Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2015

Greece PMI signals deepening downturn as intensifying crisis hits economy

The Greek debt crisis continued to take a toll on the economy in June, with the country facing a deepening recession as consumer and business spending continued to decline during the month. However, there are currently few signs of significant contagion of the crisis to other countries.

PMI falls in June

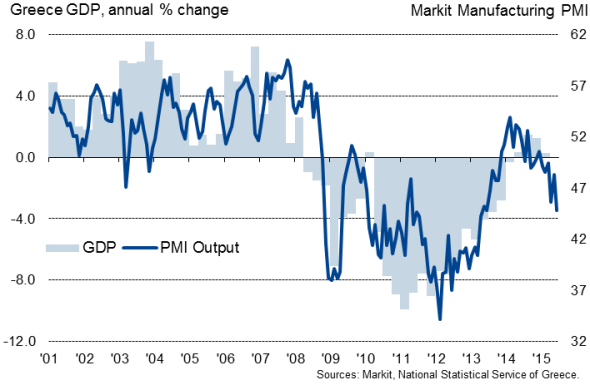

At 46.9, the Markit Greece Manufacturing PMI remained below the 50.0 no-change level to indicate a steeper downturn than May, rounding off the worst quarter for two years.

Economic growth and the PMI

Factory output fell at the fastest rate for two years and, with new orders showing one of the largest falls for over two years, the survey data point to a further fall in production in July. Export orders suffered the largest monthly decline since February 2013.

Employment fell only marginally, albeit now down for a third month running, as most companies held on to staff awaiting further clarity on the debt talks.

Greek firms are also facing higher input costs, linked in many cases to the weaker currency and recent rises in oil prices from the lows seen earlier in the year, putting further pressure on companies to cut costs, and most likely employment, in coming months unless demand revives.

With the survey indicating a deepening recession, Athens looks set to face dwindling tax revenues, placing further pressure on the public finances. The escalation of the crisis, including the imposition of capital controls imposed in late June, also suggests that the rate of economic decline is likely to accelerate further without a swift resolution to the debt talks.

Little sign of contagion, so far

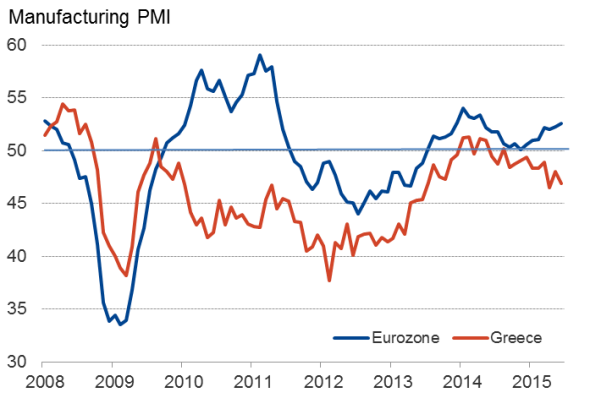

The increased rate of decline signalled by the Greek PMI contrasted with an accelerating upturn in the wider euro area, where the manufacturing index hit a 14-month high.

Greece and the eurozone

Although down compared with May, the PMIs for Italy, Spain and Ireland all remained in strong positive territory. Growth picked up in Germany, while France saw its first overall improvement in business conditions for over a year.

The ongoing economic upturns in other eurozone countries points to a lack of significant contagion from the Greek crisis within the region, for the moment at least.

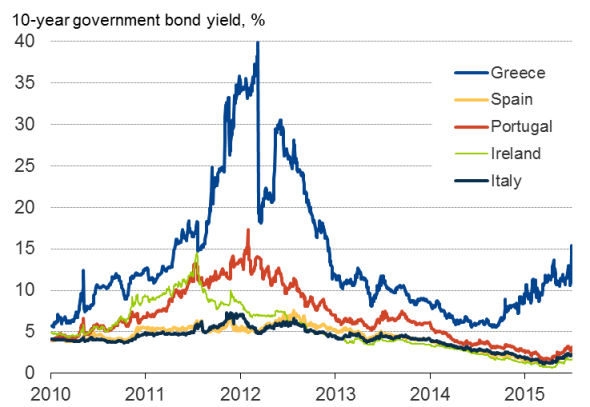

Financial market data also point to a lack of contagion, to other countries. The yields on 10-year bonds issued by Italy, Spain, Ireland and Portugal have risen only modestly in recent weeks, and are well below peaks seen during the 2011-12 crisis. Greece's 10-year bond yield, on the other hand, has spiked to 15.4%, though even this overstates underling prices due to a lack of trading in Greek debt, based on other market instrument prices.

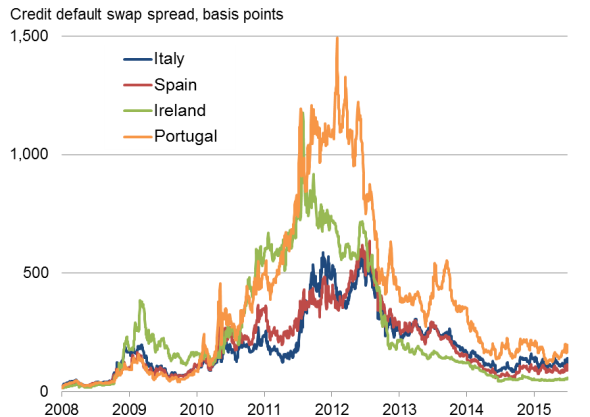

Cost of insuring against default

Source: Markit.

Similarly, low liquidity in credit default swap trading for Greek debt means CDS spreads need to be treated with caution when measuring risk of default. However, there are bigger volumes of trading in CDS for other countries, and the spreads for Italy, Spain, Portugal and Ireland suggest little default risk is being priced-in for other previously-struggling euro nations.

The reason for a lack of contagion in part reflects the better performance of economies such as Spain, Italy and Ireland compared to 2011-12, as well as measures taken by the ECB to reassure that countries will be protected as appropriate.

Back in 2012, ECB chief Mario Draghi calmed markets by pledging to "do whatever it takes" to safeguard the euro currency. The ECB established an Outright Monetary Transaction program which allows the central bank to buy sovereign bonds of any country which asks for help in the event of financial market turbulence, assuming of course that the country has abided by the appropriate fiscal rules.

Government borrowing costs (10-year bonds)

Source: Markit.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-greece-pmi-signals-deepening-downturn-as-intensifying-crisis-hits-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-greece-pmi-signals-deepening-downturn-as-intensifying-crisis-hits-economy.html&text=Greece+PMI+signals+deepening+downturn+as+intensifying+crisis+hits+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-greece-pmi-signals-deepening-downturn-as-intensifying-crisis-hits-economy.html","enabled":true},{"name":"email","url":"?subject=Greece PMI signals deepening downturn as intensifying crisis hits economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-greece-pmi-signals-deepening-downturn-as-intensifying-crisis-hits-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greece+PMI+signals+deepening+downturn+as+intensifying+crisis+hits+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-greece-pmi-signals-deepening-downturn-as-intensifying-crisis-hits-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}