Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2015

China PMI surveys signal steepest economic downturn since January 2009

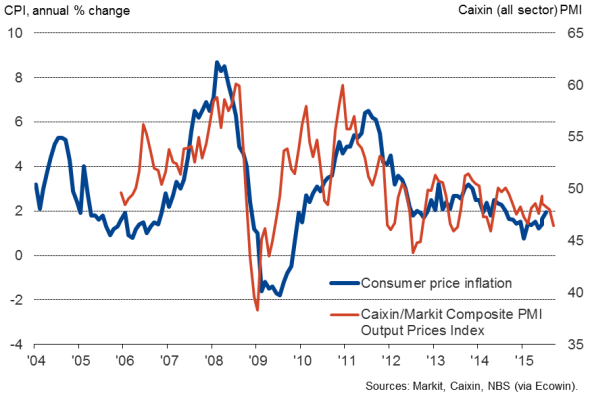

China's economy contracted at the steepest rate for over six-and-a-half years in September, according to survey data, as falling manufacturing output was accompanied by only fractional service sector growth. Firms also reported a stronger decline of new orders and further job shedding. Meanwhile prices fell at an accelerated rate, adding to growing worries about deflation.

Here are the five key survey findings:

1. Economic growth weakest since January 2009

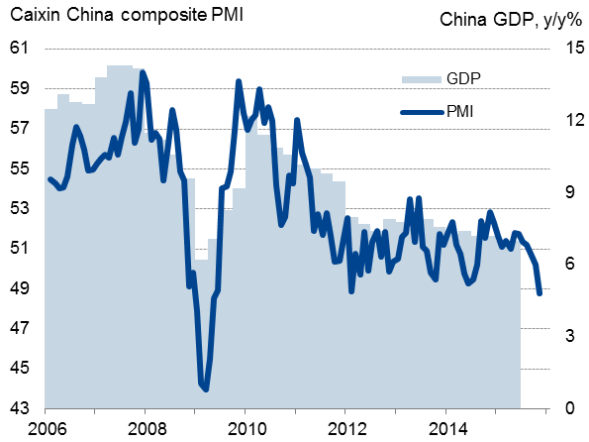

The Caixin China Composite PMI (which covers both manufacturing and services, compiled by Markit) fell from 48.8 in August to 48.0 in September. The latest reading indicated a second successive monthly deterioration in business activity and the largest monthly decline since January 2009, when the world was in the grips of the global financial crisis.

At 49.0, down from 51.1 in the second quarter, the third quarter PMI average points to GDP growth waning further from the 7.0% annual rate of increase seen in the second quarter.

With inflows of new business falling at the fastest rate since March 2009, the survey highlights how business activity has fallen due to slumping demand.

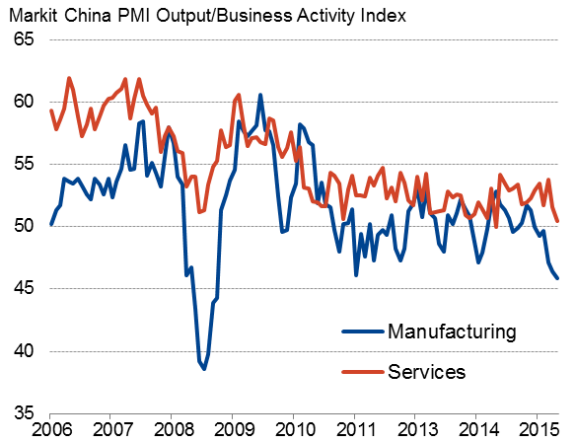

2. Manufacturing downturn joined by near stalling in service sector

The downturn is most pronounced in the manufacturing economy, where the survey data are pointing to the steepest downturn in factory output and the largest drop in new export orders since March 2009. However, the industrial sector slump is now being joined by a near-stalling of growth in the service sector. At 50.5, the PMI measuring service sector business activity fell in September to the second-lowest seen since the survey began in 2005.

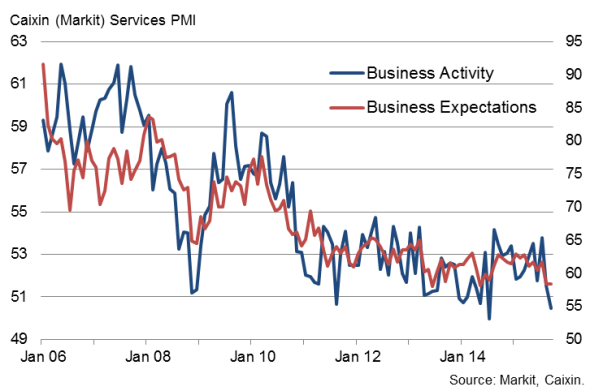

3. Service sector loses optimism

Business optimism about the year ahead in the service sector fell to one of the lowest levels seen in the near ten-year history of the survey. Inflows of new business also almost ground to a halt. The drop-off in optimism and order book growth suggest the service sector could suffer a contraction of activity in October.

Only 22% of companies expect their business activity levels to be higher in a year's time against 5% expecting a decline. This compares with 31% and 6% respectively this time last year (and 55% and zero respectively nine years ago).

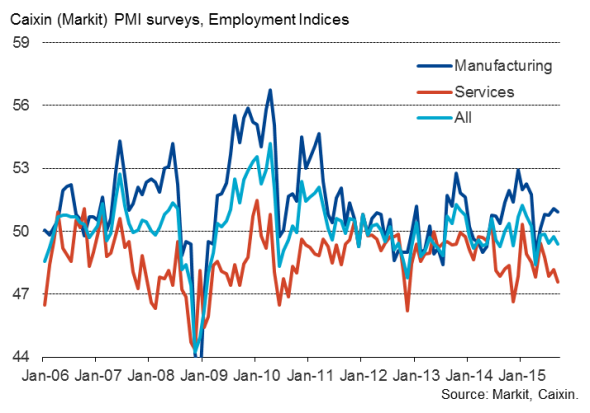

4. Further job losses

The rate of job cutting eased slightly but remained at a pace not seen since the height of the global financial crisis in early-2009. A modest upturn in service sector staffing levels helped offset the largest loss of factory jobs for just over six-and-a-half years.

The ongoing drop in employment is a major worry for a government keen to ensure social stability, suggesting that more policy action may be forthcoming as the authorities seek to prevent any undesirable upturn in unemployment.

5. Prices fall at fastest rate for 1" years

Deflationary pressures continued to intensify, with average prices charged for goods and services falling at the fastest rate since March of last year. Price falls are not just confined to the industrial sector, where companies continued to benefit from lower commodity prices (especially oil and other fuels); charges for services showed the biggest monthly fall for just over three years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-China-PMI-surveys-signal-steepest-economic-downturn-since-January-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-China-PMI-surveys-signal-steepest-economic-downturn-since-January-2009.html&text=China+PMI+surveys+signal+steepest+economic+downturn+since+January+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-China-PMI-surveys-signal-steepest-economic-downturn-since-January-2009.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys signal steepest economic downturn since January 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-China-PMI-surveys-signal-steepest-economic-downturn-since-January-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+signal+steepest+economic+downturn+since+January+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-China-PMI-surveys-signal-steepest-economic-downturn-since-January-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}