.

Economic growth indicators

Sources: Markit, Datastream.

Sources: Markit, Datastream.

The combination of weak payroll growth and signs of the broader economy failing to regain momentum in the second quarter substantially decrease, and perhaps even kill-off, the likelihood of the Fed voting to raise rates in June, and substantially reduce the odds of a July hike.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-US-labour-market-gloom-adds-to-PMI-signal-of-second-quarter-malaise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-US-labour-market-gloom-adds-to-PMI-signal-of-second-quarter-malaise.html&text=US+labour+market+gloom+adds+to+PMI+signal+of+second+quarter+malaise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-US-labour-market-gloom-adds-to-PMI-signal-of-second-quarter-malaise.html","enabled":true},{"name":"email","url":"?subject=US labour market gloom adds to PMI signal of second quarter malaise&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-US-labour-market-gloom-adds-to-PMI-signal-of-second-quarter-malaise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+labour+market+gloom+adds+to+PMI+signal+of+second+quarter+malaise http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-US-labour-market-gloom-adds-to-PMI-signal-of-second-quarter-malaise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}