Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 01, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Carmax leads the five retailers seeing heavy short interest ahead of earnings

- Wirecard is the most shorted company announcing earnings next week

- Japanese machinery maker Osg is the most shorted of the 19 Asian companies prior to earnings

North America

The list of heavily shorted US stocks announcing earnings this week is led by second hand car retailer Carmax. As the largest used car seller in North America its shares plummeted in the opening weeks of the year after it announced a fall in gross profit per cars sold. While the company has since seen its shares recover most of their lost ground, short sellers, which had been increasing their positions in the lead up to January's dip doubled down. Short interest in Carmax shares is now north of 20% of shares outstanding which is nearly three times the levels seen a year ago.

Retailers are a key focus of the current part of the earnings cycle and we see four other retailers joining Carmax on the heavily shorted list with Bed Bath and Beyond the only firm seeing more than 10% of its shares shorted.

Of the other three retailers, Sacks Fifth Avenue owner Hudson's Bay Co has seen the largest jump in short interest in the month leading up to earnings with demand to borrow the Canadian firm's shares jumping by a third in the last four weeks.

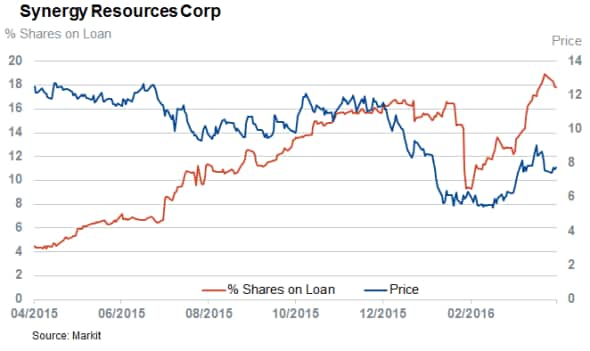

Oil and gas firms continue to make popular short targets despite the recent rebound in oil prices. This week sees Synergy Resources with an all-time high 17.8% of its shares out on loan to short sellers before its earnings update on Thursday. Short interest in Synergy has continued to rise despite the fact that its shares have jumped by a third from the lows seen earlier in the year.

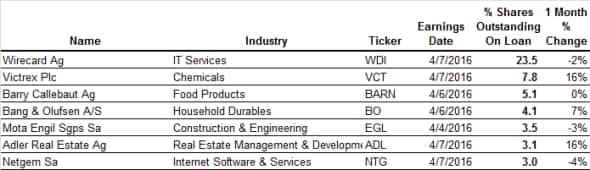

Western Europe

In Europe, payment processor Wirecard sees 23.5% of shares out on loan ahead of its earnings update which is the most out of any company announcing earnings this week. The company has been the target of an activist short campaign from Zatarra Research which has alleged that the company was involved in historical fraud and money laundering something which Wirecard management has actively denied. Despite the public rebuttal, Wirecard shares have continued to slump; prompting short sellers to add to their positions to the current all-time high.

Swiss chocolatier Barry Callebaut is another firm seeing recent high short interest as the firm has seen short interest hover around the 5% of shares outstanding mark as global cocoa prices continue to climb due to the impact of weather woes on global supplies.

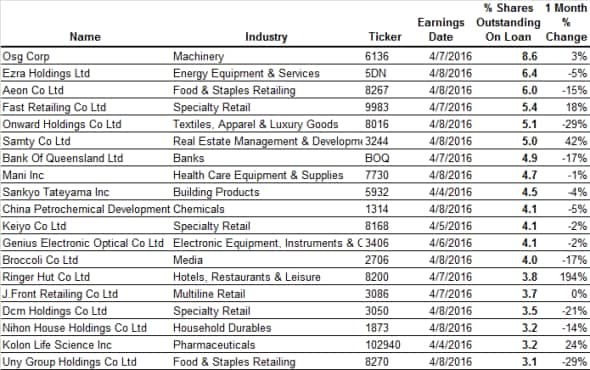

Asia Pacific

Japanese machinery firm Osg is the most shorted Asian firm announcing earnings this week with 8.6% of shares out on loan. Current demand to borrow the firm's shares is at an all-time high as short sellers look to profit from Japan's continuing economic woes. This trade was validated today when the Nikkei Japan Manufacturing PMI indicated that output in the Japanese manufacturing sector shrank at the fastest pace in three years over March.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}