Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

In a challenging environment of defaults, economic volatility, tariffs, and geopolitical tensions, credit risk leaders in telecom, media, and tech need advanced tools, better data, and reliable analytics.

Elevated supplier and customer defaults, volatile economic conditions, tariffs, market fragmentation, and heightened geopolitical tensions are just a few of telecom, media, and technology leaders find themselves in. Given this context, credit risk leaders require more sophisticated tools, better data, and reliable analytics.

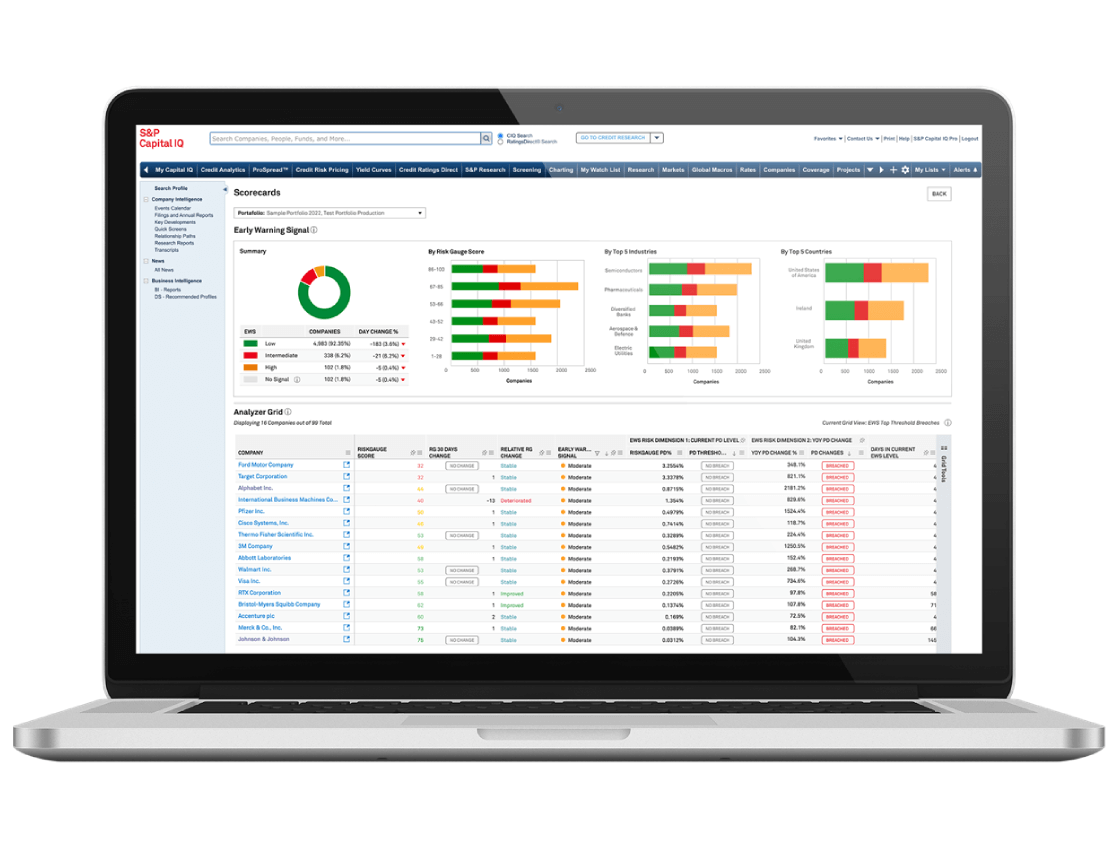

Successful telecom, media, and technology companies combat these struggles by adopting agile credit risk management processes and capabilities to minimize negative exposures and maximize their return on credit opportunities. Specific capabilities include portfolio views of risk that stratify counterparties by country and industry to assess potential default, scenario planning, and early warning systems that support early intervention and shelter companies from credit deterioration.

