Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2015

Global manufacturing PMI hits 26-month low amid deepening emerging market downturn

Global manufacturing remained stuck firmly in the slow lane at the end of the third quarter, hindered by slumping demand in many key emerging markets.

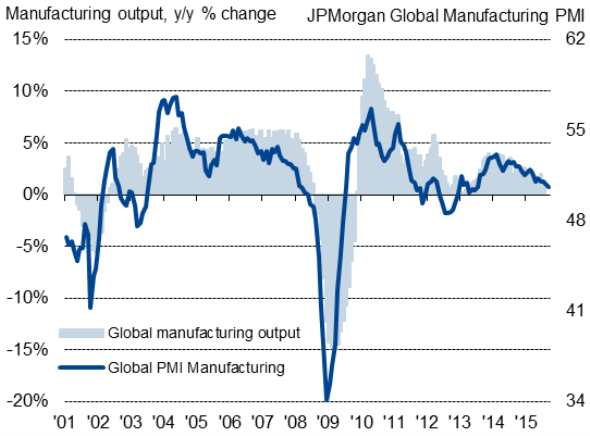

Global factory output

The JPMorgan PMI", compiled by Markit, fell to 50.6 in September compared to 50.7 in August. The latest reading was the weakest since July 2013 and finished off the weakest quarter of manufacturing expansion since the second quarter of 2013. The index is broadly consistent with global manufacturing output expanding at an annual rate of just 1.0% in the third quarter, with the loss of momentum in September suggesting the slowdown could intensify in the fourth quarter.

The survey also highlighted a waning of global trade flows, as manufacturing exports fell to the greatest extent since June 2013, although the rate of decline remained only modest compared to the last significant trade downturn seen in 2012.

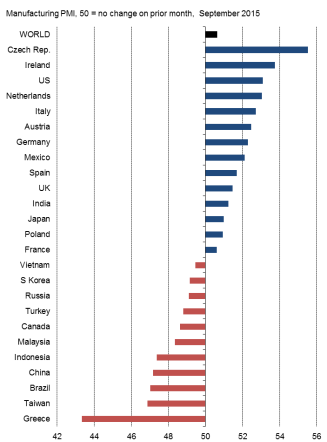

September manufacturing PMI rankings

Factory headcounts fell worldwide, albeit only marginally, for the first time since July 2013 as firms cut capacity in the face of growing uncertainty about the economic outlook.

Firms benefitted, however, from the first fall in average input prices since February, linked to the recent slide in global commodity prices. Output prices were cut as cost savings were commonly passed onto customers, dropping to the greatest extent since June 2013.

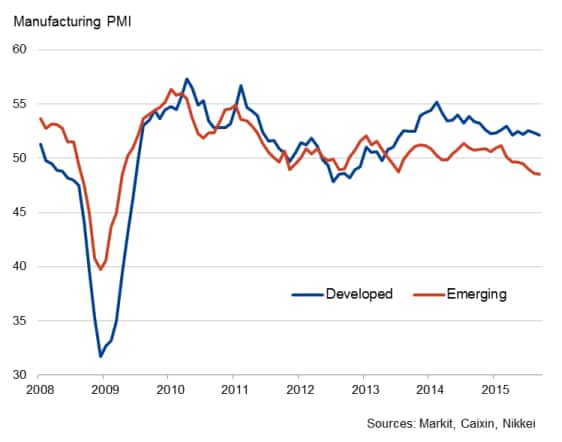

Developed world growth contrasts with deepening emerging market recession

The developed world saw manufacturing activity rise at the joint-weakest rate seen since mid-2013, with the PMI down to 52.1 but remaining above the 50.0 neutral level. With the exception of Canada, all major developed economies continued to expand, led by the US, where a slight upturn in the PMI contrasted with slower rates of growth in the Eurozone, UK and Japan.

Despite the slowdown, the sustained expansion seen in the developed world sat in marked contrast to the deepening downturn recorded in the emerging markets, where the PMI fell to 48.5, its lowest since March 2009 and signalling the sixth successive monthly contraction.

Of the 11 monitored countries which saw a contraction of manufacturing activity, nine were emerging markets. Canada, a major exporter of commodities to emerging markets, also reported a contraction of activity. Greece, whose economy has been ravaged by its debt crisis sat at the bottom of the PMI rankings for a third straight month, though saw its rate of contraction ease since August.

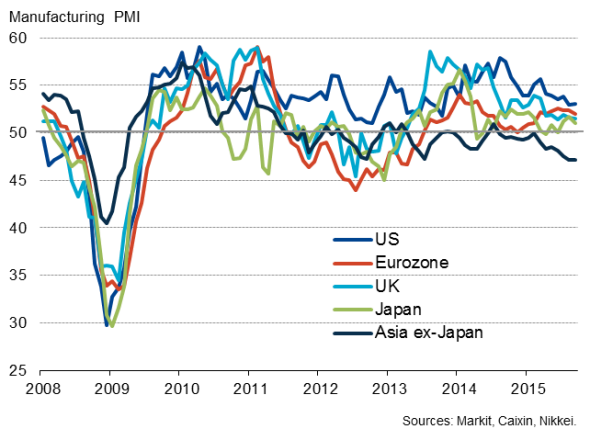

Asia growth at three-year low

China's PMI sank to its lowest since March 2009, dragging down the PMI for Asia to its lowest for almost three years (with the Asia ex-Japan index holding at 47.1, its lowest since March 2009).

Rates of decline eased in Taiwan, South Korea and Malaysia, but intensified in Indonesia, while Vietnam slipped into decline for the first time in over two years and growth eased to a seven-month low in India.

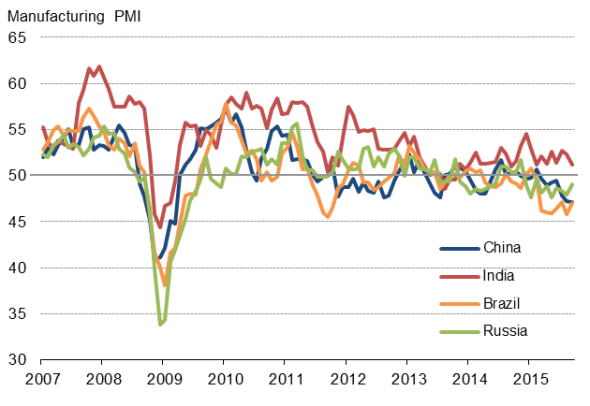

Other emerging markets outside of Asia also continued to struggle. Brazil and Russia contracted, though rates of decline eased, while growth slowed in Mexico.

Czechs stay top of growth table

The Czech Republic held the top spot in the manufacturing PMI rankings for the fourth month running in September, followed some way behind by Ireland, the US and then the Netherlands.

Developed and emerging markets

Asia subdues global growth

Main emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Global-manufacturing-PMI-hits-26-month-low-amid-deepening-emerging-market-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Global-manufacturing-PMI-hits-26-month-low-amid-deepening-emerging-market-downturn.html&text=Global+manufacturing+PMI+hits+26-month+low+amid+deepening+emerging+market+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Global-manufacturing-PMI-hits-26-month-low-amid-deepening-emerging-market-downturn.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI hits 26-month low amid deepening emerging market downturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Global-manufacturing-PMI-hits-26-month-low-amid-deepening-emerging-market-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+hits+26-month+low+amid+deepening+emerging+market+downturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Global-manufacturing-PMI-hits-26-month-low-amid-deepening-emerging-market-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}