Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 04, 2016

Investors not riding oil's rally

Investors have been actively selling out of their oil ETF positions since the commodity started to rally from February lows.

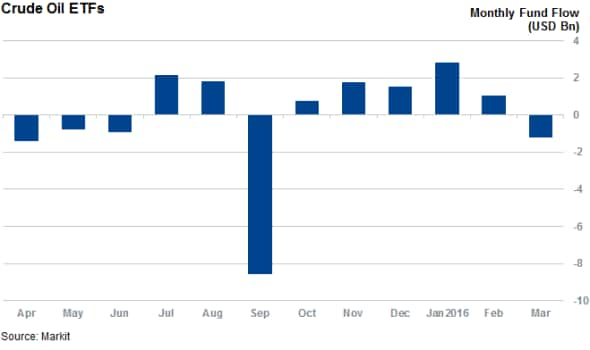

- Investors pulled $1.2bn out of crude oil ETFs in March, first outflow in six months

- Japanese investors bucked the global trend pouring $115m into their four oil tracking funds

- Funds which track energy producers saw the largest outflows in 10 months over March

Investors have been lacking faith in oil's recent rally as they have been actively selling out of oil ETFs since the end of February. Investors had actively poured money into ETFs and that tracked the value of crude oil as the commodity continued to sink to new lows in the months leading up to February, pulled over $1.2bn out of the 124 such funds during March.

This marks the first outflow out of the asset class since September of last year and hints that the recent rally has so far failed to inspire ETF investors given their eagerness to cash out in the opening weeks of the commodity's rally.

The triple leveraged and the second largest crude oil linked ETF, VelocityShares 3x Long Crude Oil link S&P GSCI Crude Index ER ETN, has felt this trend most acutely as investors cashed out $386m over the month, roughly 40% of its total AUM.

While the trend is not solely linked to US listed products, as seen by the fact that European listed crude oil ETFs have also seen outflows, Japanese funds have bucked the trend as the four Japanese listed crude oil ETFs saw over $100m of inflows over March. This trade or trend could be driven by the Yen strengthening against the dollar, the currency in which oil trades and the continued investments into crude by Japanese investors could be driven by their desire to take a view on a weakening yen after the currency which had its best performance against the dollar in over six years in Q1.

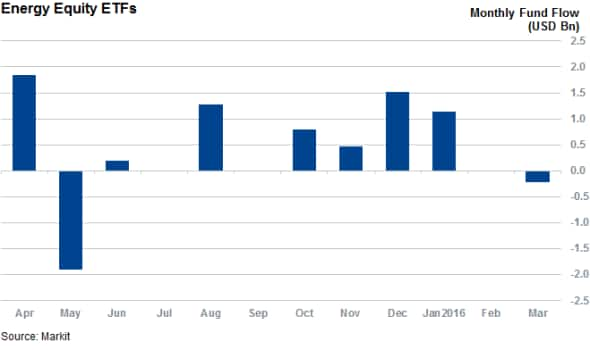

Equity funds which invest in oil and gas producers have also seen similar asset flows as investors pulled over $225m out of the 87 such ETFs. Much like their peers which invest indirectly in the commodity, the cash pulled out of oil ETFs over March marked the largest exodus from the asset class of the most recent cycle as the outflows have been the most severe since May of last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042016-Equities-Investors-not-riding-oil-s-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042016-Equities-Investors-not-riding-oil-s-rally.html&text=Investors+not+riding+oil%27s+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042016-Equities-Investors-not-riding-oil-s-rally.html","enabled":true},{"name":"email","url":"?subject=Investors not riding oil's rally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042016-Equities-Investors-not-riding-oil-s-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+not+riding+oil%27s+rally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042016-Equities-Investors-not-riding-oil-s-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}