Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 02, 2015

Puerto Rico avoids debt default, for now

The beleaguered US commonwealth narrowly escaped defaulting on its Government Development Bank (GDB) bonds yesterday, but with more senior general obligation (GO) payments fast approaching, the commonwealth's fiscal woes are far from over.

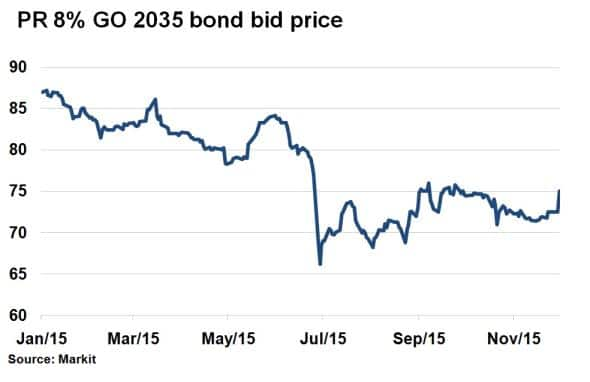

- PR's 8% 2035 GO bond price rose 2.5pts yesterday, the highest level since the end of September

- The Markit MCDX index tightened to its lowest intraday level since May

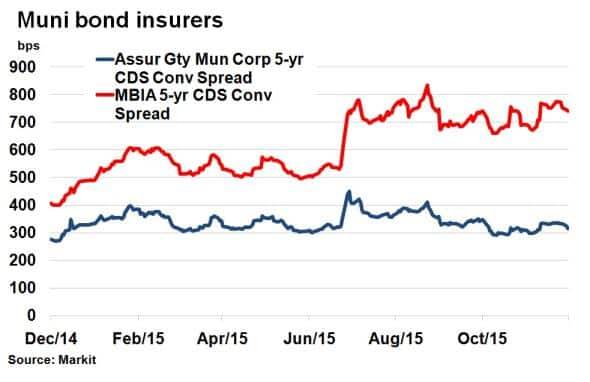

- Muni insurers' CDS spreads remain elevated and are in the same range as high yield CDS

Puerto Rico's (PR) development bank successfully made a $354m debt payment yesterday, closely staving off defaulting on its GDB bonds.

PR's 8% 2035 GO bond saw its price climb 2.5pts to 75.00 (cash basis to par) according to Markit's municipal bond pricing service. The jump marked a new two month high for commonwealth's most senior debt.

PR's troubles remain far from over as it had already defaulted on its Public Finance Corporation (PFC) bonds in August. With $72bn of debt outstanding and an economy in a prolonged recession, PR also potentially faces a humanitarian crisis from the deterioration in infrastructure, pensions and utilities if its people continue to bear the debt burden. PR has already stated several times it does not have sufficient funds to continue payments.

The problem lies in the commonwealth's lack of access to the same bankruptcy laws as states and the Obama administration has proposed an amendment to enable all US commonwealths so obtain similar protections, but the US congress has so far been shy to act ahead of the 2016 election year. Yesterday's payment has only bought time as a hefty GO bond interest payments looms at the beginning of 2016.

Wider market avoids contagion

Despite PR's ongoing troubles, the broader municipal bond market has seen credit risk tighten over the past two months. The Markit MCDX index, made up of investment grade single name municipalities, has seen its 5-yr CDS spread tighten to 93bps, the lowest intraday level since May. This highlights the wider market's relative insulation from the PR situation; providing one possible motive for the lack of decisive action from congress.

From an investor stand point, exposure to the asset class through mutual funds and ETFs has remained popular. After a blip in June, the last six months have seen positive net inflows. Tax benefits coupled with a favourable risk/reward in comparison to sovereign and corporate bonds have kept popular with US investors.

Muni insurers

Despite this positive investor sentiment, muni bond insurers haven't seen credit risk recede.

Monoline insurer MBIA has seen its 5-yr CDS spread continue to hover above 700bps, while fellow insurer Assured Guaranty Municipal Holdings has also seen little change in its credit spread over the past few months. Interestingly both names continue to enjoy investment grade status from rating agencies, whereas Markit's CDS pricing service implies a BB for Assured and B rating for MBIA; effectively high yield.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-credit-puerto-rico-avoids-debt-default-for-now.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-credit-puerto-rico-avoids-debt-default-for-now.html&text=Puerto+Rico+avoids+debt+default%2c+for+now","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-credit-puerto-rico-avoids-debt-default-for-now.html","enabled":true},{"name":"email","url":"?subject=Puerto Rico avoids debt default, for now&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-credit-puerto-rico-avoids-debt-default-for-now.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Puerto+Rico+avoids+debt+default%2c+for+now http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-credit-puerto-rico-avoids-debt-default-for-now.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}