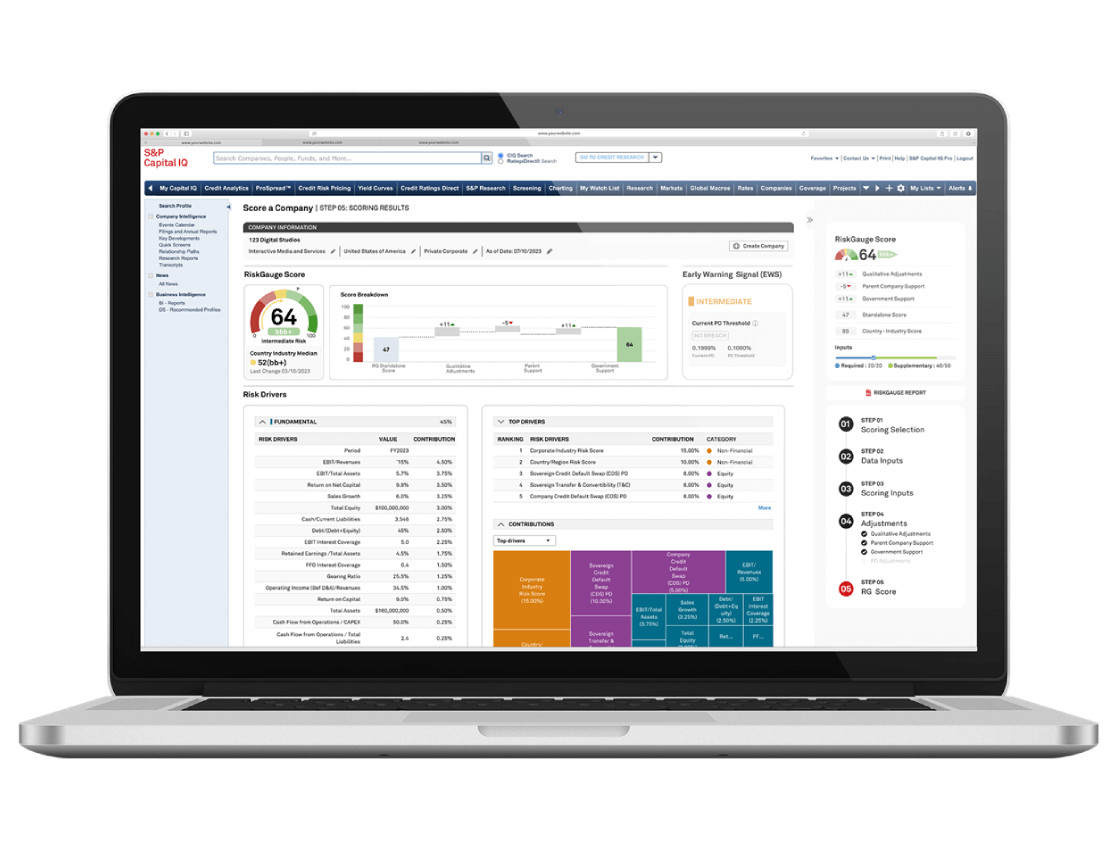

Enable credit teams to work efficiently and effectively against large, diverse portfolios of counterparties using Riskgauge™ Desktop.

Corporate credit leaders in technology-intensive firms face increased vulnerability to the financial instability of suppliers and customers, whether small and medium sized counterparties or tech- and capital-intensive companies, such as chip manufacturing.

