Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 02, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Following the release of manufacturing PMI data, services, composite and sector PMI releases will be a key highlight in the coming week for the complete picture on economic conditions in May. The Bank of Canada and Reserve Bank of Australia will meanwhile be the major central banks to watch, while various tier-1 data, such as GDP from the eurozone and Japan, and inflation figures from economies including mainland China, will be scrutinised.

While concerns over the US debt-ceiling continued to drive market sentiment in the past week, attention was also shared with economic release including worldwide manufacturing PMI figures released for May. While flash data preluded the persistent divergence between manufacturing and service sector performances, the latest final manufacturing PMI numbers have told of the continued weakness in the goods producing sector, in turn driving lower goods inflation. Various Asia Pacific nations also saw the weakness prevail as a result of sustained soft demand conditions. The upcoming services release will therefore be of interest to examine whether the divergence continued across the global in May. This is especially important to provide a better sense of the inflation trajectory as service-led inflation remains a lingering issue for central bankers still in the pursuit of taming prices and who generally remain "data dependent".

The Bank of Canada and Reserve Bank of Australia will be amongst the first to update monetary policy in May. Although no further hikes are expected from both, according to consensus expectations, their rhetoric will be closely watched.

Separately, to gain a sense of the inflation trajectory across various APAC economies including mainland China, official CPI data will be released across the region. The PMI's divergence in goods and services prices, in part due to easing supply chain constraints, may well be present in these data with the consensus expectations pointing to abating inflationary pressures in mainland China.

Trade figures out of mainland China will also be of interest, with Caixin Manufacturing PMI figures having pointed to faster new exports growth. However, the overall export climate in the region remains adversely affected by softer global conditions with regards to trade.

The coming week sees the updating of global service sector PMI data, which will be eyed for evidence of sustained growth but also for persistent elevated inflationary pressures.

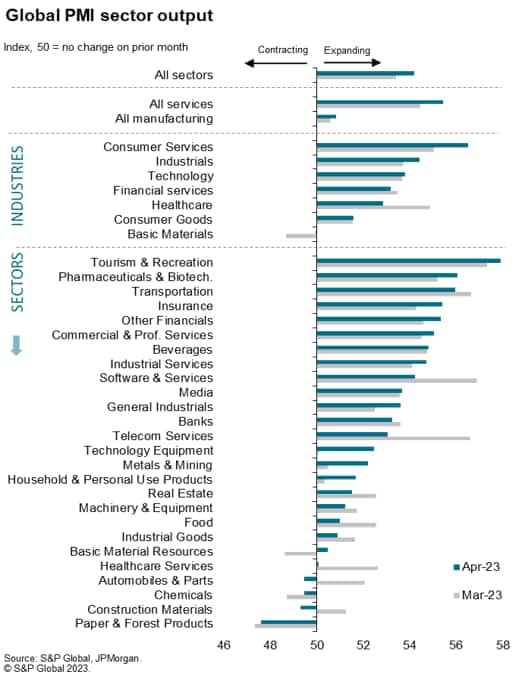

Recent PMI data have shown a strong shift of consumer spending and growth away from goods towards services, with tourism and recreation in particular benefitting from post-pandemic freedoms. Falling demand, combined with inventory reduction policies, has meanwhile subdued the goods-producing sector, constraining growth again in May and suppressing goods price inflation (see special report). However, while demand has switched from goods to services, so have supply constraints, meaning service sector inflation is showing stubborn persistence. May's services PMIs on the 5th June, and the detailed sector PMI data on 6th June, will therefore provide important insights into monetary policy developments.

Monday 5 Jun

New Zealand, Thailand, Malaysia Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* (May)

Indonesia Inflation (May)

Singapore Retail Sales (Apr)

Germany Trade (Apr)

Switzerland CPI (May)

Eurozone PPI (Apr)

United States Factory Orders (Apr)

United States ISM Non-manufacturing PMI (May)

Tuesday 6 Jun

South Korea Market Holiday

Japan Household Spending (Apr)

Singapore S&P Global PMI* (May)

Australia RBA Interest Rate Decision

Australia Building Permits (Apr, final)

Australia Current Account (Q1)

Thailand Inflation (May)

Eurozone HCOB Construction PMI* (May)

Eurozone Retail Sales (Apr)

United Kingdom S&P Global/CIPS UK Construction PMI*

S&P Global Sector PMI* (May)

Wednesday 7 Jun

Australia GDP (Q1)

China (Mainland) Trade (May)

Japan Leading Economic Index (Apr, prelim)

Taiwan Trade (May)

United Kingdom Halifax House Price Index* (May)

United Kingdom KPMG / REC UK Report on Jobs* (May)

France Trade (Apr)

Canada Trade (Apr)

Canada BoC Interest Rate Decision

United States Trade (Apr)

S&P Global Metal Users PMI* (May)

S&P Global Electronics PMI* (May)

Thursday 8 Jun

Japan GDP (Q1, final)

Japan Current Account (Apr)

Australia Trade (Apr)

India RBI Interest Rate Decision

Eurozone Employment Change (Q1)

Eurozone GDP (Q1)

United States Initial Jobless Claims

United States Wholesale Inventories (Apr)

Friday 9 Jun

China (Mainland) CPI, PPI (May)

Malaysia Industrial Production (Apr)

India Industrial Production (Apr)

Canada Unemployment Rate (May)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Worldwide services, composite and sector PMI

The start of the week finds worldwide services and composite PMI releases, which follows manufacturing PMI figures that showed weakness in the manufacturing sector ensued midway into the second quarter. Whether services will continue to support global growth, after witnessing the fastest developed world growth in 11 months according to flash PMI data, will be of interest here. Furthermore, developments on the inflation front will be keenly watched given the risks of service-led inflation keeping central bankers on a tightening bias.

Additionally, detailed sector PMI data will be available on Tuesday. Insights into the consumer sectors, especially consumer services which supported growth in April, and financial services will be eagerly anticipated.

Americas: BoC meeting, US ISM services PMI, trade

Besides the PMI data, a series of US economic releases will be due including trade, factory orders and inventories data.

The Bank of Canada meanwhile updates their monetary policy decision on Wednesday, though their key interest rates are widely anticipated to remain on hold at 4.5%.

Europe: Eurozone Q1 GDP, Germany trade

Further to the services and sector PMI data, Q1 GDP from the eurozone will be watched, albeit being the second revision. Trade figures from Germany will also be due.

For the UK, the KPMG/REC recruitment industry survey will be eyed alongside the PMI data for labour market trends, including wage growth.

Asia-Pacific: RBA meeting, China trade and inflation data, Japan GDP, Taiwan, Indonesia, Thailand, Philippines inflation

In APAC, the key data in the coming week will be China's trade and inflation figures. The latest Caixin China General Manufacturing PMI revealed faster new exports growth, suggesting more robust figures for May. On the other hand, manufacturing input costs fell solidly which may suggest further abating of factory gate inflation.

Besides mainland China's data, a series of inflation figures will also be updated across various APAC economies while Japan's final Q1 GDP will be due Thursday.

Finally, the Reserve Bank of Australia's rate setting meeting will be closely watched after the minutes of the May gathering hinted at the possibility of a pause.

Special reports:

Global Producer Prices Fall for First Time in Three Years - Chris Williamson

Singapore Economy Weakens in Early 2023 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location