Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2015

Regional weakness adds to easing of Vietnamese manufacturing growth

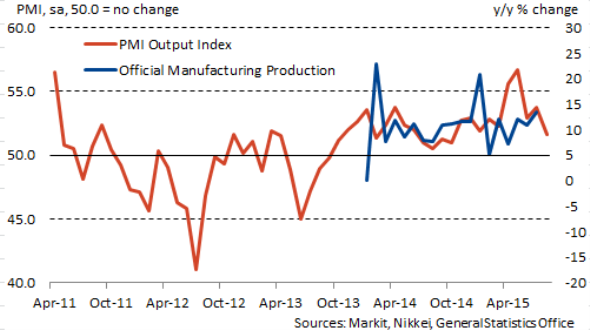

Growth of manufacturing output in Vietnam eased to the slowest for ten months in August, according to the latest Nikkei PMI survey, compiled by Markit. This continued a trend of generally weaker expansions seen since the survey's record high in May. The slower rise in output was matched by new orders, as new work appears more difficult to secure than it was earlier in the year. This is particularly the case in international markets as companies reported a third successive monthly fall in new export orders.

The latest reduction in new business from abroad was linked both to weakness in international demand and competition from Chinese firms following the depreciation of the yuan during the month. It appears that the poor performance of some regional partners in recent months - as outlined by the PMI surveys - has contributed to declining new export business at Vietnamese firms.

Manufacturing output growth slows

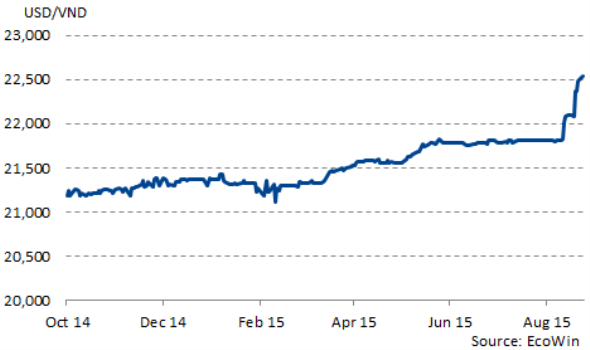

Responding to the recent depreciations in the Chinese currency, the State Bank of Vietnam (SBV) acted to weaken the dong in order to support Vietnamese exporters. The currency operates in a crawling peg with the US dollar, and on 12th August the central bank widened the range in which the exchange rate can move from 1% to 2%. They then followed this up a week later by widening the band further to 3% and moving the mid-point of the range lower. The dong depreciated by roughly 1% after the first action, and again after the second, and at the time of writing is 3.3% weaker against the dollar than on 11th August, before these changes were made. This should help exporters in Vietnam maintain competitiveness in coming months in their efforts to see a return to growth of new business from abroad. In the long-term, the widening of the band increases the flexibility of the exchange rate to respond to changes in economic conditions and should be seen as a positive development.

Vietnamese dong per US dollar

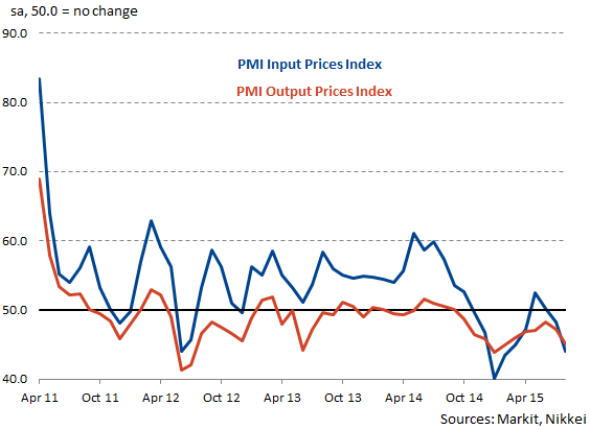

Competition with Chinese firms was a factor behind lower output prices as well as falling new export orders in August. Vietnamese manufacturers will also hope to see this impact ease off as the effects of the SBV's action feed through so that they can begin to raise selling prices again. Wider deflationary pressures are also at play, however, with input costs falling sharply amid reports of lower prices in international markets for items such as steel and oil.

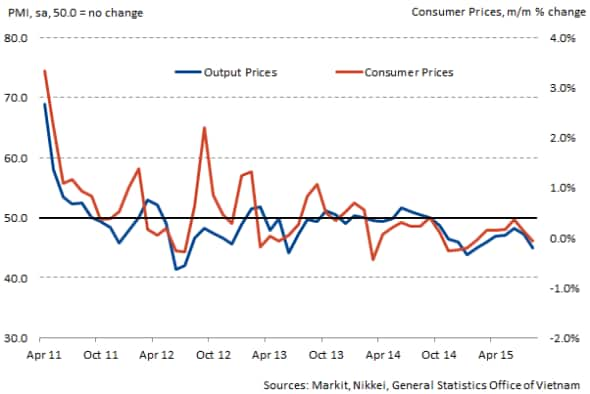

The weaker dong has the potential to lead to inflationary pressures. However, consumer price inflation has been low for some time now and the latest PMI data showed this continuing in August, with both input costs and output prices falling at the fastest rates in six months. Official data pointed to a month-on-month fall in consumer prices during August, with the annual rate of inflation at a six-month low of 0.6%. The SBV is therefore unlikely to be too concerned about inflation in the near-term.

PMI Price Indices

Consumer Price Inflation

The current uncertainty surrounding the Chinese economy and impacts of any weakness on the wider region suggest that Vietnamese manufacturers may be in for a difficult second half of the year. However, the authorities have demonstrated a willingness to act decisively in order to support local firms. The next PMI release on 1st October will provide an update on the health of the sector in September.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-economics-regional-weakness-adds-to-easing-of-vietnamese-manufacturing-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-economics-regional-weakness-adds-to-easing-of-vietnamese-manufacturing-growth.html&text=Regional+weakness+adds+to+easing+of+Vietnamese+manufacturing+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-economics-regional-weakness-adds-to-easing-of-vietnamese-manufacturing-growth.html","enabled":true},{"name":"email","url":"?subject=Regional weakness adds to easing of Vietnamese manufacturing growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-economics-regional-weakness-adds-to-easing-of-vietnamese-manufacturing-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Regional+weakness+adds+to+easing+of+Vietnamese+manufacturing+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-economics-regional-weakness-adds-to-easing-of-vietnamese-manufacturing-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}