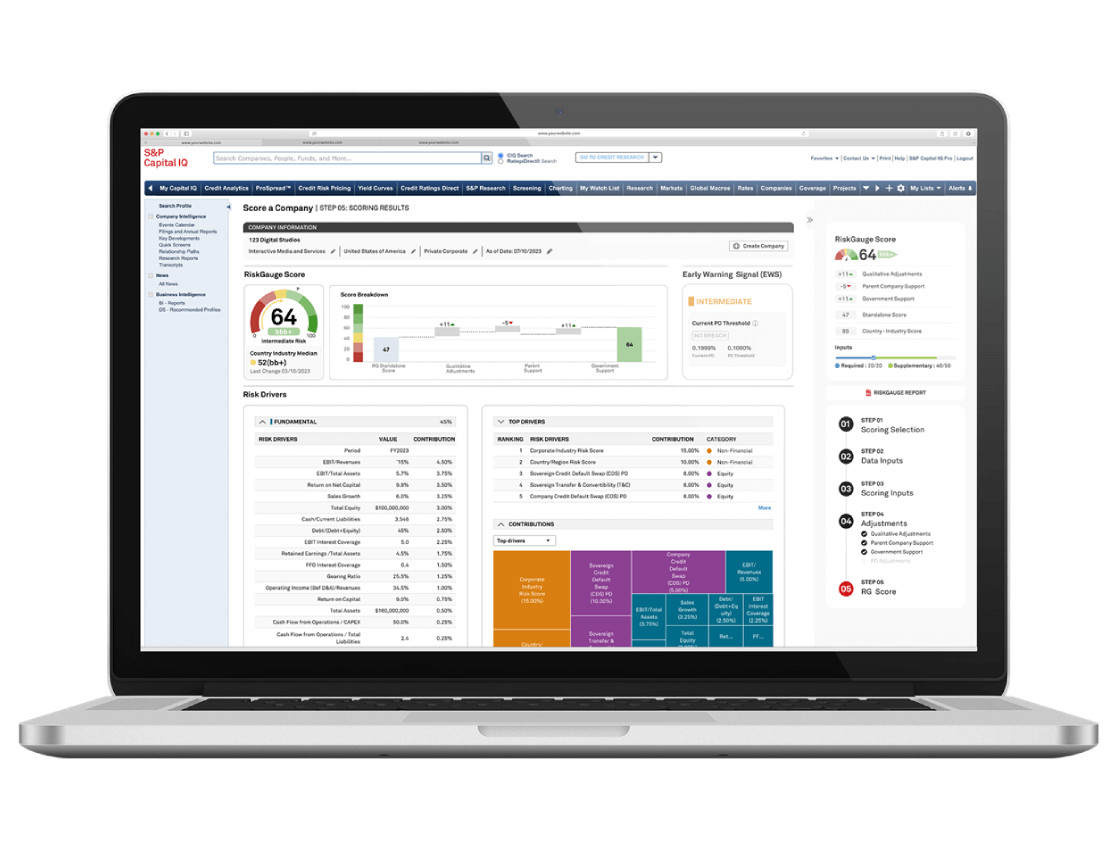

To help manage this, RiskGauge Desktop provides millions of pre-calculated credit scores for a broad range of counterparties, including SME’s, large corporates, and financial institutions. Users can also use their own data to generate scores.

