Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 02, 2015

Bears circle Swatch and Fitbit in battle for wrists

Wearables continue to gather momentum this festive season with Fitbit receiving a bullish upgrade from analysts, but growing short sentiment remains as the category mirrors trends seen by sat nav market.

- Swatch short interest at record high, with a quarter of shares sold short

- Fitbit sees a surge in shorting activity; shorts at risk of squeezing

- Wearables future may echo events which occurred in the GPS market eight years ago

Tracking movements

Smart watches are set to make hot stocking fillers for 2015 with products such as the Apple Watch already disrupting established watchmakers and the slew of newly launched wearable tech firms.

Probably the biggest shift in broader sentiment in the battle for 'wrist real estate' is being caused by relatively more feature-rich smart watches. The product category, which was initially rebuffed by Swiss watch makers, has in some ways proved its toughest critics wrong given that many firms have either launched or are soon to release their own offerings.

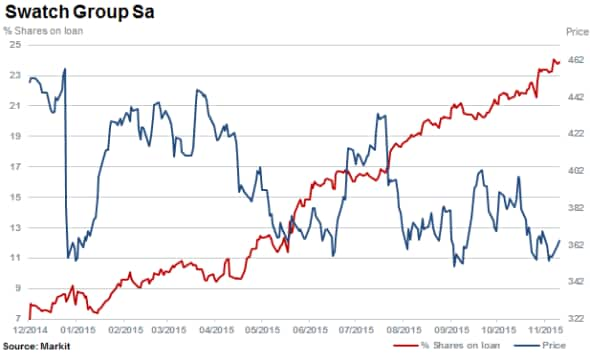

Swiss watch conglomerate Swatch now stands at the centre of that trend. While the firm hasn't been helped by the removal of the Swiss currency peg earlier in the year and a collapse in demand from Asian consumers, the rise of the smart watch category has coincided with a surge in bearish sentiment in Swatch's stock. This means that there are now roughly a quarter of Swatch shares now out on loan; an all-time high for the firm and a three-fold jump since the start of the year.

Focused on fitness

The bearish sentiment is also being felt in newly listed wearable fitness tracking firm Fitbit. While the firm is third higher than its pre-IPO price of $20, the current price represents a drastic fall from grace given that its shares traded at high of $51.60 in July. Short attraction has been unrelenting since the IPO with shares outstanding on loan increasing to 12.1% currently. The cost to borrow Fitbit stock, an indication of the strength of demand, remains significant at north of 20%.

Opinions are not divided on Fitbit's current impressive growth figures, but are split on sustained future growth and prospects of the category. Competitors (with more diversified revenues) have already begun to zero in on Fitbit's once impressive market share of more than 50%. Growth in smart watch sales is also putting more pressure on the segment as the features offered by Fitbit and its peers become incorporated in evermore capable smart watches.

While demand to short Fitbit shares continues to remain strong, short sellers need to be wary as Markit Research Signals' Short Squeeze model currently identifies Fitbit in the top percentile of companies at risk of suffering a short squeeze. This is driven by the fact that the majority of Fitbit short positions currently stand out of the money in the wake of the recent analyst upgrade; the average breakeven price for shorts is estimated just above ~$31 dollars. Further bullish sentiment could force short sellers to close out positions, accelerating upward swings in the company's shares.

Parallels in sat nav saga

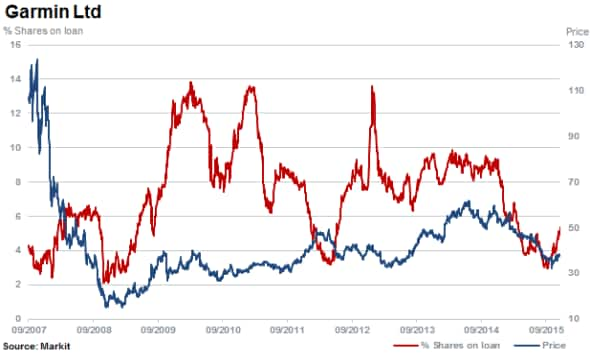

Ironically Garmin and Tomtom, whose shares are down 69% and 79% respectively from highs reached in 2007, are involved in the new wearables boom. The past of these two companies perfectly highlights the impact of the introduction of new technology on incumbents.

Tremendous revenue growth saw both Garmin and Tomtom garner rapid investor support as their businesses flourished, pushing share prices to record highs.

Prior to the mass adoption of smartphones, satnav sales in the UK alone rocketed from "5m in 2002 to "340m by 2007. Sales at Garmin peaked in 2008 at $3.5bn after growing by an astounding 360% over four years. Sales then fell 16% in 2009 and have remained flat ever since.

The first generation iPhone was launched in June 2007 and smart phones (powered with GPS and Google maps) subsequently quickly cannibalised the businesses of Personal Navigation Device companies (PND). This is clearly seen in the price charts of the two leaders (Tomtom and Garmin) seven years ago, with prices cratering in 2007//2008 after the mass adoption of smart phones.

More recently, Tomtom shares have outperformed, rising 126% in the last 12 months driving down short interest by almost half in the last six months. Shares in Garmin meanwhile have declined a third and the firm has seen a recent rise in short interest reaching 5.3% of shares outstanding on loan.

Relte Stephen Schutte, Analyst at Markit

Posted 2 December 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-Equities-Bears-circle-Swatch-and-Fitbit-in-battle-for-wrists.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-Equities-Bears-circle-Swatch-and-Fitbit-in-battle-for-wrists.html&text=Bears+circle+Swatch+and+Fitbit+in+battle+for+wrists","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-Equities-Bears-circle-Swatch-and-Fitbit-in-battle-for-wrists.html","enabled":true},{"name":"email","url":"?subject=Bears circle Swatch and Fitbit in battle for wrists&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-Equities-Bears-circle-Swatch-and-Fitbit-in-battle-for-wrists.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bears+circle+Swatch+and+Fitbit+in+battle+for+wrists http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122015-Equities-Bears-circle-Swatch-and-Fitbit-in-battle-for-wrists.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}