Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2016

UK PMI points to economic growth of 0.2% in second quarter as Brexit uncertainty mounts

The pace of UK economic growth lifted slightly higher in May, but remained close to the weakest seen over the past three years. Employment growth, backlogs of work and inflows of new business meanwhile all showed deteriorating trends, in many cases linked to growing uncertainty regarding the UK's possible exit from the European Union.

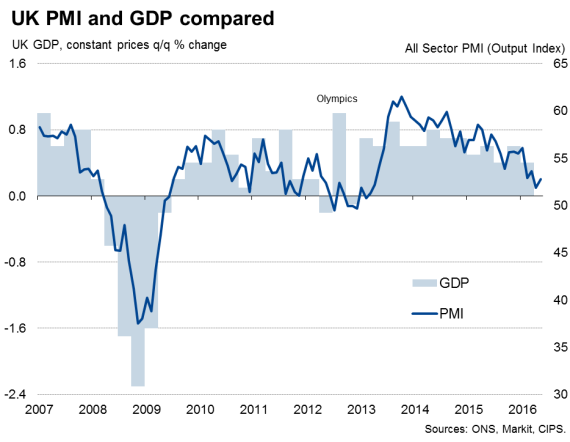

Economy set to grow 0.2% in Q2

At 52.8 in May, up from 51.9 in April, the weighted average output index from the three Markit/CIPS PMI surveys pointed to a modest upturn in the overall rate of economic growth. But the latest reading was nevertheless the second-lowest since April 2013.

The average PMI reading of 52.4 over the past two months is also down from 54.2 in the first quarter and points to gross domestic product growth of just 0.2% in the second quarter, down from 0.4% in the opening quarter of the year.

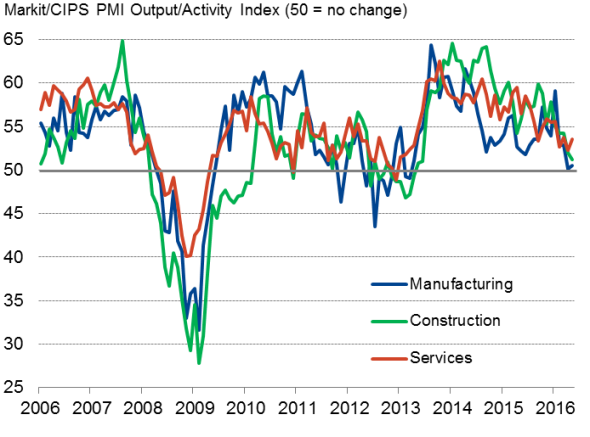

The manufacturing sector saw a near-stagnation of output growth for a second successive month in May, contrasting with robust growth earlier in the year. Growth has also slowed to a near-standstill in the construction sector, which reported the smallest increase in activity since June 2013.

The lack of any significant growth in manufacturing and construction once again left services as the main engine of economic expansion in May, though even here the rate of increase has remained subdued compared to late last year. Although services growth accelerated slightly in May, the increase was still one of the weakest recorded in the past three years.

Output by sector

One-in-three firms hit by Brexit uncertainty

Companies continued to report weakened demand due to sluggish economic growth both at home and abroad, but an increasing number of firms have also cited uncertainty regarding the EU referendum as a factor hurting their business growth in recent months.

Responses to a special question in May in showed some 36% of firms reporting a detrimental impact from 'Brexit' uncertainty, with 8% seeing a strongly detrimental effect. It seems reasonable to expect this uncertainty to persist and even intensify in June, subduing economic growth further.

Employment hit by order book downturn

There are other indications that the rate of growth will deteriorate again in June. Inflows of new business across the three sectors rose at the slowest pace seen since late-2012, suggesting activity will weaken in response to reduced orders. Growth of new business placed in the service sector slowed to a 41-month low, joining manufacturing in a state of near-stagnation. Meanwhile, new orders fell in construction for the first time in over three years.

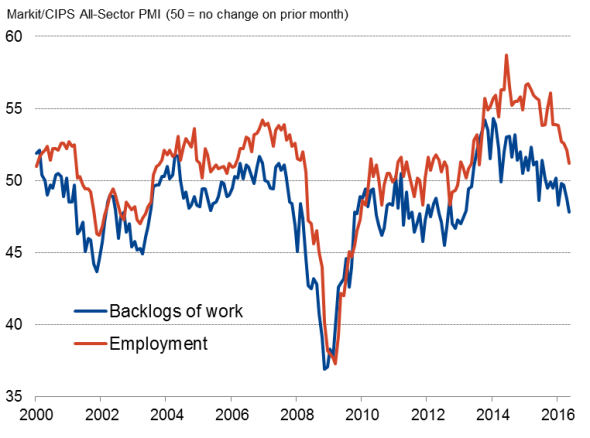

With business activity growing at a faster rate than inflows of new business in May, backlogs of orders consequently showed the largest monthly fall since February 2013. Such a decline can be the precursor to a downturn in both output and employment, as firms reduce capacity in line with demand.

The May survey showed employment growth across the three sectors having already slumped to the lowest since August 2013. A fifth successive month of manufacturing job losses was accompanied by a near-stalling of employment growth in the service sector. Only construction saw ongoing robust hiring.

Employment and backlogs of work

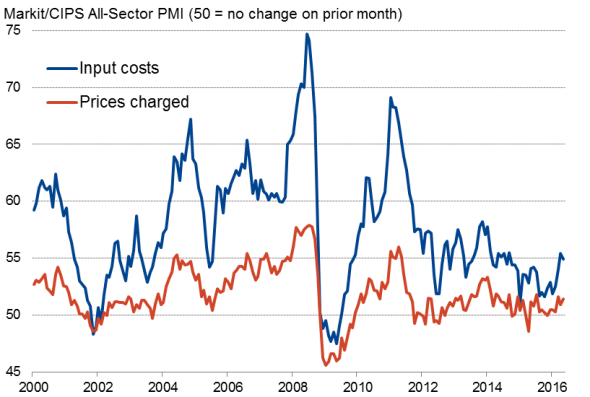

Costs rise as National Living Wage feeds through

Hiring was adversely affected in some companies by the introduction of the National Living Wage, which was also blamed for a further increase in firms' costs. Across all sectors, costs rose at the second-quickest rate in 20 months. Rising commodity prices - notably oil - also contributed to the increase, pushing manufacturers' input prices up for the first time in nearly two years.

Higher costs have fed through to rising prices for goods and services, though the overall increase in charges was still only very modest.

Price pressures

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-UK-PMI-points-to-economic-growth-of-0-2-in-second-quarter-as-Brexit-uncertainty-mounts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-UK-PMI-points-to-economic-growth-of-0-2-in-second-quarter-as-Brexit-uncertainty-mounts.html&text=UK+PMI+points+to+economic+growth+of+0.2%25+in+second+quarter+as+Brexit+uncertainty+mounts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-UK-PMI-points-to-economic-growth-of-0-2-in-second-quarter-as-Brexit-uncertainty-mounts.html","enabled":true},{"name":"email","url":"?subject=UK PMI points to economic growth of 0.2% in second quarter as Brexit uncertainty mounts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-UK-PMI-points-to-economic-growth-of-0-2-in-second-quarter-as-Brexit-uncertainty-mounts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+points+to+economic+growth+of+0.2%25+in+second+quarter+as+Brexit+uncertainty+mounts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-UK-PMI-points-to-economic-growth-of-0-2-in-second-quarter-as-Brexit-uncertainty-mounts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}