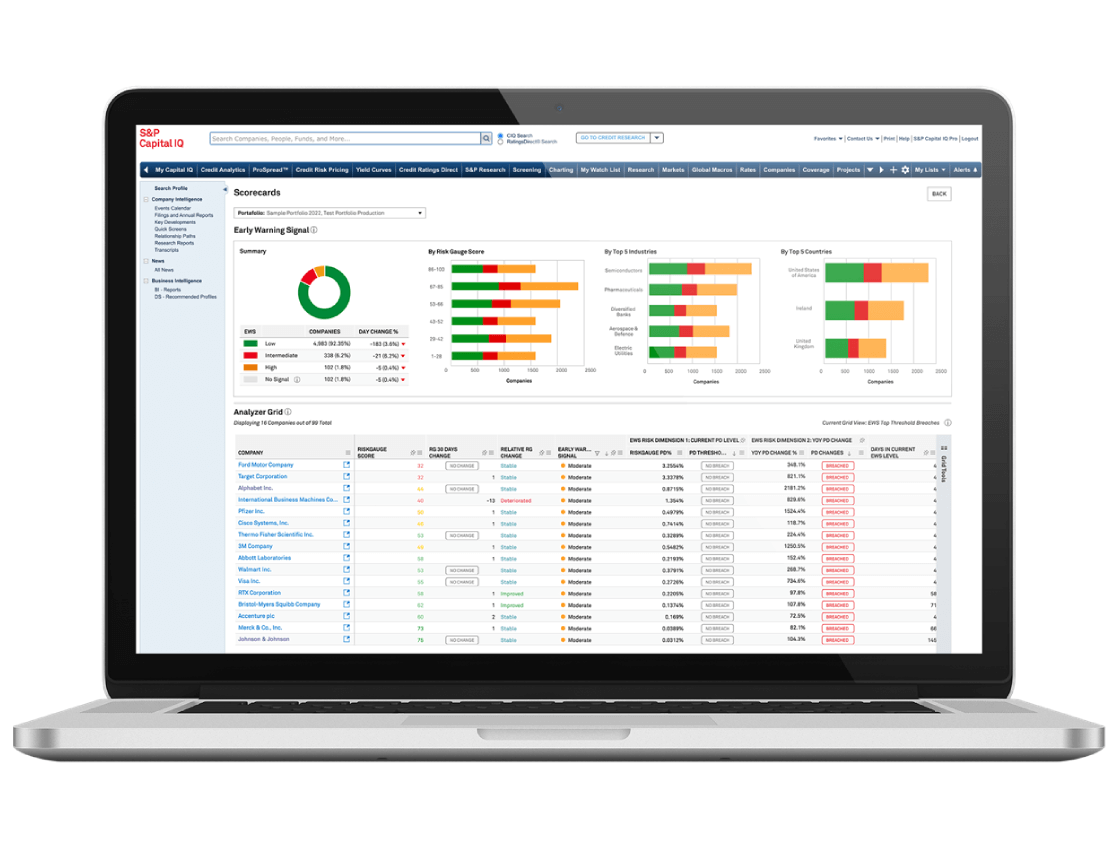

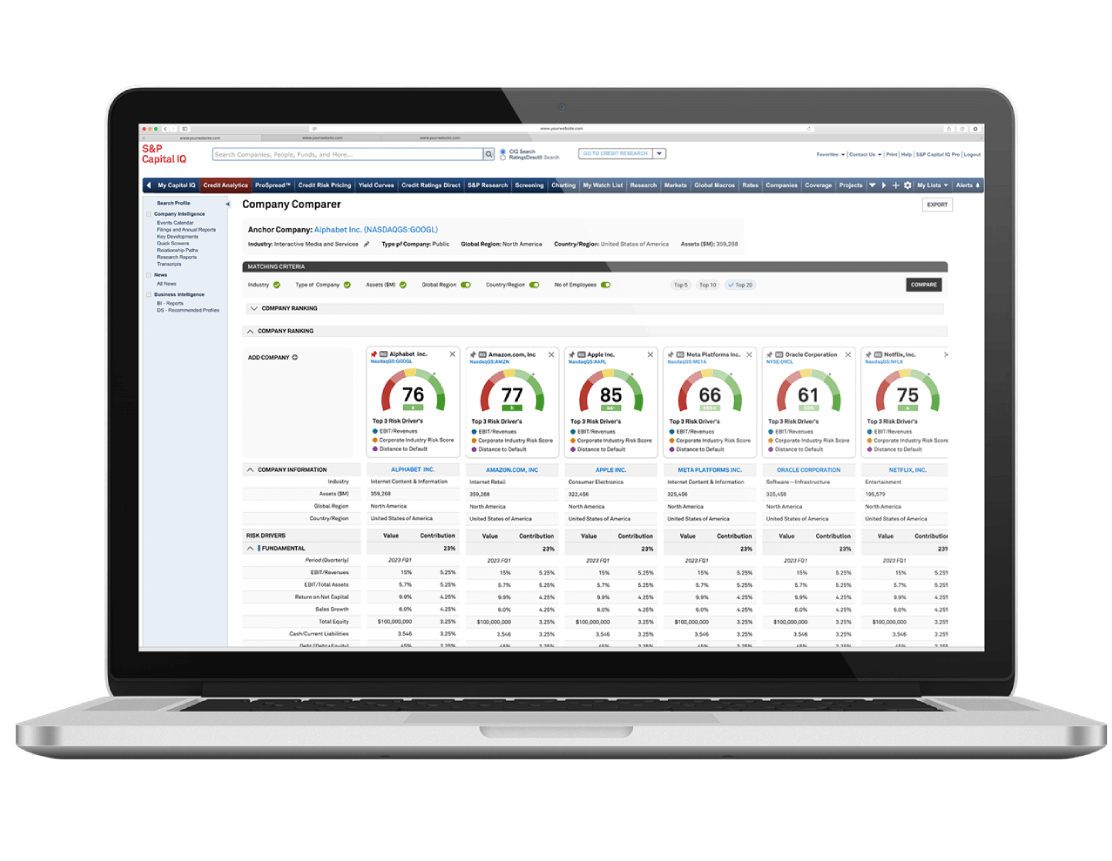

Understanding risk across markets is key for better credit management. From market-based realities like U.S. tariffs on Chinese semiconductors to fragmentation in the technology, media, and telecom leaders face an increasingly complex operating environment. RiskGauge Desktop brings clarity and speed to these leaders, enabling quick country, industry, or score-based portfolio analysis, enabling fast drill down into important details to assess their creditworthiness during these turbulent conditions.

