Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2015

Solid June PMI results mean eurozone manufacturers enjoy best quarter for a year

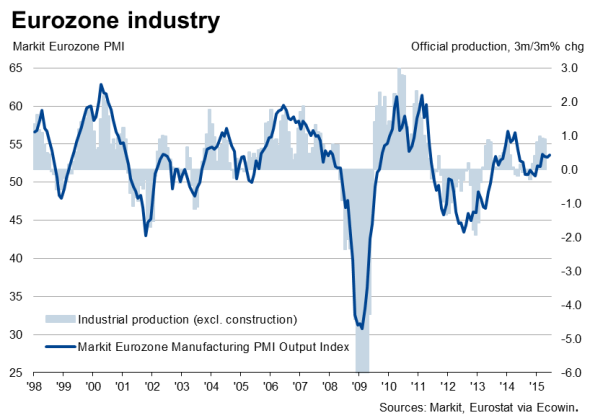

A solid PMI reading for June rounded off euro area manufacturers' best quarter for a year, representing a major improvement compared to the malaise seen at the end of 2014 and a reassuringly robust performance in the light of the escalating Greek debt crisis.

The Markit Eurozone Manufacturing PMI" rose for a second month running to reach 52.5, its highest reading since April 2014. The June final reading was in line with the earlier flash estimate.

Moreover, in the three months to June, the average readings for the headline PMI and the indices tracking both output and new orders all hit their highest since the second quarter 2014.

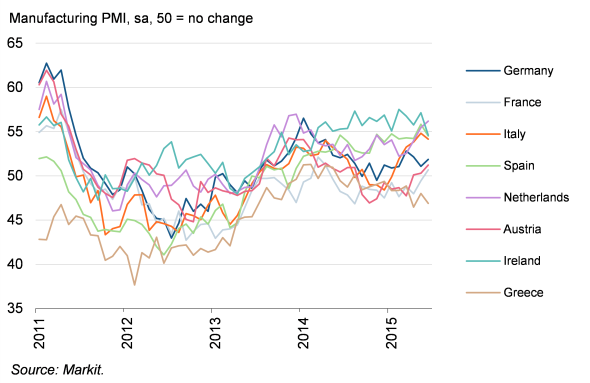

In an otherwise broad-based upturn, Greece remained the outlier, suffering the steepest drop in manufacturing output for two years as orders continued to collapse in a month of fraught discussions seeking to stave off default and potential exit from the euro zone.

However, the overall pace of expansion remains insipid rather than impressive. Although France's factories have reported an improvement in business conditions for the first time in over a year, and the Netherlands, Ireland and Italy are all seeing especially strong rates of growth, the lacklustre rates of expansion seen in Germany and France mean the PMI is broadly consistent with Eurozone manufacturing output rising by a mere 0.3% in the second quarter, providing only a modest boost for the wider economic recovery.

The pace of growth is especially disappointing given how accommodative financial conditions are at the moment, with record low interest rates and the ECB's quantitative easing now well under way. However, this is perhaps not surprising given the heightened degree of uncertainty surrounding the Greek debt talks that was seen during the month. This at least suggests that a resolution of the crisis will trigger stronger growth.

The outlook for the region clearly remains uncertain, given the situation with Greece, but the June survey results paint an encouraging picture of an industrial sector that is weathering the storm and enjoying reasonable growth which should help drive an ongoing recovery in coming months barring any contagion from the Greek crisis. So far, there is little evidence of any such significant contagion and the ECB has already reassured that it is prepared to step in with emergency measures to avoid further financial market contagion if needed.

Manufacturing by country

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-Economics-Solid-June-PMI-results-mean-eurozone-manufacturers-enjoy-best-quarter-for-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-Economics-Solid-June-PMI-results-mean-eurozone-manufacturers-enjoy-best-quarter-for-a-year.html&text=Solid+June+PMI+results+mean+eurozone+manufacturers+enjoy+best+quarter+for+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-Economics-Solid-June-PMI-results-mean-eurozone-manufacturers-enjoy-best-quarter-for-a-year.html","enabled":true},{"name":"email","url":"?subject=Solid June PMI results mean eurozone manufacturers enjoy best quarter for a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-Economics-Solid-June-PMI-results-mean-eurozone-manufacturers-enjoy-best-quarter-for-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Solid+June+PMI+results+mean+eurozone+manufacturers+enjoy+best+quarter+for+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-Economics-Solid-June-PMI-results-mean-eurozone-manufacturers-enjoy-best-quarter-for-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}