Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Webinar

Live Webinar

Financial markets offered very few surprises during the second quarter of the year as equity indices across the globe continued to break through new record highs and both inflation and interest rates continued to fall. Given the unidirectional moves seen across global equities, the VIX (otherwise known as the fear gauge), trended close to all time lows. In the fixed income markets, economic data remained key to bond performance. Data often remained mixed however and led to the European Central Bank cutting interest rates by 25bps during June, marking the first signs of central bank policy divergence.

In the securities lending markets, revenues were not as exceptional as those seen throughout both 2022 and 2023, but remained robust within the broader context of a longer time period. Despite the decline in lending opportunities across European equities and the continuation of the steady reduction in average fees seen across fixed income assets, revenues remained healthy across other markets such as the US and Asia. An increase in financing and term lending was also seen.

To get the full picture of how the securities lending market performed during Q2, please join us at our upcoming Q2 Securities finance Market review webinar at 3pm BST / 10am EST on July 25th 2024. During this webinar we are delighted to welcome Gesa Johannsen, Head of Clearance and Collateral Management International Business at BNY. Gesa will be running us through the latest trends in the collateral markets and will be discussing the opportunities that market participants should be looking at during the second half of the year.

S&P Global Market Intelligence

S&P Global Market Intelligence

Executive Director, Equity Analytic Products (EAP)

Matt Chessum is an executive director within the Equity Analytic products team at S&P Global Market Intelligence and is responsible for the EMEA and US Product Specialist teams, market commentary, thought leadership and media relations. Previously, Matt was an Investment Director at aberdeen asset management where his main responsibilities included overseeing the securities lending activity and the management of GBP denominated Money Market mandates.

Matt is a former member of the Bank of England's securities lending committee and a former board member of the International Securities Lending Association (ISLA).

S&P Global

BNY

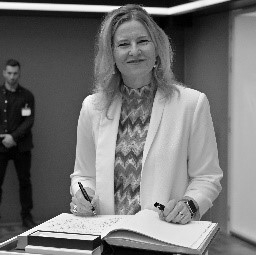

Managing Director, Head of International Clearance and Collateral Management Business

Gesa leads the International Clearance and Collateral Management Business at BNY.

Gesa leads the International Clearance and Collateral Management Business at BNY. Reporting to the CEO of the Business, she leads the business strategy for the collateral management business with more than $6 trillion of assets on the platform that we manage, optimize, move and keep safe for our clients.

Taking responsibility for the business success internationally she maintains critical oversight of the business’ regulatory obligations.

Gesa has over 25 years industry experience. Prior to joining BNY in 2013, she spent 10 years at Eurex Clearing and led the product strategy of the CCP. Gesa has also previously held senior roles at KPMG and Deutsche Bank.

Gesa represents BNY on the Board of ISDA (International Swaps and Derivatives Association) since 2021, taking an active role to support ISDA’s strategic goals to foster safe and efficient derivatives markets.

She holds a Diploma Degree in Economics of the University of Cologne.

Event Support