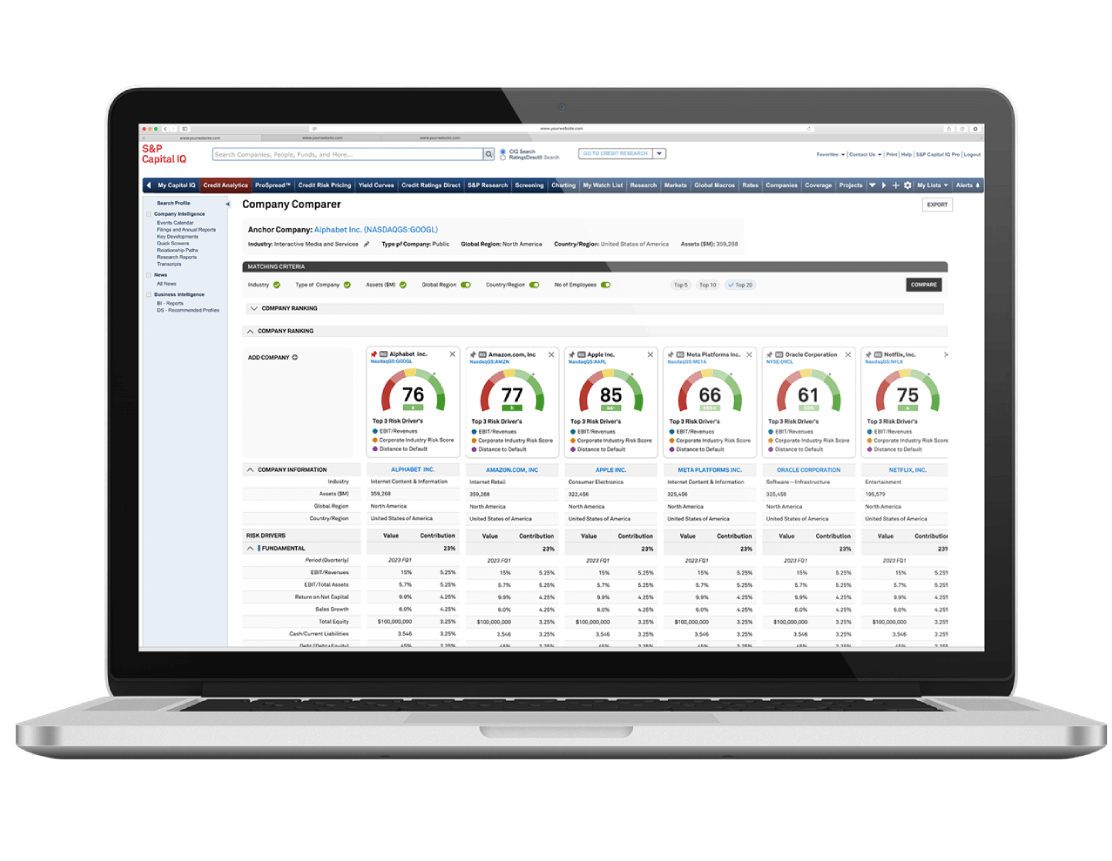

The growing importance of artificial intelligence (AI) has put a new spotlight on cybersecurity risks, while higher revenues for memory producers are changing market dynamics. RiskGauge Desktop provides decision-driving insights into company-specific impacts of these and other trends through benchmarking portfolios of similar counterparties- either pre-set or customized by the user - based on industry, size, or other relevant factors.

