Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2015

Brazil's economy slips into technical recession during Q2

Latest GDP data from IBGE showed that the Brazilian economy registered its worst quarterly performance since 2009 in quarter two, broadly in line with the Markit-compiled PMI data. Worryingly, the PMI suggests that this downturn extended into the third quarter. Output continues to contract across the manufacturing and service sectors, with the country's economic malaise compounded by high interest rates, stubborn inflation and rising unemployment.

Gross Domestic Product plunges

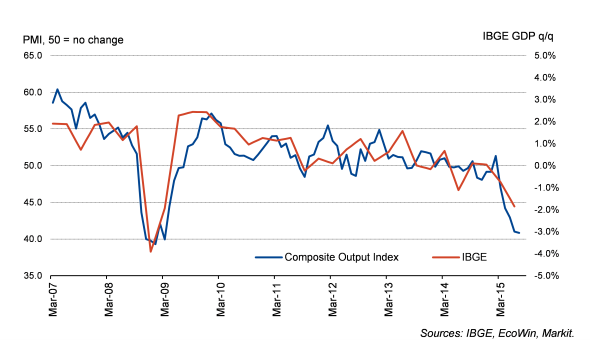

Data released on August 28th by the IBGE highlighted a 1.9% quarterly decline in GDP, following a revised 0.7% drop in Q1. The official data follow signs sent by the PMI, which has pointed to contraction in each month since March.

Brazil GDP and the PMI

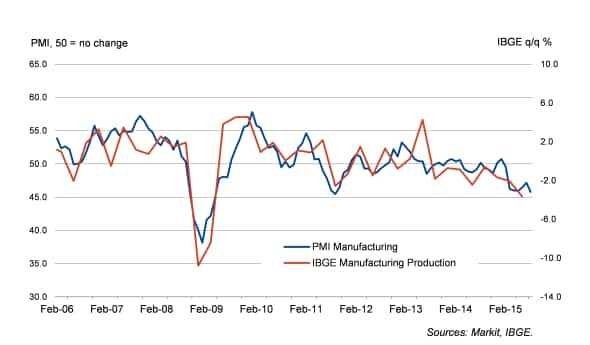

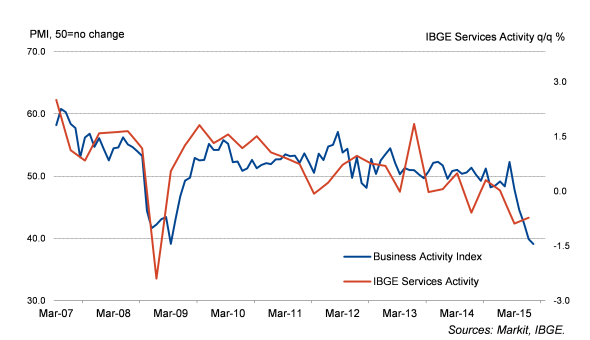

The Composite PMI Output Index averaged 42.7 in the second quarter of 2015, with the manufacturing index recording 43.9 (Q1: 48.1) and the services index posting 42.3 (Q1: 49.5). Moreover, the outlook for the country's economy in Q3 looks bleak, with the Manufacturing PMI signalling continued downturn in August. IBGE reported that the economic retreat reflected declines across the three main sectors; farming (-2.7%), industrial (-4.3%) and services (-0.7%).

Manufacturing Sector and the PMI

Services Activity and the PMI

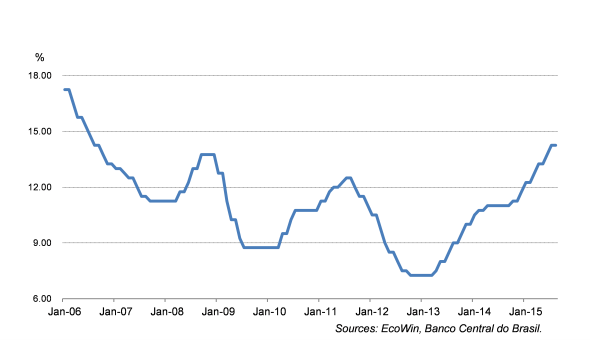

The country has been hit by the government's efforts to improve public finances, with spending being shed and tax rates increased. To add to that, consumer spending retracted on the back of rising borrowing costs and soaring inflation. Brazil's benchmark interest rate was raised for the seventh successive time in July to an almost nine-year peak of 14.25%, reflecting the central bank's effort to curb inflation.

Brazil's Benchmark Interest Rate, SELIC

Besides all this, consumer and investment confidence have been blown by the Petrobras - a state-controlled energy and petroleum company - scandal which resulted in many politicians being investigated under Opera""o Lava Jato (Operation Car Wash).

