Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 24, 2022

By Sara Johnson

Two shocks pushed the economy off course in the second quarter—Russia's invasion of Ukraine on 24 February and COVID-19 lockdowns in mainland China. After growing at annual rates of 6.2% quarter on quarter (q/q) in the fourth quarter of 2021 and 2.6% in the first quarter of 2022, world real GDP fell at a 1.8% rate in the second quarter. Recent data suggest the global economy is back on track, led by resilient emerging markets.

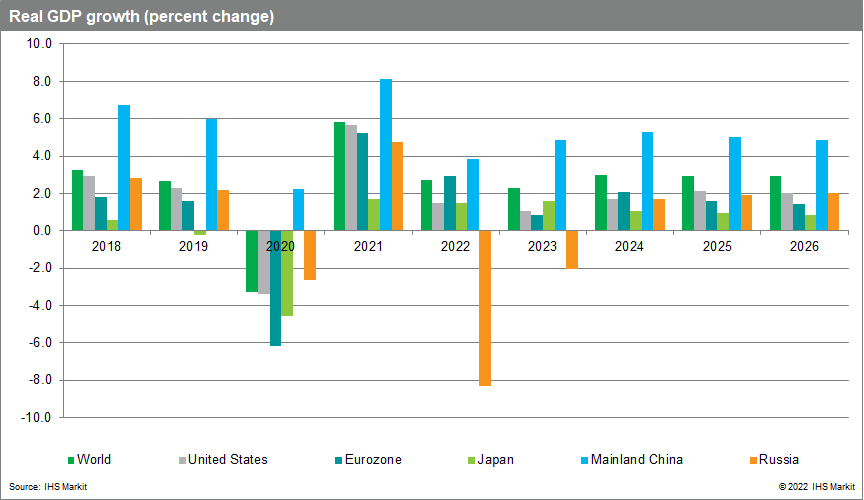

High global inflation continues to squeeze household budgets and undermine consumer confidence. Meanwhile, the post-pandemic resurgence in tourism and consumer services is beginning to fade. The lagged impacts of monetary policy tightening and rising interest rates will be felt throughout the year ahead, restraining investment and consumer durables spending. World real GDP growth is thus projected to slow from 5.8% in 2021 to 2.7% in 2022 and 2.3% in 2023. Once inflation subsides and financial conditions improve, global growth is expected to revive to 3.0% in 2024.

In the current economic situation, a global "soft landing" might be characterized by cooling demand, resolution of supply-chain disruptions, diminishing input and output price inflation, balanced labor markets, and smoothly functioning financial markets. On the inflation front, recent declines in industrial and agricultural commodity prices are helpful. As of mid-August, the IHS Markit Materials Price Index has fallen 20% from its early March peak. Crude oil prices have dropped below USD100/barrel largely owing to weak demand from mainland China. The retreat in commodity prices is filtering downstream to intermediate and finished products and should bring some relief to consumers in most parts of the world. After picking up from 3.9% in 2021 to 7.6% in 2022, global consumer price inflation is projected to ease to 4.5% in 2023 and 2.6% in 2024. New supply shocks could darken the near-term world economic outlook, however, since inventories are low in energy and metals markets.

An open question is whether central banks can achieve a soft landing and reach their inflation targets without pushing interest rates above prevailing inflation rates. Supply conditions related to the COVID-19 pandemic and the energy transition have driven a large part of the global inflation surge during the past two years. Our view is that tightening financial conditions are necessary to cool excess demand and help bring down inflation. The degree of tightening will depend on local conditions. In the United States (US), the federal funds rate is expected to rise to a range of 3.50-3.75% in December 2022 and stay there for a full year. With the eurozone tipping into recession later in 2022, the European Central Bank moves more cautiously, raising its refinance rate to its long-run neutral rate of 2.00% in January 2023. Investors' flight to safety poses risks for emerging markets that depend on capital inflows to finance trade and fiscal deficits.

The United Kingdom (UK) slipped into recession in the second quarter as high inflation eroded household incomes and consumer sentiment plunged to a record low. With consumer price inflation at 10.1% year on year (y/y) in July and headed higher (with a 75% October increase in gas and electricity rate caps), the UK recession is expected to linger through the spring quarter of 2023.

Eurozone real GDP growth was higher than expected (0.7% q/q) in the second quarter thanks to inventory accumulation and pent-up demand for services. Growth prospects are rapidly deteriorating, however, in response to continuing energy supply shortages, accelerating prices, the ongoing Russia-Ukraine war, and tightening financial conditions. With the eurozone likely to experience a mild recession in late 2022 and early 2023, real GDP growth is projected to slow from 5.2% in 2021 to 2.9% in 2022 and 0.8% in 2023. Manufacturing centers in northern Europe, including Germany, are most exposed to cuts in Russian energy supplies.

Although real GDP decreased slightly in the first two quarters of 2022, do not call it a recession! Since December 2021, the monthly indicators used by the National Bureau of Economic Research in dating business cycles have posted solid gains, including employment, industrial production, real personal income excluding transfer payments, and real retail sales. Meanwhile, a sharp slowdown in inventory accumulation has pulled down real GDP. Our economic forecast calls for a period of sluggish economic growth through the end of 2023, as moderate gains in consumer spending and government purchases are offset by significant declines in residential and commercial construction. Real GDP growth is projected to slow from 5.7% in 2021 to 1.5% in 2022 and 1.0% in 2023 before picking up to 1.7% in 2024. With growth falling short of potential, the US unemployment rate will likely rise from 3.5% in July to 4.8% in mid-2024.

After declining 2.6% q/q in the second quarter, real GDP is expected to recover in the third quarter, although July data indicate subpar growth in services and manufacturing. The government's dynamic zero-COVID policy will remain in place through at least March 2023, preventing a return to normalcy and limiting the effectiveness of the government's new stimulus programs. The housing market remains in a deep recession, and declining land sales are hurting local government finances. Real GDP growth is projected to slow from 8.1% in 2021 to 3.8% in 2022 before picking up to 4.9% in 2023.

After slowing from 6.2% in 2021 to 3.8% in 2022, Asia Pacific's real GDP growth is projected to pick up to 4.2% in 2022 and 4.5% in 2023. India, Indonesia, Vietnam, the Philippines, Bangladesh, and Cambodia will likely achieve growth rates of 5-7%. This performance reflects strong intraregional growth dynamics related to regional free-trade agreements, efficient supply chains, competitive costs, and steady inflows of foreign direct investment.

With global demand cooling and supply disruptions easing, global inflation is expected to moderate in 2023 and 2024. The global economy is expected to achieve a soft landing, with real GDP averaging 2.5% in 2022 and 2023. This will be a multi-speed economy, however, with Western Europe likely to experience a mild recession in late 2022 and early 2023. Other major countries will avert recessions but perform below potential.

Support your business plans with unparalleled risk analysis and the economic forecast for over 200 countries offered by our Advanced Country Analysis and Forecast (AdCAF).

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.