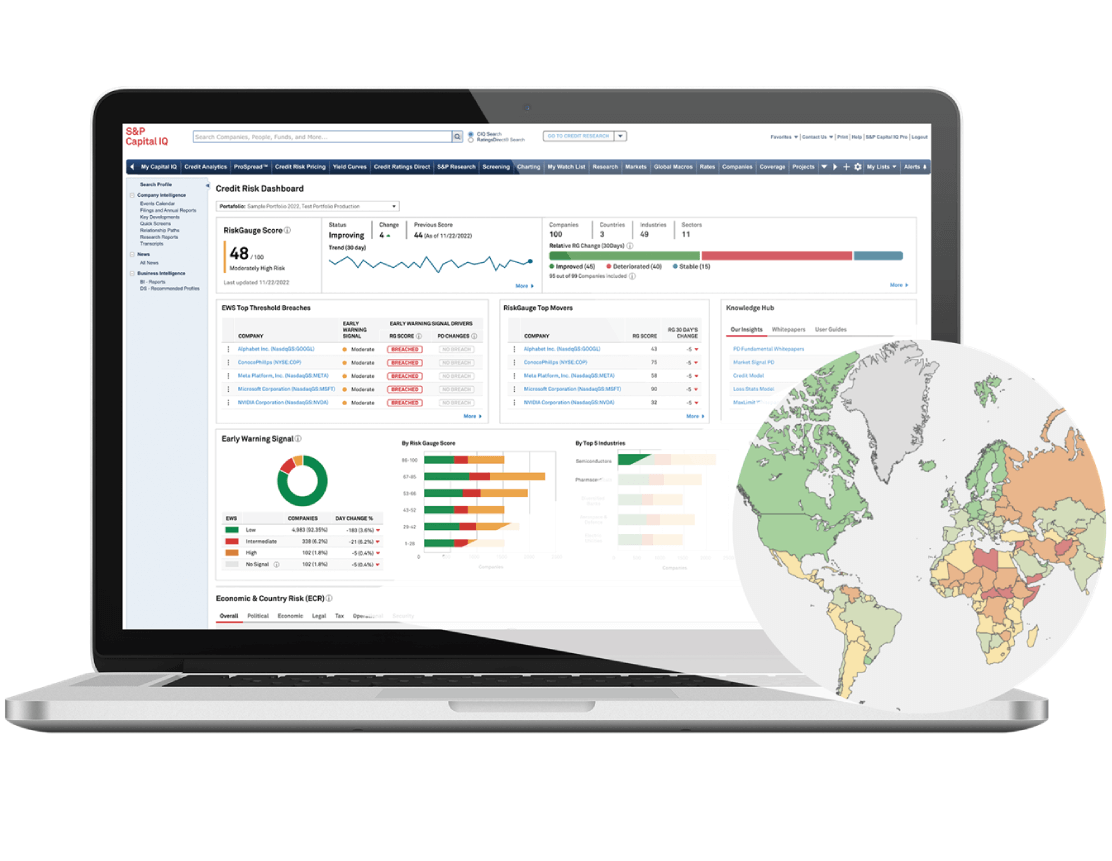

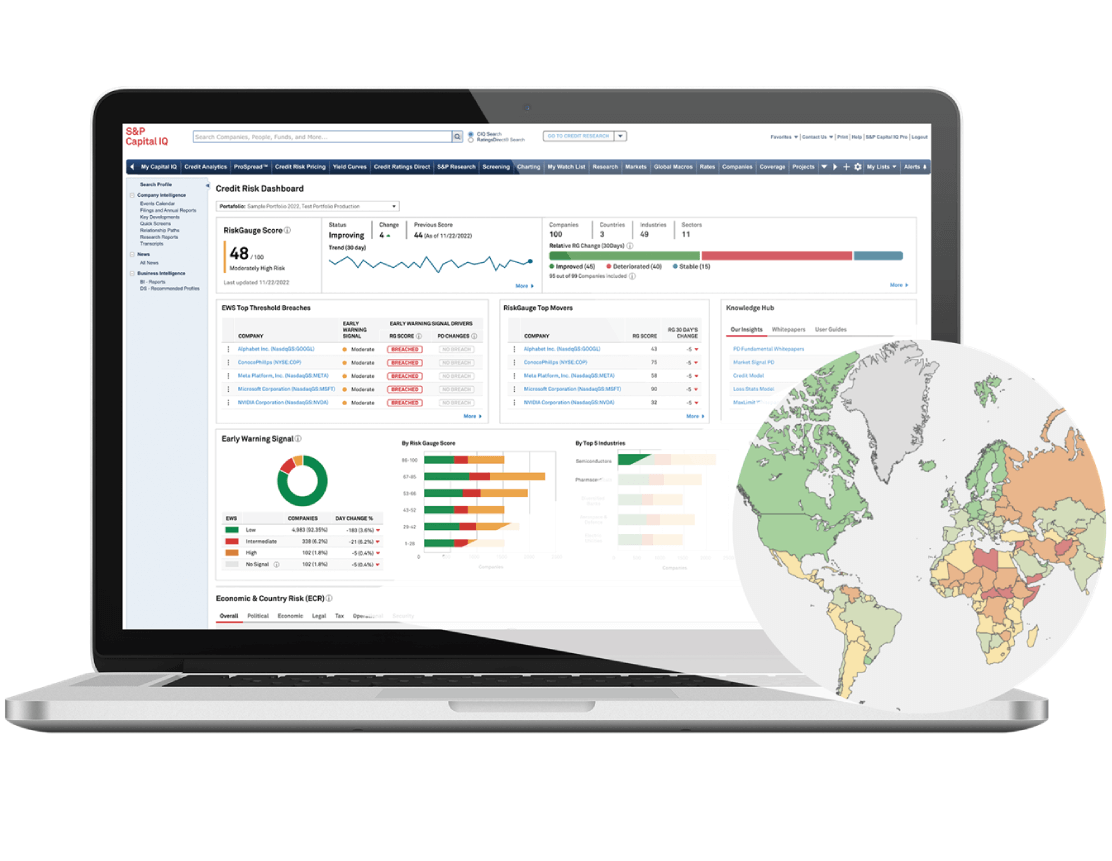

Avoiding increased exposure to unmanageable debt in a high-default environment is a top goal for most credit leaders; RiskGauge Desktop users can build and customize dashboards that show top movers across a portfolio, provide early warning signals of potential credit deterioration, and highlight economic and country risk hot spots. Portfolios can include up to 500,000 companies, reducing the need to utilize additional platforms and tools.