Brazilians hit by inflationary pressures

Despite moderating to 0.62% m/m in July, Brazil's official inflation rate - IPCA Consumer Prices Index "- reported by the IBGE surged to 9.56% on an annual basis. This latest reading is the highest in almost 12 years and well above the central bank's upper-limit target of 6.5%. Strong price increases have been corroding a large portion of the population's disposable income, contributing to the current economic recession.

The Composite PMI Input Prices Index has been riding above the series long-run average in each month since last December up to July. Cost inflation in August accelerated to a 22-month peak at manufacturers, while services cost inflation reached a near seven-year peak in July. Survey members recently indicated that the weaker currency (particularly against the USD) had resulted in higher prices paid for imported items. Increased utility, petrol and borrowing costs were also widely mentioned.

The USD/BRL Spot Rate closed at 3.62 in July, its highest in nearly 13 years. The sharp depreciation in the country's currency failed to lift exports, however. The manufacturing New Export Orders Index has not recorded above the crucial 50.0 threshold - which indicates growth - since February when a marginal rise in foreign demand was signalled, reflecting a competitive global market.

Recession weighs on labour market

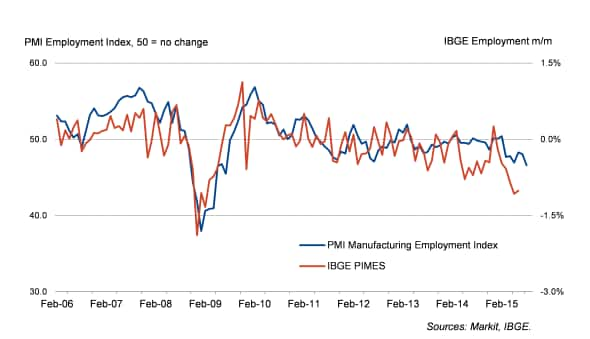

The deteriorating economic scenario has also been evident in the labour market. In July, the IBGE reported 1.8 million of unemployed among the main metropolitan areas, an increase of 56.0% compared against July 2014. This is the sharpest rise since data were first collected in 2002. Although workforce numbers were broadly unchanged since May (22.8 million), a 0.9% annual drop was signalled.

Employment in the industrial sector (PIMES), measured by the IBGE, fell 1% in June from May and dropped 6.4% on an annual basis (sharpest decline since July 2009). Similarly, the manufacturing Employment Index was at a 70-month low of 46.9 in May, before plummeting to a new low of 46.6 in August and indicating that the end of the downturn is not yet in sight.

Brazil's Workforce and the PMI

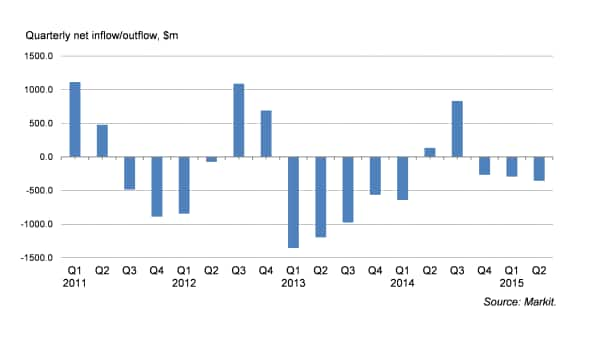

Investor sentiment deteriorates further

Investors' appetite for Brazilian exposed ETF's deteriorated further in the Q2, with the country seeing a net outflow of $356.9 million. Latest data indicated that in July, exchange-traded funds have recorded a net outflow of $6.3 million.

Brazilian-exposed ETF flows (quarterly)

Exchange-traded funds (ETF) provide investors with easy, liquid exposure to various markets. Fund flows consequently provide a valuable and timely insight into how investor appetite towards different markets is changing.

Services and Composite PMI data, published on 3rd September, will provide further insight into the country's economic performance for the third quarter of 2015.

Pollyanna De Lima | Principal Economist, IHS Markit

Tel: +44 149 146 1075

pollyana.delima@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-Economics-Brazil-s-economy-slips-into-technical-recession-during-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-Economics-Brazil-s-economy-slips-into-technical-recession-during-Q2.html&text=Brazil%27s+economy+slips+into+technical+recession+during+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-Economics-Brazil-s-economy-slips-into-technical-recession-during-Q2.html","enabled":true},{"name":"email","url":"?subject=Brazil's economy slips into technical recession during Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-Economics-Brazil-s-economy-slips-into-technical-recession-during-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil%27s+economy+slips+into+technical+recession+during+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-Economics-Brazil-s-economy-slips-into-technical-recession-during-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}