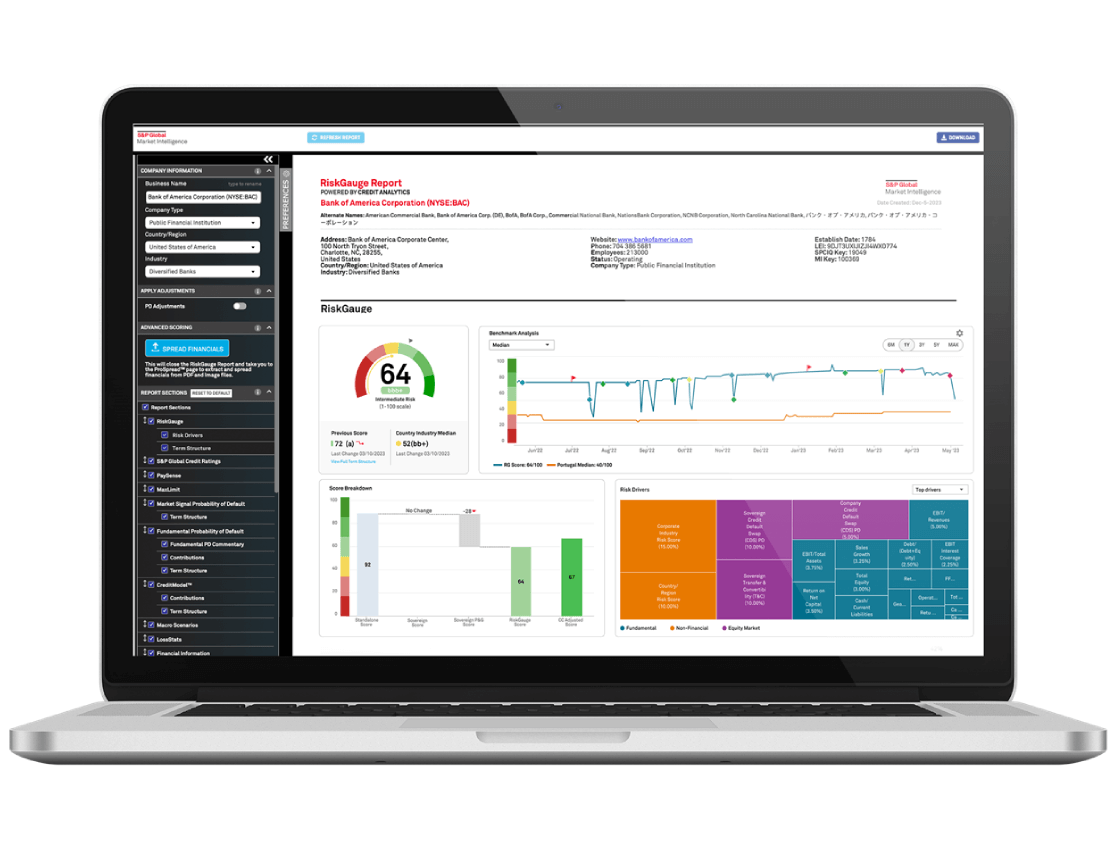

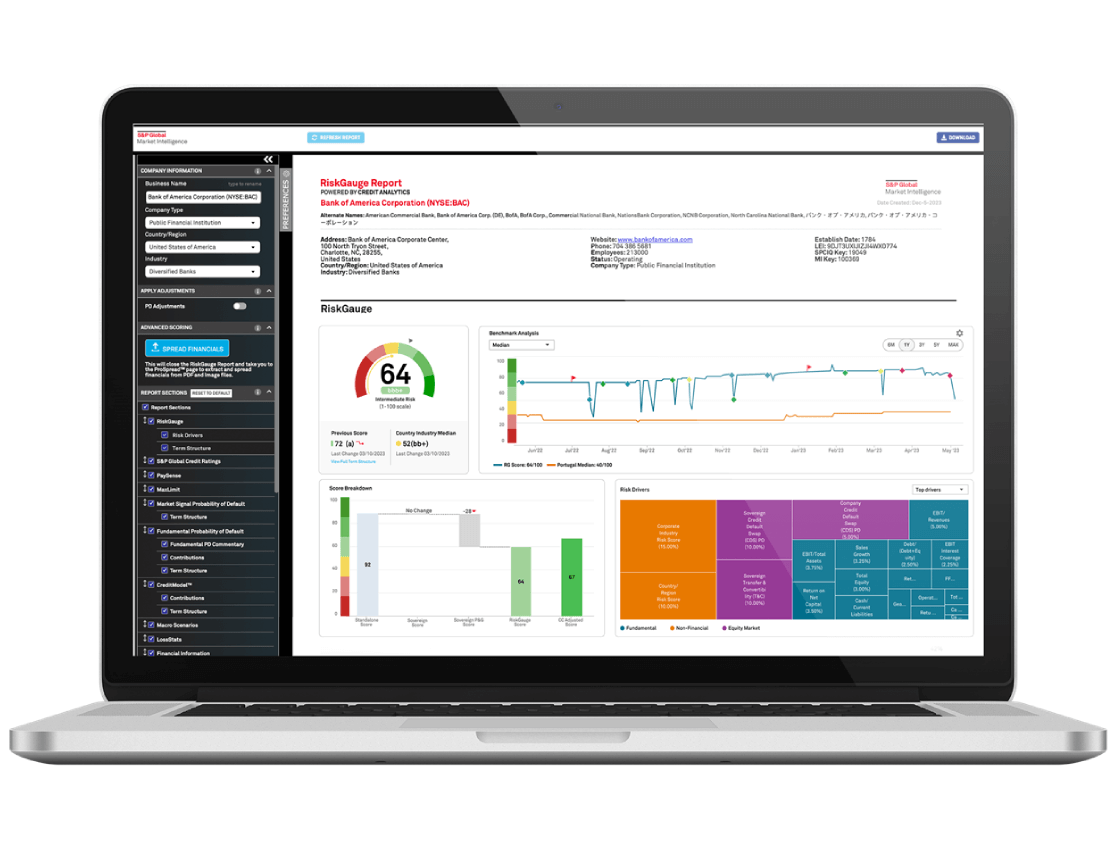

Comprehensive credit assessment reports help avoid erosion of shareholder value due to suboptimal risk management systems in volatile times. These reports help users understand the current and historical risk status of millions of companies, plus bespoke companies of interest, and compare performance against country and industry benchmarks.

Firmographics are included, such as contact details, operating status, identifiers, and established dates. In addition, the MaxLimit feature provides a useful proxy for the maximum trade receivable exposure by counterparty, Macro Scenario Model reveals the impact on counterparty risk given an economic event, and the LossStatsTM Model highlights the potential losses and recoveries across exposures.

Corporate credit leaders in technology-intensive firms face increased vulnerability to the financial instability of suppliers and customers, whether small and medium sized counterparties or tech- and capital-intensive companies, such as chip manufacturing.

To help manage this, RiskGauge Desktop provides millions of pre-calculated credit scores for a broad range of counterparties, including SME’s, large corporates, and financial institutions. Users can also use their own data to generate scores.

Understanding risk across markets is key for better credit management. From market-based realities like U.S. tariffs on Chinese semiconductors to fragmentation in the technology, media, and telecom leaders face an increasingly complex operating environment. RiskGauge Desktop brings clarity and speed to these leaders, enabling quick country, industry, or score-based portfolio analysis, enabling fast drill down into important details to assess their creditworthiness during these turbulent conditions.

The growing importance of artificial intelligence (AI) has put a new spotlight on cybersecurity risks, while higher revenues for memory producers are changing market dynamics. RiskGauge Desktop provides decision-driving insights into company-specific impacts of these and other trends through benchmarking portfolios of similar counterparties- either pre-set or customized by the user - based on industry, size, or other relevant factors.

Avoiding increased exposure to unmanageable debt in a high-default environment is a top goal for most credit leaders; RiskGauge Desktop users can build and customize dashboards that show top movers across a portfolio, provide early warning signals of potential credit deterioration, and highlight economic and country risk hot spots. Portfolios can include up to 500,000 companies, reducing the need to utilize additional platforms and tools.

Comprehensive credit assessment reports help avoid erosion of shareholder value due to suboptimal risk management systems in volatile times. These reports help users understand the current and historical risk status of millions of companies, plus bespoke companies of interest, and compare performance against country and industry benchmarks.

Firmographics are included, such as contact details, operating status, identifiers, and established dates. In addition, the MaxLimit feature provides a useful proxy for the maximum trade receivable exposure by counterparty, Macro Scenario Model reveals the impact on counterparty risk given an economic event, and the LossStatsTM Model highlights the potential losses and recoveries across exposures.

Provide essential tools to identify and manage potential default risks of private, publicly traded, rated, and unrated companies and government entities across a multitude of sectors.

Helps users with their arm’s length assessment of intercompany financial transactions (including those for privately held companies) by creating a stand-alone credit score and finding comparable yields and a defensible interest rate in a manner that aligns with the OECD Guidance.

Lets users screen entities and individuals on more than 70 global sanctions and adverse media lists.

Takes the work out of manual financial data extraction and spreading by extracting financial data from many document types and formats (including PDF formats and image files) in 10 different languages.

Lets you analyze risk across multiple dimensions, including financial, location, sustainability, and cybersecurity.

The leading primary source for ratings and research from S&P Global Ratings, allows users to analyze credit performance and trends across industries, entities, and securities around the world.

You're one step closer to unlocking our suite of financial information solutions and services.

Fill out the form so we can connect you to the right person.

We're proud of our recent awards!

And, we delight in supporting our customers with 24x7x365 customer service and a 98% customer service satisfaction rate.

If your company has a current subscription with S&P Global Market Intelligence, you can register as a new user for access to the platform(s) covered by your license at S&P Capital IQ Pro or S&P Capital IQ.